- United States

- /

- Insurance

- /

- NasdaqGM:TRUP

Trupanion (TRUP): Assessing Valuation Following Recent Annual Results and Mixed Shareholder Returns

Reviewed by Kshitija Bhandaru

See our latest analysis for Trupanion.

Trupanion’s share price has struggled to gain traction this year, with momentum fading; its 1-year total shareholder return sits nearly flat despite last week’s upbeat annual report. Longer-term holders have faced steeper losses, as three- and five-year total shareholder returns are still deep in the red.

If you’re eyeing what else is happening in the market, now’s a good time to expand your search and discover fast growing stocks with high insider ownership

With Trupanion’s recent results and its stock lagging, should investors be looking at a bargain, or has the market already factored in all of the company’s future growth prospects?

Most Popular Narrative: 23% Undervalued

Trupanion's narrative fair value estimate is notably higher than its most recent closing price, suggesting substantial upside potential if the projections hold. The divergence sets the stage for bold expectations about future growth and market position.

Adoption of advanced technologies, such as data analytics and direct-payment software for claims, has begun to yield efficiencies, resulting in improved claims processing cost, higher retention rates, and expanding operating margins. These factors could continue to positively impact net margins in the future.

Curious about what powers this bullish outlook? There is a crucial quantitative forecast behind the narrative. It hinges on accelerated profit expansion and aggressive future earnings multiples. Find out the surprising assumptions that drive the target valuation and see why the outlook divides analysts and investors alike.

Result: Fair Value of $56.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stagnant subscriber growth and rising competition could limit Trupanion’s revenue expansion. These factors may also challenge the optimism behind its current price target.

Find out about the key risks to this Trupanion narrative.

Another View: How Does Trupanion Stack Up on Sales Multiples?

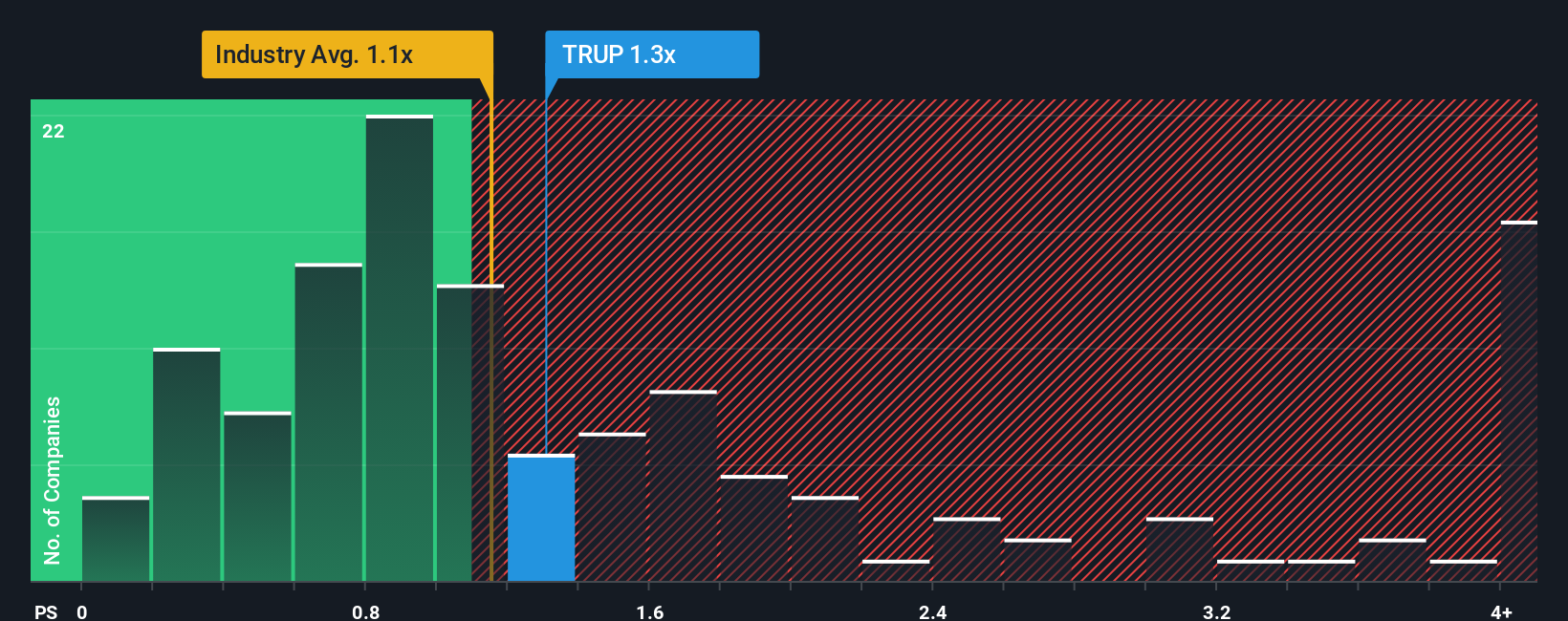

While narrative-based valuation points to upside, a sales ratio lens tells a more cautious story. Trupanion is trading at 1.4 times sales, which is higher than the US insurance industry average of 1.2. This is also well above the fair ratio of 0.9. Such a valuation may signal risk if market sentiment shifts. Could the stock re-rate lower, or do unique growth drivers justify the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trupanion Narrative

If you have a different take on Trupanion's outlook or want to analyze the numbers on your own terms, you can craft your own story in just a few minutes. Do it your way

A great starting point for your Trupanion research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Smart Investment Moves?

Expand your investment horizon with Simply Wall Street’s screeners that spotlight stocks across powerful trends and hidden value opportunities you might regret missing tomorrow.

- Spot untapped potential in up-and-coming companies by checking out these 3569 penny stocks with strong financials poised for financial strength and growth.

- Boost your search for reliable cash flow by scanning these 19 dividend stocks with yields > 3% offering attractive yields above 3%.

- Ride the wave of digital transformation and stay ahead of the curve by tracking these 78 cryptocurrency and blockchain stocks reshaping the financial world.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trupanion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TRUP

Trupanion

Provides medical insurance for cats and dogs on subscription basis in the United States, Canada, Continental Europe, and Australia.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives