- United States

- /

- Insurance

- /

- NasdaqGS:GSHD

Can Goosehead Insurance’s (GSHD) Real Estate Partnerships Deepen Its Competitive Moat in a Challenging Market?

Reviewed by Simply Wall St

- Nan & Company Properties recently announced the expansion of its franchise partnership with Goosehead Insurance, launching Altivo Insurance to integrate home insurance options directly into luxury real estate transactions in Houston and beyond.

- This collaboration offers homebuyers tailored, competitive insurance coverage at closing and addresses the need for reliable insurance amid Houston’s frequent weather-related risks.

- We'll examine how Altivo Insurance’s seamless integration of coverage into the real estate process could impact Goosehead Insurance’s growth narrative.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 30 companies in the world exploring or producing it. Find the list for free.

Goosehead Insurance Investment Narrative Recap

To believe in Goosehead Insurance’s story, you must see continued expansion in tech-enabled franchise partnerships, like the new Altivo Insurance collaboration, as a significant lever for accessing new clients in complex markets such as Houston. While the expanded partnership may support Goosehead’s growth catalyst through deeper integration with real estate partners and improved client experience, it does little in the short term to ease the company’s biggest risk: increasing exposure to climate-related catastrophes that threaten carrier relationships and coverage affordability.

Of Goosehead's recent announcements, the July franchise partnership with Baird & Warner Real Estate, which formed Adaptive Insurance Agency, is notably similar. Both arrangements integrate insurance directly into the homebuying process and may accelerate access to new clients through trusted real estate brands, providing more momentum behind Goosehead’s growth narrative centered on enterprise sales and channel expansion.

On the other hand, investors should be aware that as Goosehead pushes deeper into high-risk markets like Houston, carrier appetite for underwriting new policies could...

Read the full narrative on Goosehead Insurance (it's free!)

Goosehead Insurance's narrative projects $588.5 million in revenue and $71.4 million in earnings by 2028. This requires 20.0% yearly revenue growth and a $41.5 million earnings increase from $29.9 million today.

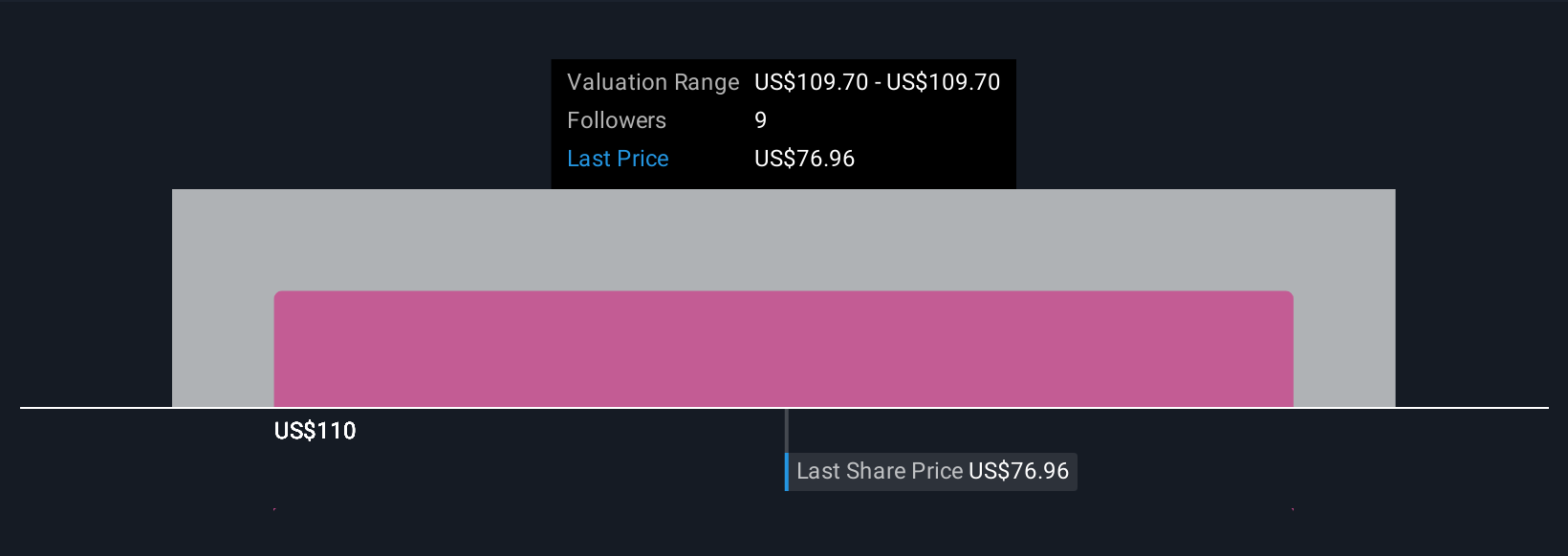

Uncover how Goosehead Insurance's forecasts yield a $109.70 fair value, a 38% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community has contributed one fair value estimate for Goosehead Insurance at US$109.70, with no variation among views. Despite this consensus, the company’s efforts to embed insurance within real estate transactions highlight the importance of distribution strategy for future performance. Compare these perspectives to your own outlook on the company's expansion, risks, and opportunities.

Explore another fair value estimate on Goosehead Insurance - why the stock might be worth as much as 38% more than the current price!

Build Your Own Goosehead Insurance Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Goosehead Insurance research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Goosehead Insurance research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Goosehead Insurance's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GSHD

Goosehead Insurance

Operates as a holding company for Goosehead Financial, LLC that engages in the provision of personal lines insurance agency services in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives