- United States

- /

- Insurance

- /

- NYSE:AIZ

Is Assurant’s 101.3% Three Year Surge Still Supported by Its Earnings Power?

Reviewed by Bailey Pemberton

- If you are looking at Assurant and wondering whether the current price really reflects its long term potential, you are not alone. This article is going to unpack exactly that.

- The stock has climbed to around $233.32, delivering 4.9% over the last week, 10.4% year to date, and 101.3% over 3 years. This naturally raises the question of whether the market is now getting ahead of itself.

- Recent moves in Assurant have been shaped by a steady drumbeat of positive sentiment around its specialty insurance and risk management franchises, as investors have focused on its role in supporting everything from mobile devices to housing related products. In addition, the market has been rewarding companies seen as resilient in uncertain economic conditions, which has helped support Assurant's share price.

- Right now, Assurant scores 3 out of 6 on our valuation checks. This suggests the stock is not extremely cheap but not obviously overvalued either. We will walk through different valuation approaches next and then finish with a more holistic way of thinking about what the market might really be pricing in.

Approach 1: Assurant Excess Returns Analysis

The Excess Returns model asks a simple question: is Assurant generating returns on its equity that are comfortably above the return investors demand, and can it keep doing so as it grows? Instead of focusing on near-term earnings, it values the stream of economic profits the company can produce over time.

For Assurant, the model starts with a Book Value of $114.72 per share and an Average Return on Equity of 16.68%. That supports a Stable EPS estimate of $21.64 per share, based on weighted future ROE forecasts from 6 analysts. Against a Cost of Equity of $9.02 per share, this implies an Excess Return of $12.62 per share, meaning each dollar of equity is expected to earn more than the required return. The Stable Book Value is projected to rise to $129.71 per share, reflecting ongoing profitable reinvestment.

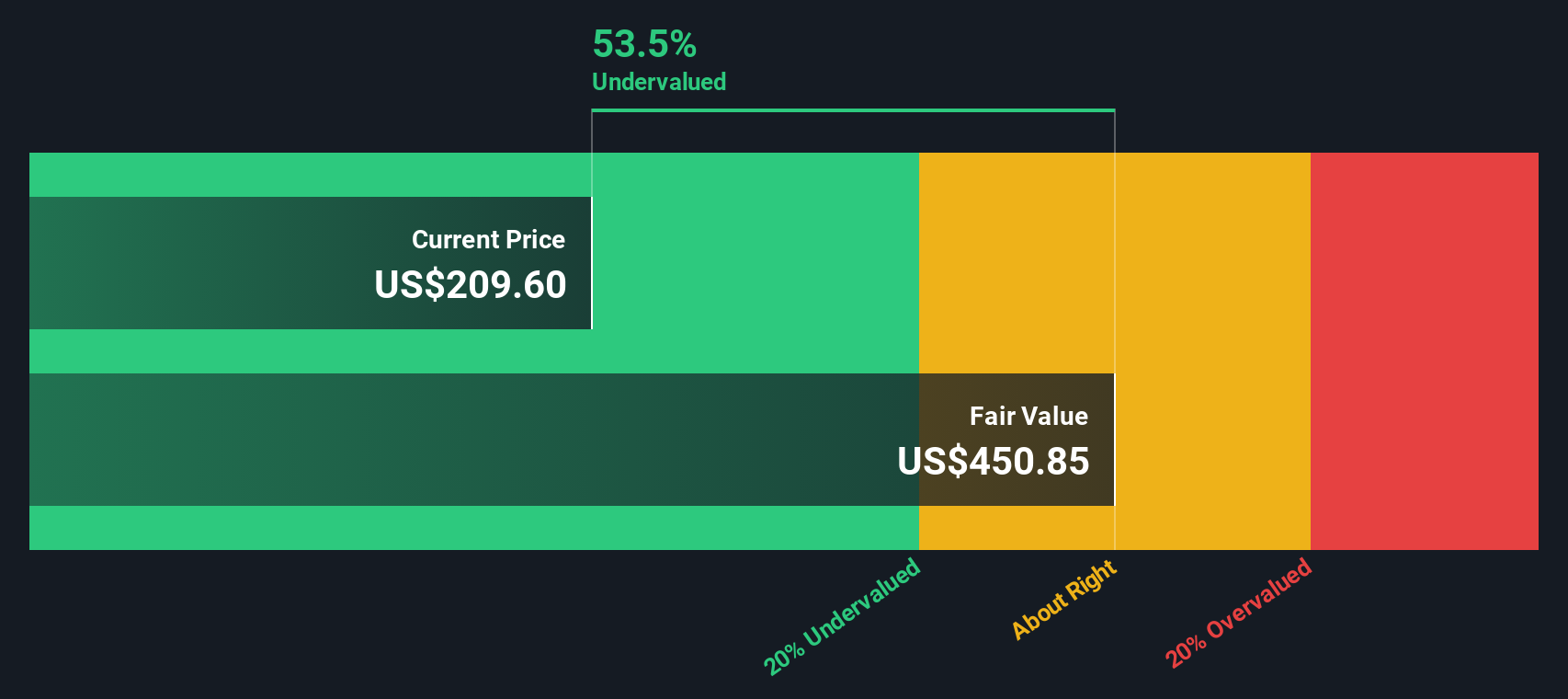

Putting these inputs together, the Excess Returns valuation points to an intrinsic value of about $471 per share, implying the stock is roughly 50.5% undervalued versus the current price.

Result: UNDERVALUED

Our Excess Returns analysis suggests Assurant is undervalued by 50.5%. Track this in your watchlist or portfolio, or discover 911 more undervalued stocks based on cash flows.

Approach 2: Assurant Price vs Earnings

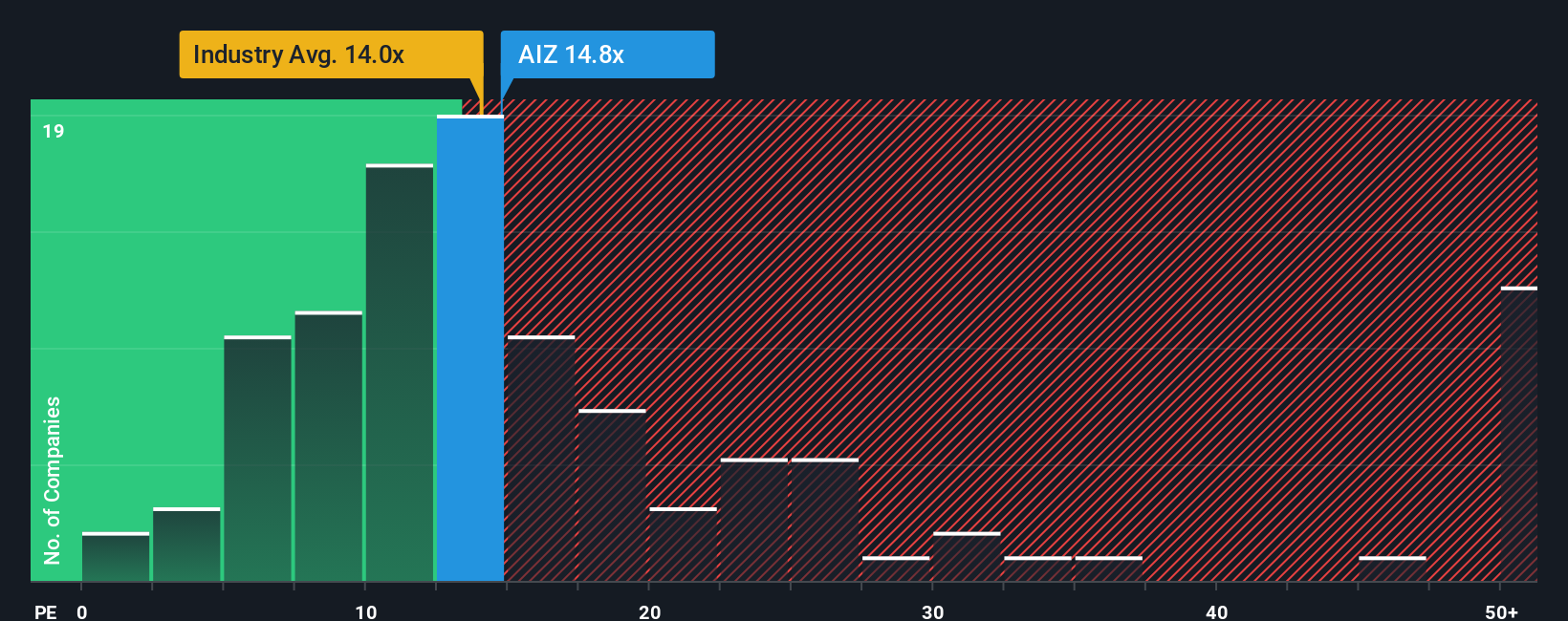

For a consistently profitable business like Assurant, the price to earnings ratio is a useful way to judge whether investors are paying a reasonable price for each dollar of current earnings. PE ratios tend to move higher when markets expect stronger, more reliable growth and move lower when a company is seen as riskier or more cyclical.

Assurant currently trades on a PE of about 13.77x, which is broadly in line with both the Insurance industry average of around 13.56x and its peer group at roughly 13.39x. At face value, that suggests the market is valuing Assurant similarly to comparable insurers, without assigning a large premium or discount.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what PE multiple a stock should trade on, given its specific earnings growth outlook, profit margins, risk profile, industry and market cap. For Assurant, this Fair Ratio comes out at about 15.20x, modestly above the current PE. This indicates the shares trade at a slight discount to what its fundamentals might justify, which could point to some upside if the company delivers as expected.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1457 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Assurant Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. This is a simple framework on Simply Wall St’s Community page that lets you write the story behind the numbers by linking your view of Assurant’s business drivers to a concrete forecast for revenue, earnings, margins and, ultimately, a Fair Value. You can then compare that Fair Value with today’s share price to decide whether to buy, hold or sell. The platform keeps that Narrative updated as new news or earnings arrive.

For example, one investor might build a bullish Assurant Narrative around resilient device protection growth, rising margins to about 8.4 percent and a Fair Value near 254 dollars. A more cautious investor might focus on regulatory and competitive risks, assume slower growth, a lower future PE closer to 12 times and a Fair Value nearer 211 dollars. Both perspectives can live side by side and evolve dynamically as fresh information comes in.

Do you think there's more to the story for Assurant? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIZ

Assurant

Provides protection services to connected devices, homes, and automobiles in North America, Latin America, Europe, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)