- United States

- /

- Insurance

- /

- NasdaqGS:JRVR

James River Group Holdings, Ltd. (NASDAQ:JRVR) Might Not Be As Mispriced As It Looks After Plunging 33%

James River Group Holdings, Ltd. (NASDAQ:JRVR) shareholders won't be pleased to see that the share price has had a very rough month, dropping 33% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 68% loss during that time.

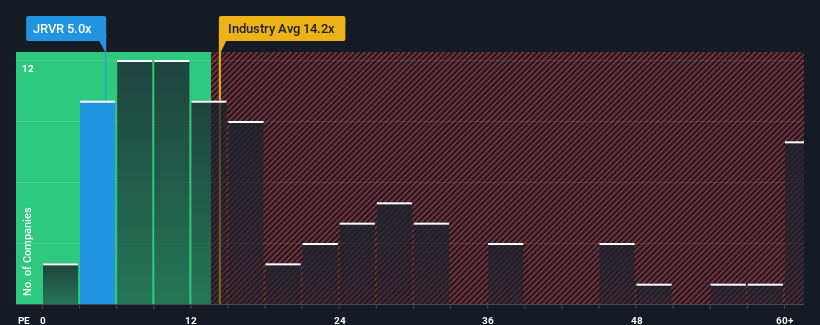

After such a large drop in price, James River Group Holdings may be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 5x, since almost half of all companies in the United States have P/E ratios greater than 17x and even P/E's higher than 32x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for James River Group Holdings as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for James River Group Holdings

How Is James River Group Holdings' Growth Trending?

James River Group Holdings' P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 93%. Pleasingly, EPS has also lifted 753% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 34% over the next year. With the market only predicted to deliver 11%, the company is positioned for a stronger earnings result.

With this information, we find it odd that James River Group Holdings is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Shares in James River Group Holdings have plummeted and its P/E is now low enough to touch the ground. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of James River Group Holdings' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You always need to take note of risks, for example - James River Group Holdings has 1 warning sign we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:JRVR

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026