- United States

- /

- Insurance

- /

- NasdaqGS:PFG

Does Principal Offer Opportunity After Solid Q1 Earnings and Stock Buyback Announcement in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Principal Financial Group stock? You are not alone. Investors are weighing their options as the stock tries to find direction this year. Over the last week, Principal dipped by 1.1%, with a slightly larger drop of 2.5% over the past month. Yet, zoom out a bit and the year-to-date return sits at a positive 4.5%. Even more impressive, the five-year return clocks in at a healthy 136.3%. That long-term growth does not come out of nowhere. Recently, shifting investor sentiment on the back of changing interest rates and a generally resilient financials sector have pushed and pulled shares like Principal’s.

If you are trying to decide whether to buy, sell, or hold, it can really help to look at how the market is valuing the company right now. We use a valuation score. Principal Financial Group gets a 3 out of 6, with points added for each metric where the stock looks undervalued. That means the stock passes three of the six standard checks investors often use to spot a true bargain.

Below, we will break down each of those valuation approaches and see where Principal stands out and where it might still be trading at a fair price. But before you make your next move, stick around. You will want to see an even smarter way of sizing up valuation that we will get to at the end.

Why Principal Financial Group is lagging behind its peers

Approach 1: Principal Financial Group Excess Returns Analysis

The Excess Returns valuation model is designed to evaluate how efficiently a company uses its shareholders' equity to generate profits beyond its cost of capital. In essence, it looks at what remains after compensating investors for their risk and provides a practical view of true economic value added.

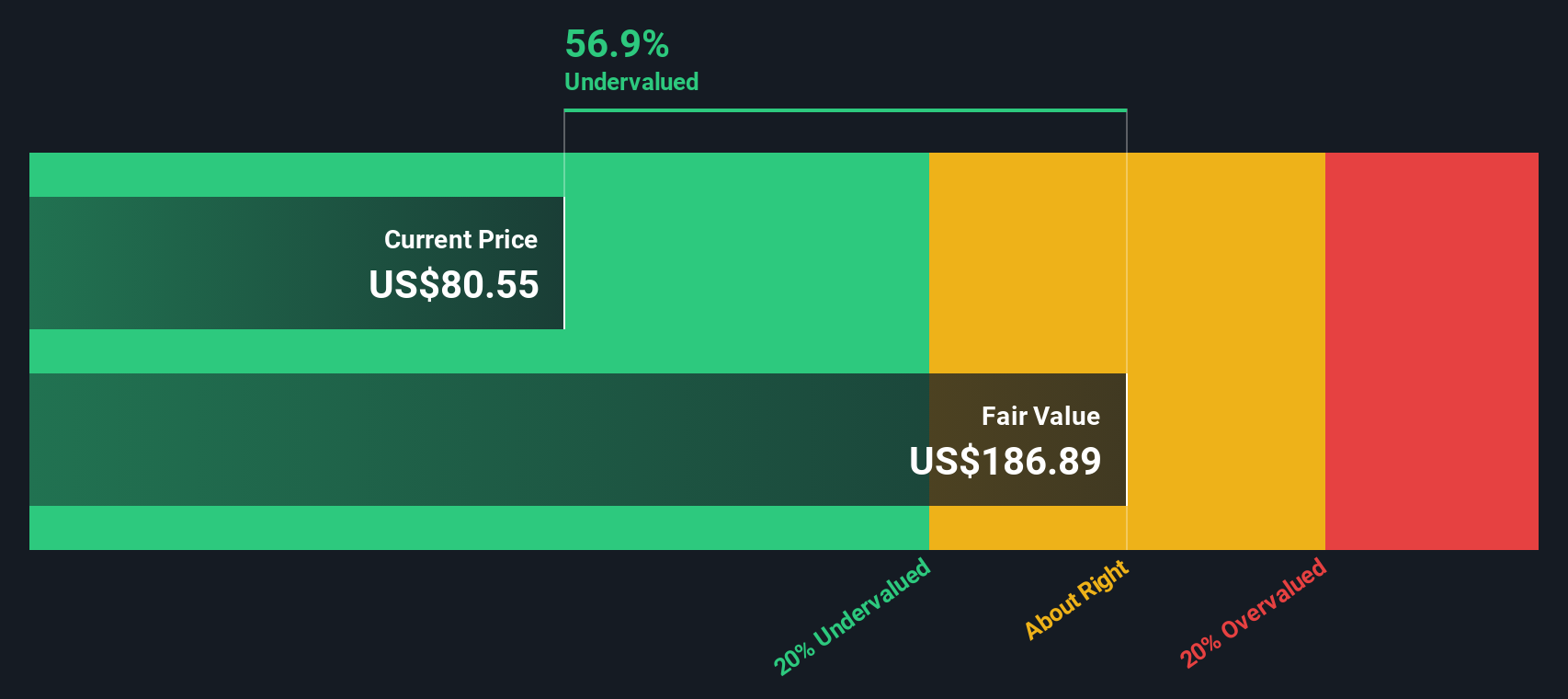

For Principal Financial Group, the numbers stand out. The current book value sits at $51.15 per share. Based on the consensus from eight analyst estimates, the stable earnings per share are projected at $8.76. With a cost of equity at $3.88 per share, this leaves an annual excess return of $4.88 per share. The company boasts an average return on equity of 15.30 percent, and the stable book value is estimated to rise to $57.27 per share according to seven analysts.

Translating these figures, the model produces an estimated intrinsic value significantly ahead of the current share price. The valuation indicates the stock is 57.3 percent undervalued. This suggests Principal is generating robust returns on invested capital compared to what investors require as a minimum, signaling a strong value proposition at today’s prices.

Result: UNDERVALUED

Our Excess Returns analysis suggests Principal Financial Group is undervalued by 57.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Principal Financial Group Price vs Earnings

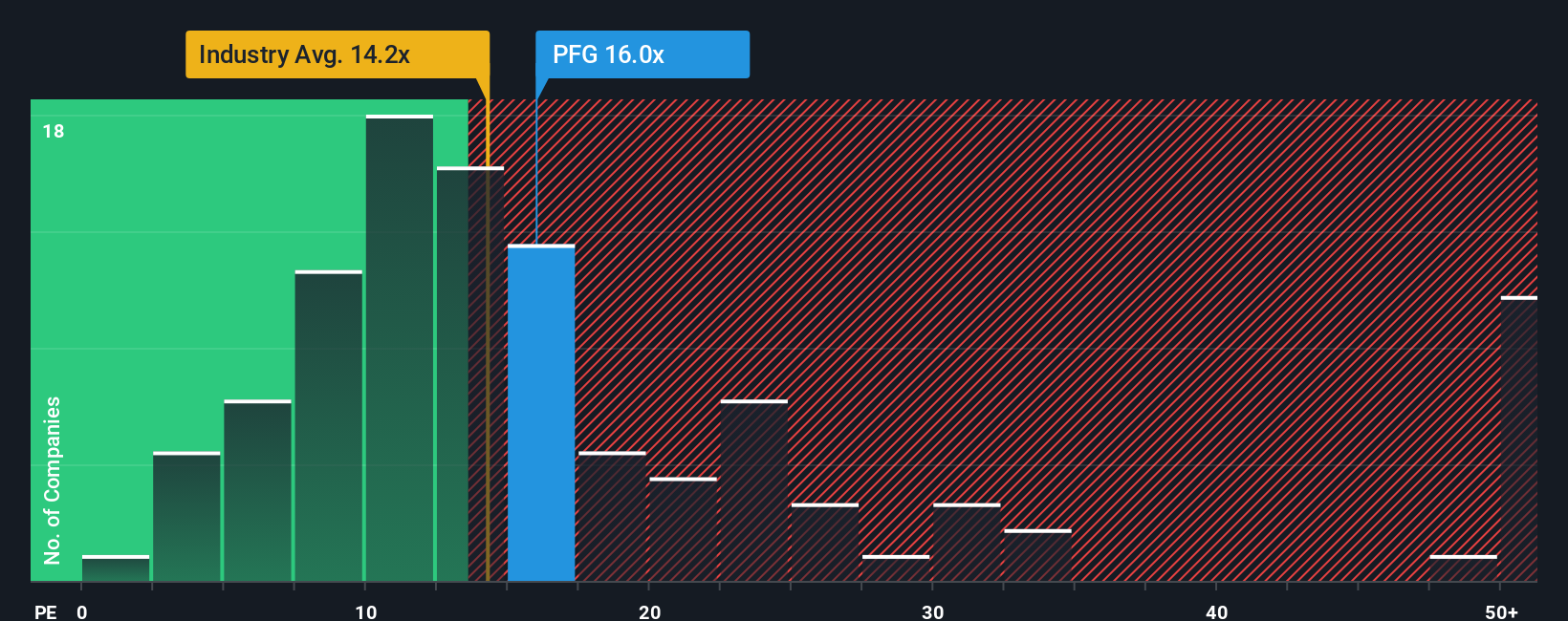

For profitable companies like Principal Financial Group, the price-to-earnings (PE) ratio is a time-tested and widely used valuation tool. It essentially tells investors how much they are paying for each dollar of current earnings. A "normal" or "fair" PE ratio for a stock is typically influenced by several factors, including expectations for future earnings growth and the level of risk associated with those earnings. Higher growth or lower risk often justifies a higher PE, while slower growth or higher risk pulls it down.

Currently, Principal Financial Group trades at a PE of 15.81x. This is slightly above the industry average PE of 14.18x and also higher than the average among its direct peers, which is 12.17x. At first glance, this might suggest the stock is a bit pricey compared to its sector.

However, looking beyond simple averages, Simply Wall St’s proprietary “Fair Ratio” gives a more tailored perspective. This Fair Ratio, set at 19.34x for Principal, is calculated using a mix of company-specific factors, such as its earnings growth outlook, industry dynamics, profit margins, market capitalization, and risk profile. Because it blends all these inputs, the Fair Ratio goes well beyond generic peer or industry benchmarks to provide a more holistic, nuanced sense of what the stock should be worth.

Comparing the company’s current PE of 15.81x to its Fair Ratio of 19.34x, Principal appears undervalued on this basis, trading below what would be reasonable given its specific characteristics and prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Principal Financial Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a smarter, more dynamic approach for investors ready to connect the story behind a company to financial forecasts and a fair value estimate.

In simple terms, a Narrative is your personal investment thesis, blending what you believe about Principal Financial Group’s future with your own fair value, revenue growth, and profit margin estimates. Rather than just looking at static numbers, a Narrative lets you tie together the company’s business outlook, industry shifts, and management strategies into a forecast that reflects your perspective. Narratives update automatically as news, results, and analyst forecasts change.

Narratives are accessible right on Simply Wall St’s Community page, where millions of investors compare their views and see instantly how their forecasts translate to a fair value versus the live share price. This makes it easier to decide when to buy or sell.

For Principal Financial Group, for example, one investor might be bullish, expecting the stock to reach $101 by 2028 thanks to expansion in retirement and global asset management. A more cautious investor might see fair value near $72 due to challenges like volatile inflows and tightening margins.

Do you think there's more to the story for Principal Financial Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PFG

Principal Financial Group

Provides retirement, asset management, and insurance products and services to businesses, individuals, and institutional clients worldwide.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives