- United States

- /

- Insurance

- /

- NasdaqGS:SKWD

Skyward Specialty Insurance Group, Inc. (NASDAQ:SKWD) Not Lagging Market On Growth Or Pricing

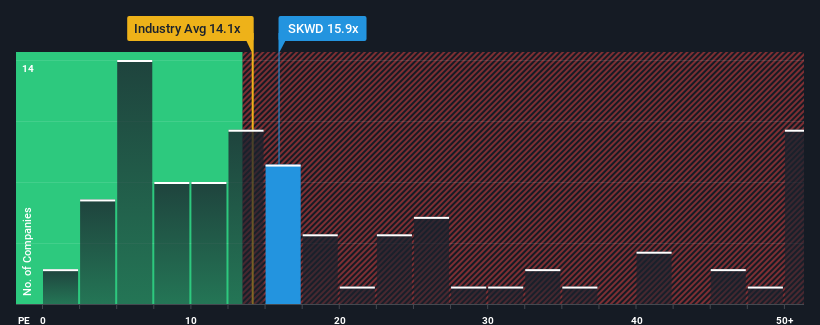

With a median price-to-earnings (or "P/E") ratio of close to 17x in the United States, you could be forgiven for feeling indifferent about Skyward Specialty Insurance Group, Inc.'s (NASDAQ:SKWD) P/E ratio of 15.9x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Skyward Specialty Insurance Group has been doing quite well of late. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Skyward Specialty Insurance Group

Is There Some Growth For Skyward Specialty Insurance Group?

There's an inherent assumption that a company should be matching the market for P/E ratios like Skyward Specialty Insurance Group's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 89% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 12% per year as estimated by the six analysts watching the company. With the market predicted to deliver 11% growth per year, the company is positioned for a comparable earnings result.

With this information, we can see why Skyward Specialty Insurance Group is trading at a fairly similar P/E to the market. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Skyward Specialty Insurance Group's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Skyward Specialty Insurance Group maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Skyward Specialty Insurance Group that you need to take into consideration.

If you're unsure about the strength of Skyward Specialty Insurance Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SKWD

Skyward Specialty Insurance Group

An insurance holding company, underwrites commercial property and casualty insurance products in the United States.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives