- United States

- /

- Insurance

- /

- NasdaqGS:WTW

Willis Towers Watson (NasdaqGS:WTW) Sees Increase In Q1 Net Income And Earnings Per Share

Reviewed by Simply Wall St

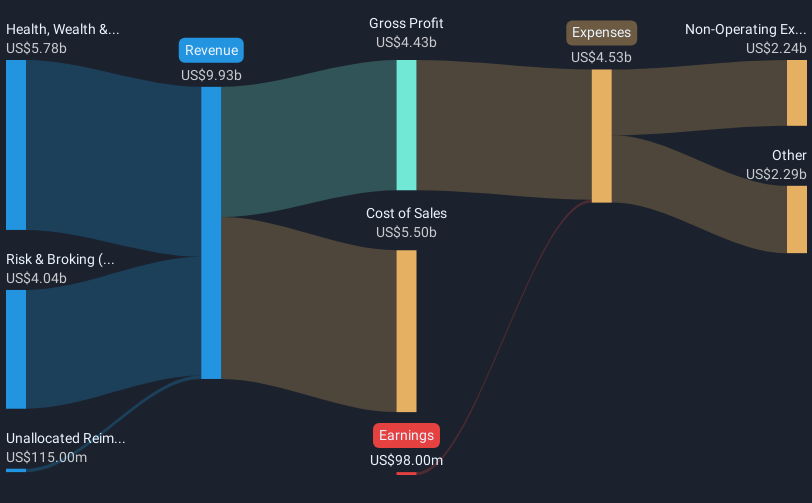

Willis Towers Watson (NasdaqGS:WTW) recently announced significant earnings results for the first quarter of 2025, with net income rising to USD 235 million and diluted EPS reaching USD 2.33. Despite a decline in sales, these improvements in profitability might have supported the company’s share price move of 2.09% over the last quarter. This upward momentum aligns with market trends, as major indexes like the Nasdaq also experienced surges influenced by broader positive earnings reports. The appointment of new executives and strategic partnerships, such as those with Liberty Specialty Markets, may have added further weight to the company's positive outlook.

We've spotted 2 weaknesses for Willis Towers Watson you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

The recent earnings announcement by Willis Towers Watson highlights improvements in profitability despite a dip in sales. This is reflected in the company's share price increase of 2.09% over the last quarter, mirroring a positive market trend. Over a longer five-year period, however, Willis Towers Watson's shares have delivered a robust total return of 98.82%, demonstrating significant value creation for shareholders. In the past year, the company outperformed both the US market, which gained 3.6%, and the insurance industry, which grew by 15.9%.

Looking forward, the completed strategic initiatives, along with the new partnerships and executive appointments, could influence revenue and earnings positively. This sets a foundation for future growth, as evidenced by analyst expectations of revenue growth at a modest 3% annually and a predicted reversion to profitability. Despite these promising forecasts, WTW's current share price of US$324.68 remains below the consensus price target of US$366.15, suggesting potential room for appreciation. However, there are risks involved, including the impact of the TRANZACT divestiture and potential foreign exchange fluctuations, which could affect future earnings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willis Towers Watson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WTW

Willis Towers Watson

Operates as an advisory, broking, and solutions company worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives