- United States

- /

- Insurance

- /

- NasdaqGS:ERIE

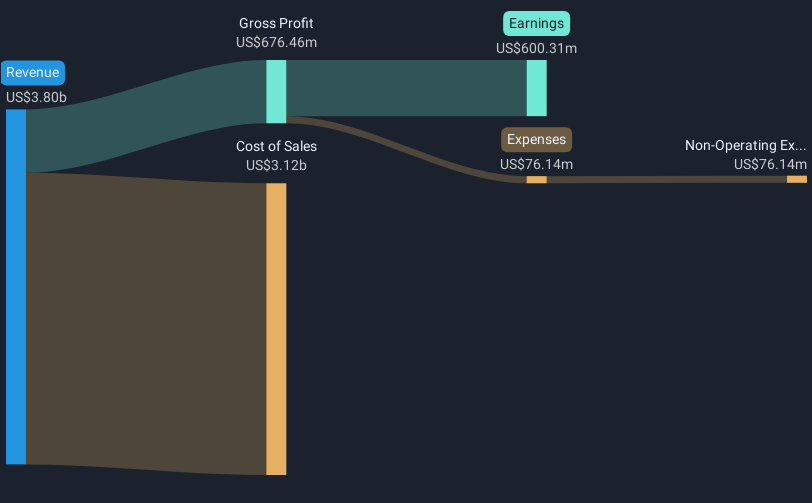

Erie Indemnity (NasdaqGS:ERIE) Sees Revenue Surge To US$3.8 Billion And Net Income Rise To US$600 Million

Reviewed by Simply Wall St

Erie Indemnity (NasdaqGS:ERIE) recently reported substantial growth in its fourth quarter and full-year earnings, with revenues increasing from $818 million to $924 million and net income rising from $111 million to $152 million. These positive financial outcomes likely contributed to the company's 5% price increase over the past week. This rise contrasts with the overall market downturn, as major indexes like the Nasdaq experienced declines amid broader economic concerns and fluctuating market conditions. Despite these challenges, Erie Indemnity's solid earnings performance seems to have instilled investor confidence, aligning with the broader trend where financial institutions showed impressive earnings growth. Additionally, a benign inflation report eased market-wide concerns, providing a favorable backdrop that may have also supported Erie Indemnity's stock performance during a volatile period for the market. Overall, the combination of strong company-specific results and relatively eased market conditions seemed to support the recent upward movement in Erie Indemnity's stock price.

Take a closer look at Erie Indemnity's potential here.

Over the past five years, Erie Indemnity has achieved a total return of 196.84%, reflecting a strong performance. This impressive growth can be attributed to several contributing factors. Notably, the company's robust earnings growth, with earnings increasing by an average of 11.6% per year, has been a significant driver. Additionally, Erie Indemnity's return on equity stood at a high 28.7%, enhancing its appeal to investors. The company's consistent dividend increases, such as the 7.1% boost announced in December 2024, have also played a part in bolstering total returns.

The company's inclusion in major indices, including the S&P 500 in September 2024, likely increased its visibility and attractiveness to institutional investors. Despite ERIE being deemed expensive compared to industry averages, its ability to consistently generate high-quality earnings has contributed to long-term investor confidence. In the past year, although Erie Indemnity underperformed relative to both its industry, which returned 18.4%, and the overall US market, the longer-term gains reflect its solid business fundamentals.

- See whether Erie Indemnity's current market price aligns with its intrinsic value in our detailed report

- Assess the potential risks impacting Erie Indemnity's growth trajectory—explore our risk evaluation report.

- Are you invested in Erie Indemnity already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Erie Indemnity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ERIE

Erie Indemnity

Operates as a managing attorney-in-fact for the subscribers at the Erie Insurance Exchange in the United States.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives