- United States

- /

- Insurance

- /

- NasdaqGS:GSHD

Goosehead Insurance's (NASDAQ:GSHD) five-year total shareholder returns outpace the underlying earnings growth

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on the bright side, you can make far more than 100% on a really good stock. Long term Goosehead Insurance, Inc (NASDAQ:GSHD) shareholders would be well aware of this, since the stock is up 108% in five years. In contrast, the stock has fallen 8.1% in the last 30 days. We note that the broader market is down 7.2% in the last month, and this may have impacted Goosehead Insurance's share price.

While the stock has fallen 3.5% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

Our free stock report includes 1 warning sign investors should be aware of before investing in Goosehead Insurance. Read for free now.There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

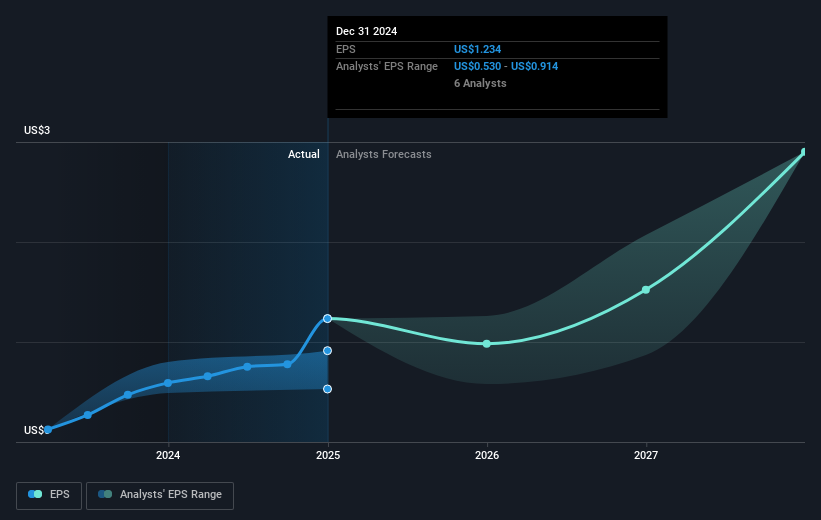

During five years of share price growth, Goosehead Insurance achieved compound earnings per share (EPS) growth of 38% per year. This EPS growth is higher than the 16% average annual increase in the share price. So one could conclude that the broader market has become more cautious towards the stock. Of course, with a P/E ratio of 87.87, the market remains optimistic.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About The Total Shareholder Return (TSR)?

We've already covered Goosehead Insurance's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Goosehead Insurance shareholders, and that cash payout contributed to why its TSR of 125%, over the last 5 years, is better than the share price return.

A Different Perspective

It's nice to see that Goosehead Insurance shareholders have received a total shareholder return of 92% over the last year. That gain is better than the annual TSR over five years, which is 18%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Goosehead Insurance , and understanding them should be part of your investment process.

Goosehead Insurance is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GSHD

Goosehead Insurance

Operates as a holding company for Goosehead Financial, LLC that engages in the provision of personal lines insurance agency services in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives