- United States

- /

- Insurance

- /

- NasdaqGS:ROOT

Root (ROOT) Is Down 6.2% After Tariff Hike Spurs Market Selloff and Supply Chain Worries - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In recent days, President Trump announced a major increase in tariffs on Chinese imports, sparking declines across major stock indexes and affecting insurance companies such as Root, Inc. amid concerns over supply chain dependencies.

- Despite the market's initial reaction, analysts have expressed continued cautious optimism for Root due to recent positive earnings and a term loan restructuring that has strengthened its capital position.

- We'll explore how heightened trade tensions and increased capital flexibility could influence Root's long-term investment narrative and risk outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Root Investment Narrative Recap

To be a Root, Inc. shareholder, you need to believe in its technology-driven approach to insurance, with a focus on AI-powered risk segmentation and digital-first distribution. The recent tariff increase has added to overall market volatility, but the most important near-term catalyst for Root, the upcoming Q3 earnings, remains intact, while the primary risk continues to be rising claims costs and margin pressure if macroeconomic conditions worsen. For now, the tariffs do not appear to have materially impacted Root’s core business or its key operating levers.

Of recent company updates, Root’s announcement of its Q3 2025 earnings release on November 5 is most relevant in the context of heightened market uncertainty. With investors closely watching for signs of sustainable profitability and the effect of capital initiatives, the upcoming results will provide a crucial checkpoint for the company’s progress on its core growth and risk management strategies.

In contrast, investors should keep a close eye on Root’s exposure to claims inflation and potential cost escalation, as...

Read the full narrative on Root (it's free!)

Root's narrative projects $1.9 billion revenue and $72.3 million earnings by 2028. This requires 10.8% yearly revenue growth and a $9.3 million decrease in earnings from $81.6 million today.

Uncover how Root's forecasts yield a $130.60 fair value, a 60% upside to its current price.

Exploring Other Perspectives

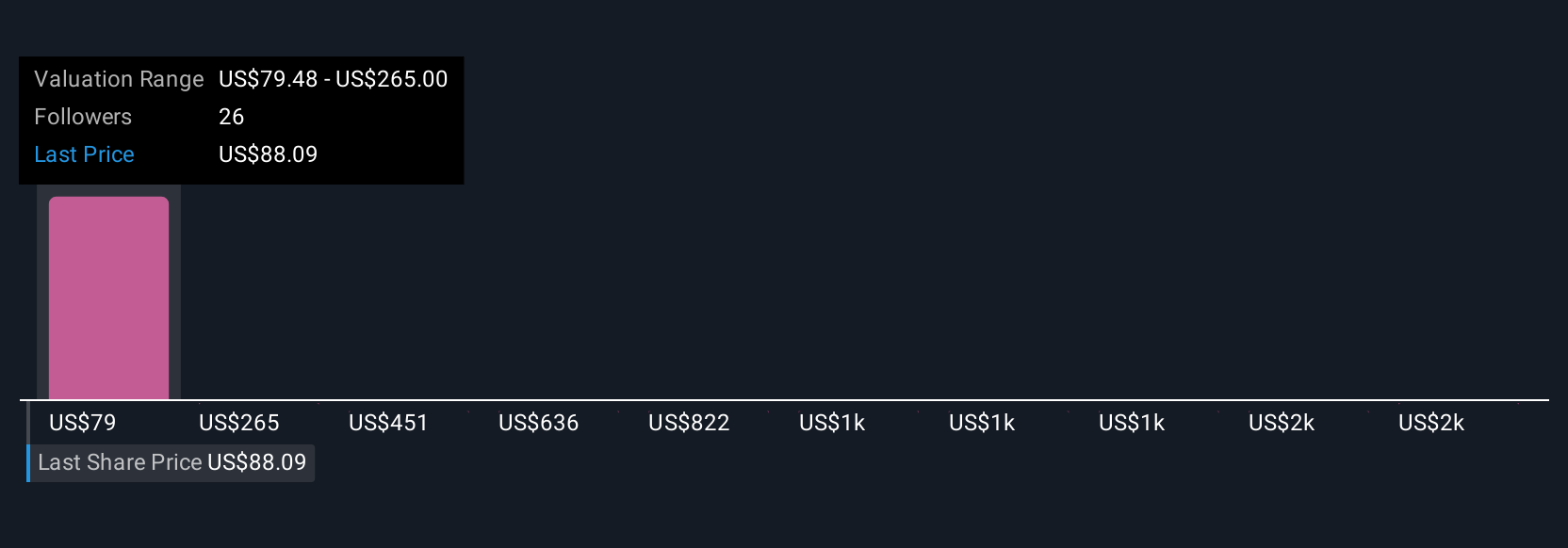

Twelve Simply Wall St Community members estimate Root’s fair value between US$79.48 and US$1,934.69 per share. Competition in digital insurance distribution remains a key theme among participants looking beyond near-term market swings.

Explore 12 other fair value estimates on Root - why the stock might be worth just $79.48!

Build Your Own Root Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Root research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Root research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Root's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROOT

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.