- United States

- /

- Insurance

- /

- NYSE:AJG

Arthur J. Gallagher (AJG): Evaluating Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

Arthur J. Gallagher (AJG) has been slipping lately, with the stock down over the past month and past 3 months, even as revenue and net income continue to grow at a healthy double digit clip.

See our latest analysis for Arthur J. Gallagher.

Zooming out, that recent weakness sits against a share price of $237.85 and a solid backdrop, with the 5 year total shareholder return of 108.16 percent still signaling long term momentum, even as shorter term share price returns cool.

If AJG's pullback has you rethinking your insurance exposure, it could be worth scanning other healthcare stocks to see how defensive names elsewhere are holding up.

With revenue, earnings, and analyst targets all pointing higher even as the share price slips, investors now face a key question: Is Arthur J. Gallagher undervalued here, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 23.7% Undervalued

Against Arthur J. Gallagher's last close at $237.85, the most widely followed narrative sees a materially higher fair value driven by earnings and margin expansion assumptions.

Successful, disciplined execution of the ongoing M&A strategy including the Assured Partners acquisition and a deep pipeline of additional bolt on deals broadens AJG's geographic reach, service offerings, and client base, serving as a catalyst for both revenue and earnings accretion.

Want to see what kind of revenue surge and margin lift this deal pipeline is supposed to unlock, and which profit multiple keeps that upside alive? Explore the full narrative to unpack the growth runway and valuation logic behind that higher fair value call.

Result: Fair Value of $311.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on execution, as property rate declines and heavy reliance on acquisitions are both capable of undermining margins and earnings momentum.

Find out about the key risks to this Arthur J. Gallagher narrative.

Another Lens on Valuation

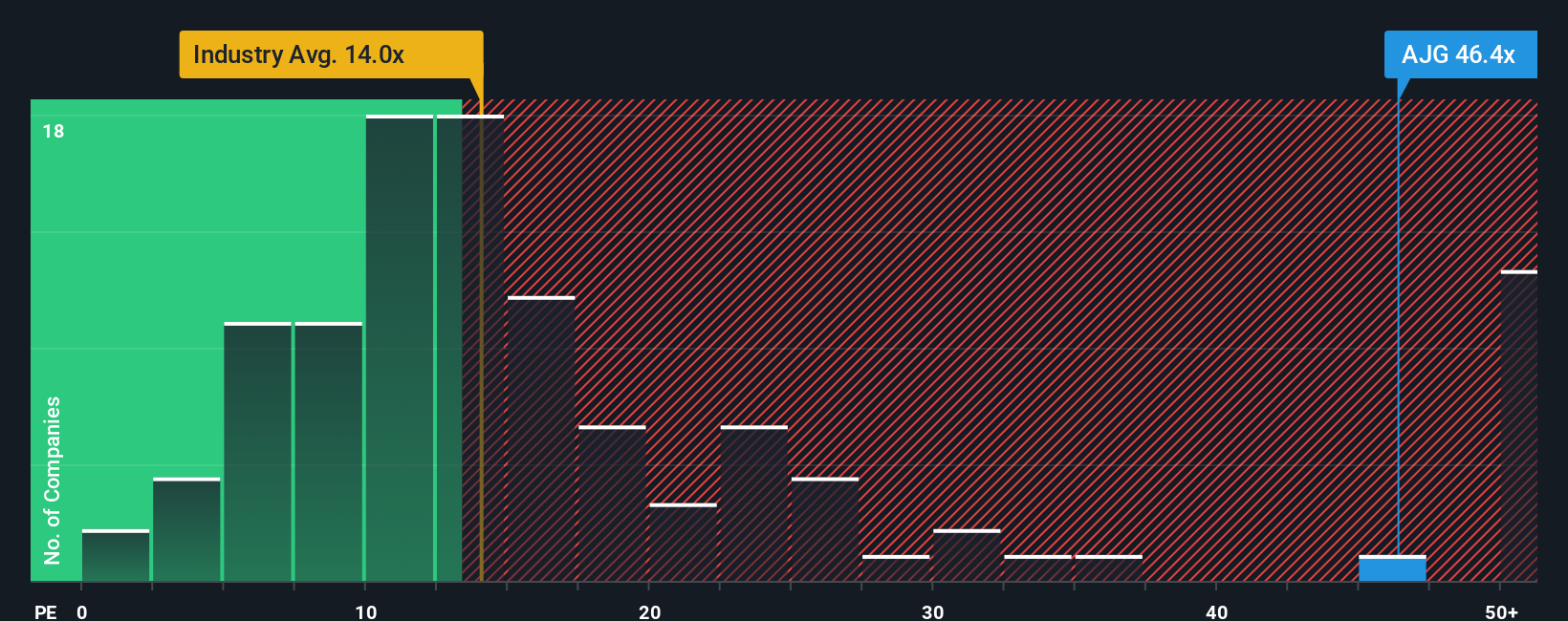

On earnings, the picture looks harsher. AJG trades on a price to earnings ratio of 38.1 times, versus 12.8 times for the US Insurance industry and a fair ratio of 18.1 times, implying meaningful downside if sentiment snaps back toward more typical levels.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arthur J. Gallagher Narrative

If you see things differently or want to test your own assumptions against the data, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Arthur J. Gallagher research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more compelling investment ideas?

Before you move on, give yourself an edge by scanning fresh opportunities on Simply Wall St's Screener and lining up your next high conviction idea today.

- Capture early uptrends by zeroing in on these 3594 penny stocks with strong financials that already show robust balance sheets and improving fundamentals.

- Ride structural growth by targeting these 30 healthcare AI stocks at the crossroads of medical innovation and intelligent data analytics.

- Lock in potential income streams by filtering for these 15 dividend stocks with yields > 3% that combine attractive yields with sustainable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AJG

Arthur J. Gallagher

Provides insurance and reinsurance brokerage, consulting, and third-party property/casualty claims settlement and administration services to entities and individuals worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)