- United States

- /

- Insurance

- /

- NasdaqGS:GSHD

Goosehead Insurance (GSHD): Assessing Valuation Following a Recent Share Price Decline

Reviewed by Kshitija Bhandaru

See our latest analysis for Goosehead Insurance.

This recent pullback continues a downward trend for Goosehead Insurance, with a 30-day share price return of -15.4 percent and year-to-date losses deepening to nearly -36 percent. Despite the tough stretch for the stock, its three-year total shareholder return remains strongly positive. Longer-term investors have still seen significant gains even as current sentiment has shifted and momentum is fading.

If you're weighing new opportunities while the market shifts, now is a perfect moment to uncover fast growing stocks with high insider ownership.

With shares down sharply even as Goosehead Insurance posts solid growth, the key question is whether the market is overlooking its future potential or if its current price already reflects all that upside. Is there a true buying opportunity here, or has the market accurately priced in the company's growth prospects?

Most Popular Narrative: 33.5% Undervalued

The most widely followed narrative signals a substantial potential upside for Goosehead Insurance, as its fair value estimate is notably above the latest closing price of $67.35. This context sets the stage for a deeper look at the fundamental drivers powering this conviction.

Rapid adoption of Goosehead's proprietary AI and digital platforms is driving lower servicing costs and improved client experience. This positions the company to benefit from rising consumer demand for seamless, tech-enabled insurance solutions, with expectations of expanding operating leverage and boosting net margins over time.

Curious what’s fueling this bullish outlook? The narrative’s secret sauce blends ambitious revenue forecasts with surging profit margins and a premium future earnings multiple. Which bold assumptions bring the fair value so far above today’s price? Dive in to discover the full story behind these game-changing projections.

Result: Fair Value of $101.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sharp increases in climate-driven insurance claims or a slowdown in franchise agent growth could quickly challenge these bullish assumptions for Goosehead Insurance.

Find out about the key risks to this Goosehead Insurance narrative.

Another View: What About the Valuation Ratios?

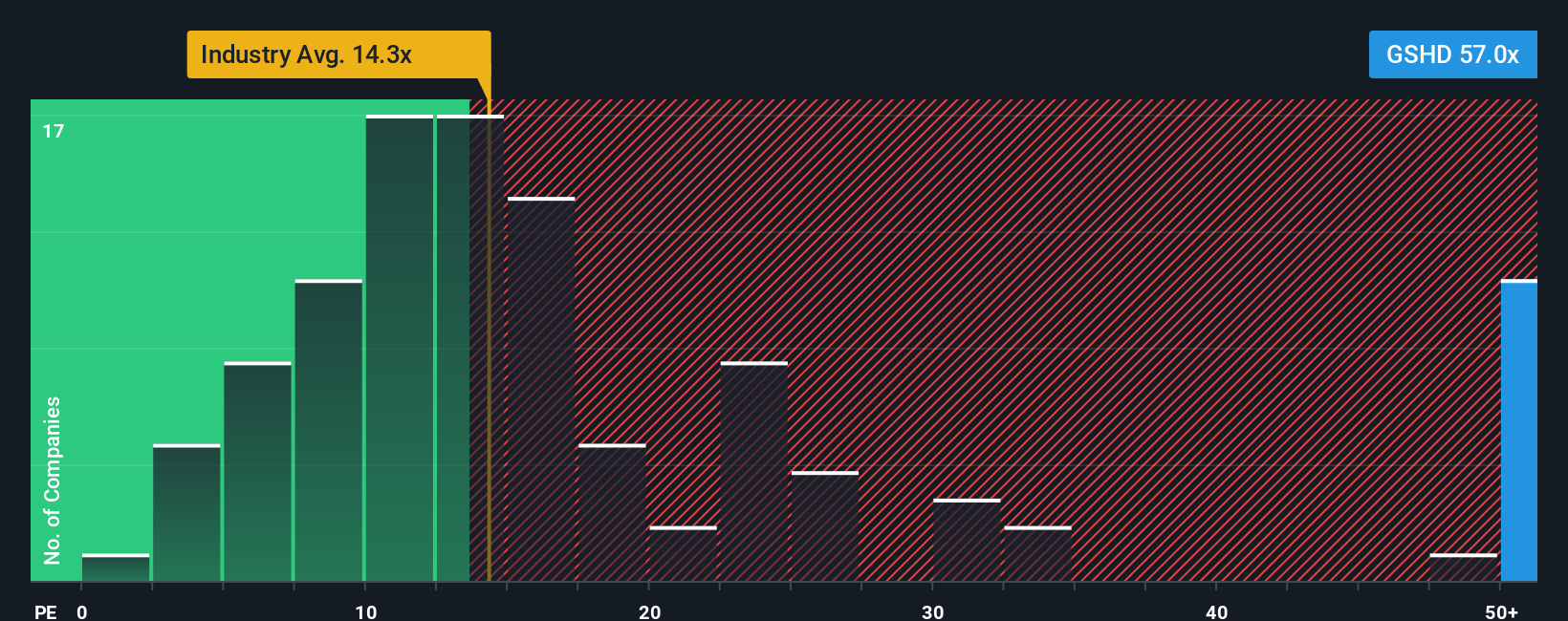

While the narrative makes a strong case for Goosehead Insurance's growth, its current price-to-earnings ratio is 56.5x, which is much higher than the US Insurance industry average of 14.1x and the fair ratio of 21.5x. This premium suggests investors are paying up for future potential. Could this optimism leave little room for error if expectations shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Goosehead Insurance Narrative

If you see things differently or want to dig into the numbers firsthand, there is nothing stopping you from building your own narrative in just a few minutes. Do it your way

A great starting point for your Goosehead Insurance research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Upgrade your watchlist and uncover your next opportunity by checking out these handpicked stock groups. There’s no need to miss your chance. Take action now.

- Capture the momentum and profits from leading-edge firms. Start screening with these 24 AI penny stocks making waves in artificial intelligence advancements.

- Secure potential income streams and financial resilience by reviewing these 18 dividend stocks with yields > 3% offering robust yields for income-focused portfolios.

- Capitalize on tomorrow’s tech with these 26 quantum computing stocks pioneering breakthroughs in quantum computing and disruptive innovations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GSHD

Goosehead Insurance

Operates as a holding company for Goosehead Financial, LLC that engages in the provision of personal lines insurance agency services in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives