- United States

- /

- Insurance

- /

- NasdaqGS:NWLI

Is Now The Time To Put National Western Life Group (NASDAQ:NWLI) On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in National Western Life Group (NASDAQ:NWLI). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for National Western Life Group

National Western Life Group's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. Over the last three years, National Western Life Group has grown EPS by 9.3% per year. That's a pretty good rate, if the company can sustain it.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that National Western Life Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. The good news is that National Western Life Group is growing revenues, and EBIT margins improved by 2.5 percentage points to 22%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

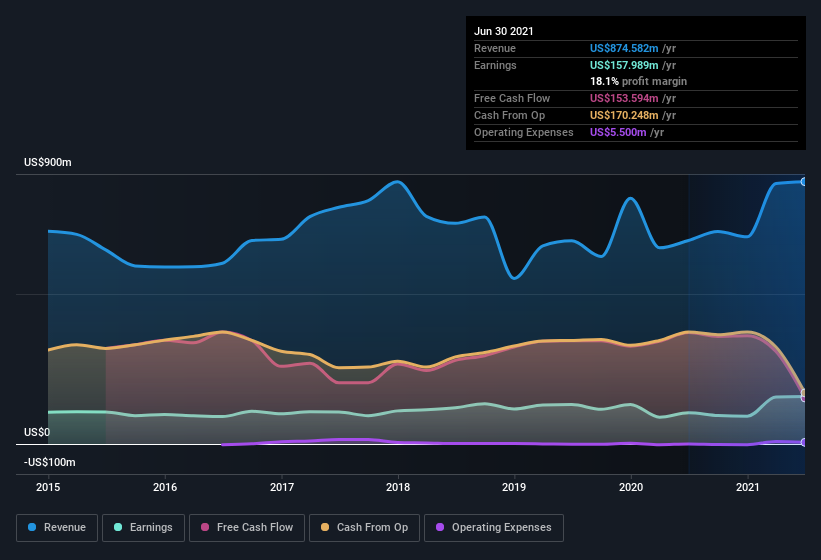

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check National Western Life Group's balance sheet strength, before getting too excited.

Are National Western Life Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for National Western Life Group shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Reynaldo Perez, the Senior Vice President of the company, paid US$22k for shares at around US$200 each.

On top of the insider buying, it's good to see that National Western Life Group insiders have a valuable investment in the business. Notably, they have an enormous stake in the company, worth US$255m. That equates to 30% of the company, making insiders powerful and aligned with other shareholders. So it might be my imagination, but I do sense the glimmer of an opportunity.

Does National Western Life Group Deserve A Spot On Your Watchlist?

One positive for National Western Life Group is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if National Western Life Group is trading on a high P/E or a low P/E, relative to its industry.

The good news is that National Western Life Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if National Western Life Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:NWLI

National Western Life Group

Through its subsidiary, National Western Life Insurance Company, operates as a stock life insurance company in the United States, Brazil, Taiwan, Peru, Venezuela, Colombia, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives