- United States

- /

- Consumer Services

- /

- NasdaqGS:PRDO

Undiscovered Gems In US Market Featuring 3 Promising Small Caps

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 3.1% drop, yet it remains up by 13% over the past year with earnings projected to grow by 14% annually. In this dynamic environment, identifying promising small-cap stocks can offer unique opportunities for growth and diversification in an investor's portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Morris State Bancshares | 9.72% | 4.93% | 6.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Health In Tech (NasdaqCM:HIT)

Simply Wall St Value Rating: ★★★★★★

Overview: Health In Tech, Inc. operates as an insurance technology platform company with a market cap of $357.94 million.

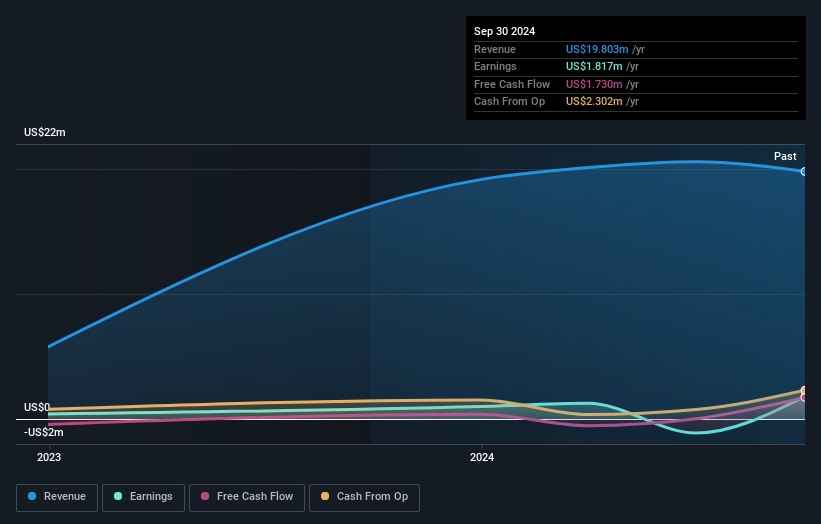

Operations: Health In Tech, Inc. generates revenue primarily from its Insurance Brokers segment, amounting to $19.80 million.

Health In Tech, a nimble player in the insurance sector, showcases impressive growth with earnings surging 114.8% over the past year, outpacing the industry's 24.4%. The company remains debt-free and boasts high-quality earnings, providing a solid foundation for its financial health. Recent strategic collaborations aim to enhance affordability and efficiency in healthcare offerings through their eDIYBS platform. Following its $9.2 million IPO and inclusion in the NASDAQ Composite Index, Health In Tech is poised to leverage these developments for future expansion while maintaining positive free cash flow at US$1.73 million as of September 2024.

- Take a closer look at Health In Tech's potential here in our health report.

Assess Health In Tech's past performance with our detailed historical performance reports.

Perdoceo Education (NasdaqGS:PRDO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Perdoceo Education Corporation offers postsecondary education through online, campus-based, and blended learning programs in the United States and has a market capitalization of approximately $1.69 billion.

Operations: The company's primary revenue streams are derived from Colorado Technical University (CTU) and The American Intercontinental University System (AIUS), generating $456.90 million and $213.55 million, respectively.

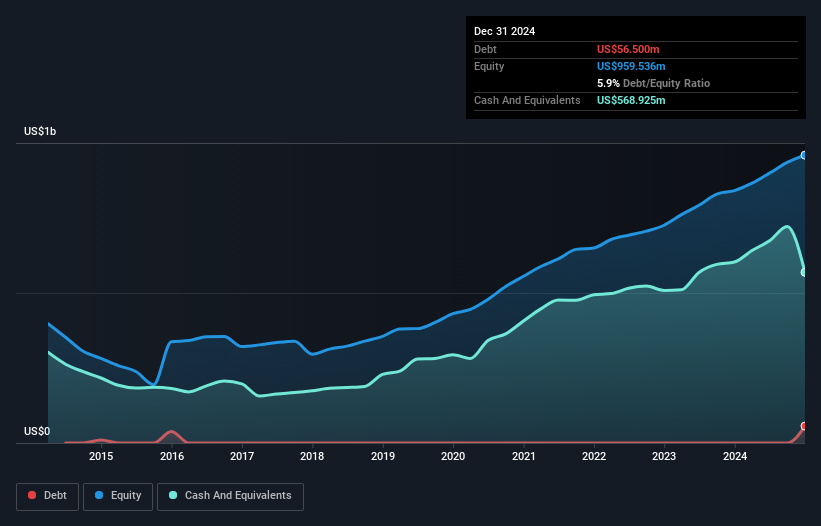

Perdoceo Education, a nimble player in the education sector, recently reported a slight dip in annual revenue to US$681.26 million from US$710 million, while net income remained stable at US$147.59 million. Despite a modest negative earnings growth of -0.04% last year, it trades 58% below its estimated fair value and boasts high-quality past earnings with more cash than total debt. The company's strategic acquisitions and tech investments aim to diversify revenue streams and enhance operational efficiency, though challenges like marketing costs and regulatory uncertainties persist as potential hurdles for future growth prospects.

Hamilton Beach Brands Holding (NYSE:HBB)

Simply Wall St Value Rating: ★★★★★★

Overview: Hamilton Beach Brands Holding Company is involved in designing, marketing, and distributing small electric household and specialty housewares appliances globally, with a market cap of approximately $257.33 million.

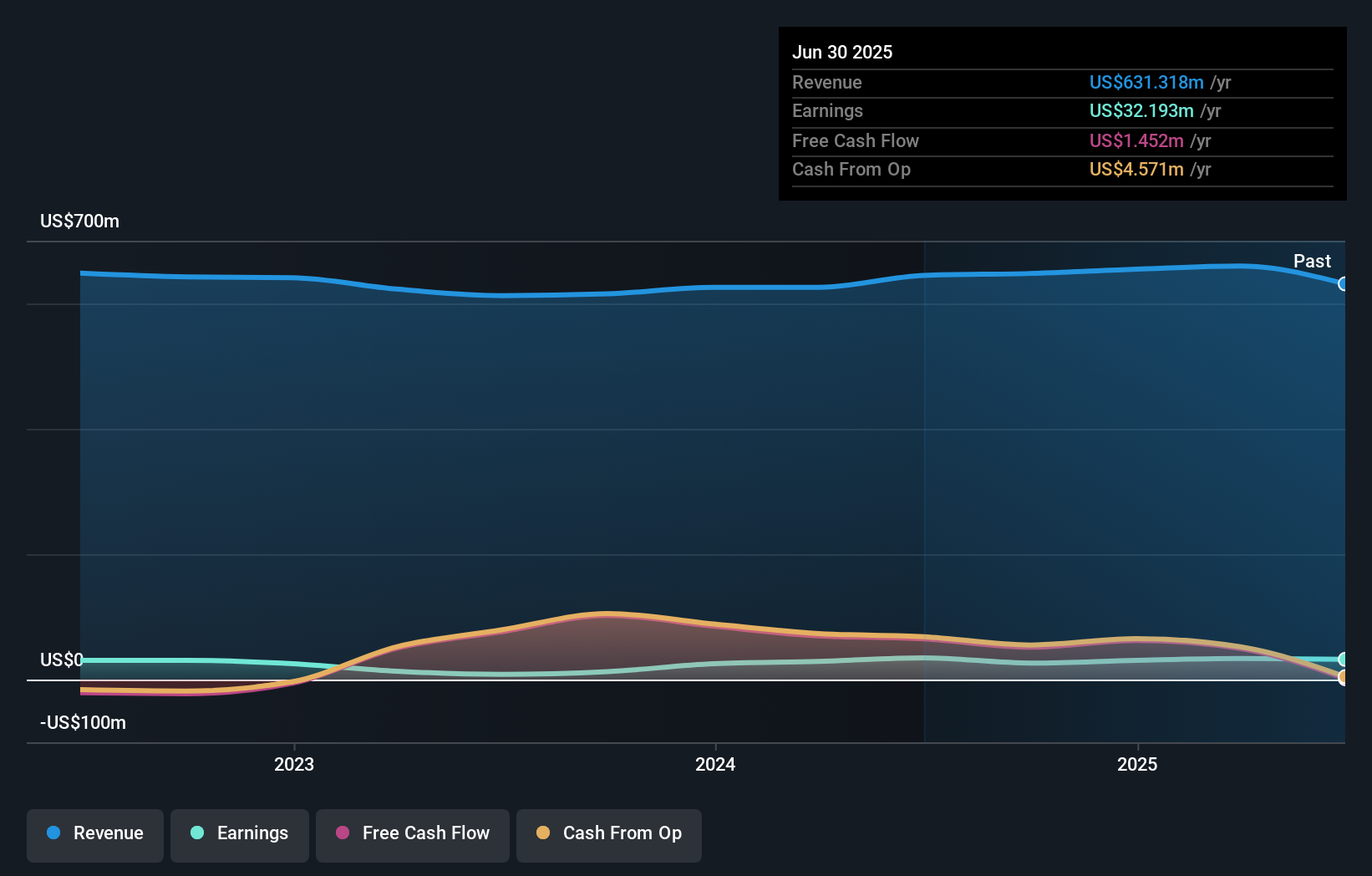

Operations: Hamilton Beach Brands generates revenue primarily from its Home and Commercial Products segment, which accounts for $650.41 million, while the Health segment contributes $4.28 million.

Hamilton Beach Brands Holding, a small player in the consumer durables sector, has shown robust financial health with earnings growth of 21.9% over the past year, outpacing the industry's 5.7%. The company reported US$654.69 million in sales for 2024 and net income of US$30.76 million, reflecting strong operational performance despite a one-off loss of US$9.6 million impacting results. Trading at 47% below its estimated fair value suggests potential undervaluation, while its debt-to-equity ratio improved significantly from 161.5% to just 30.1% over five years, highlighting effective debt management and financial discipline.

- Click here to discover the nuances of Hamilton Beach Brands Holding with our detailed analytical health report.

Understand Hamilton Beach Brands Holding's track record by examining our Past report.

Seize The Opportunity

- Reveal the 277 hidden gems among our US Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PRDO

Perdoceo Education

Provides postsecondary education through online, campus-based, and blended learning programs in the United States.

Undervalued with excellent balance sheet.