- United States

- /

- Insurance

- /

- NasdaqGS:WTW

Willis Towers Watson (NasdaqGS:WTW) Board Approves US$0.92 Quarterly Cash Dividend

Reviewed by Simply Wall St

Willis Towers Watson (NasdaqGS:WTW) announced a dividend affirmation, approving a regular quarterly cash dividend of $0.92 per common share, payable on or about July 15, 2025. This decision aligns with WTW's ongoing commitment to shareholder value. Over the past week, the company's share price remained flat despite the broader market's 5% increase. While the dividend announcement highlighted WTW's stable financial outlook, it did not significantly impact the share price movement. The company's stable return would have countered the broader market optimism, underscoring its consistent approach to shareholder rewards amid positive market trends.

We've spotted 2 weaknesses for Willis Towers Watson you should be aware of.

The recent affirmation of Willis Towers Watson's dividend underscores its focus on shareholder value, which aligns with its broader strategy of addressing client-specific needs through specialization in Risk & Broking and innovation, such as the Tariff Guard product. While its short-term share price remained static amid broader market optimism, it's important to contextualize this against a five-year total return of 68.13%, indicating significant long-term value creation for investors.

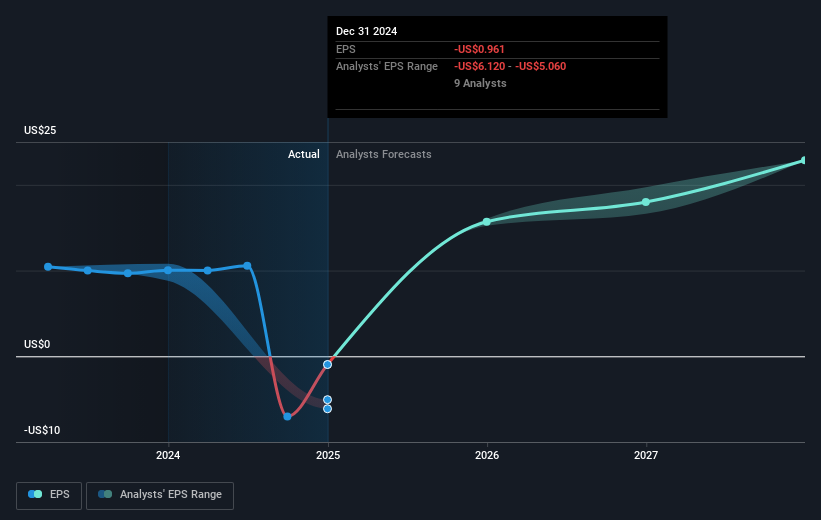

Over the past year, WTW's performance exceeded the US Insurance industry return of 16.4%, highlighting its resilience amidst challenging conditions. However, geopolitical and macroeconomic uncertainties, especially in North America, could impact revenue growth, making the company's stability crucial. Analysts forecast modest revenue growth of 3.1% annually, with significant improvement in earnings from US$53.0 million in losses to US$2.8 billion by 2028, which hinges on successful execution of its strategic initiatives.

Despite a current share price of US$307.55, the analyst consensus price target is US$365.79, equating to a substantial potential upside. Investors should consider how developments like the ongoing technology enhancements, such as the Neuron platform, might bolster operational efficiency and earnings forecasts, potentially contributing to a favorable adjustment toward the anticipated price target. As potential headwinds emerge, it's crucial to monitor how these factors may influence WTW's financial trajectory going forward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Willis Towers Watson, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Willis Towers Watson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WTW

Willis Towers Watson

Operates as an advisory, broking, and solutions company worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives