- United States

- /

- Insurance

- /

- NasdaqGS:ERIE

Erie Indemnity (NasdaqGS:ERIE) Jumps 15% After Earnings Reveal Strong US$11.48 EPS

Reviewed by Simply Wall St

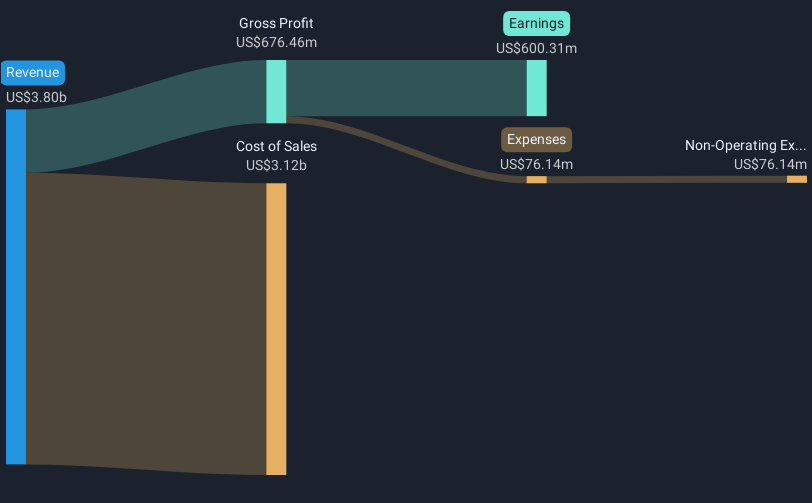

Erie Indemnity (NasdaqGS:ERIE) witnessed a price surge of 15% over the last week, notably tied to the release of its full-year 2024 earnings. The company announced an impressive 16% increase in revenue and a 35% rise in net income, alongside a significant jump in diluted earnings per share to USD 11.48. These robust financial results likely fueled investor confidence, even as broader markets faced volatility. This was amidst a challenging backdrop where the Dow Jones and S&P 500 saw declines of 1.8% due to new U.S. tariffs and related economic concerns. Despite the broader market downturn, Erie Indemnity’s strong earnings and declared quarterly dividend of USD 1.3650 per share appear to have differentiated it, driving the positive share price performance amid widespread sell-offs in other sectors. The company’s resilience and growth in earnings show its strong position even as market trends exhibit broader challenges.

Click to explore a detailed breakdown of our findings on Erie Indemnity.

Over the last five years, Erie Indemnity's total shareholder return amounted to an impressive 232.05%, signifying substantial growth. This period was marked by consistent earnings enhancements, notably the 14.4% annual growth in profits, supported by robust net profit margins, reaching 15.8% over the past year. The company's earnings performance was further amplified by a high return on equity at 30.2%, establishing a solid financial footing despite being considered pricey by industry standards. Earnings growth for 2024 surpassed past averages, contributing positively to shareholder returns. Additionally, while Erie underperformed against the US market and insurance industry in the past year, its long-term earnings growth trajectory strengthened investor sentiment.

Another key driver of total returns was Erie Indemnity's progressive dividend policy. Regular increases in quarterly dividends, such as the rise from US$1.11 in 2022 to US$1.3650 in 2025, afforded shareholders incremental, tangible returns. While executive changes and debt financing extended maturity were part of Erie's broader strategies, their impact played a secondary role in the broader growth narrative over the longer term.

- Analyze Erie Indemnity's fair value against its market price in our detailed valuation report—access it here.

- Assess the potential risks impacting Erie Indemnity's growth trajectory—explore our risk evaluation report.

- Got skin in the game with Erie Indemnity? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Erie Indemnity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ERIE

Erie Indemnity

Operates as a managing attorney-in-fact for the subscribers at the Erie Insurance Exchange in the United States.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives