- United States

- /

- Insurance

- /

- NasdaqGS:ERIE

Earnings Momentum Might Change The Case For Investing In Erie Indemnity (ERIE)

Reviewed by Simply Wall St

- Erie Indemnity Company reported second quarter 2025 financial results, posting revenues of US$1.06 billion and net income of US$174.69 million, both higher than the previous year.

- Consistent revenue and net income growth over the first six months of 2025 highlights ongoing operational strength for the insurance management provider.

- We'll explore how this continued earnings momentum shapes Erie Indemnity's investment narrative, especially in light of its solid six-month performance.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 26 companies in the world exploring or producing it. Find the list for free.

What Is Erie Indemnity's Investment Narrative?

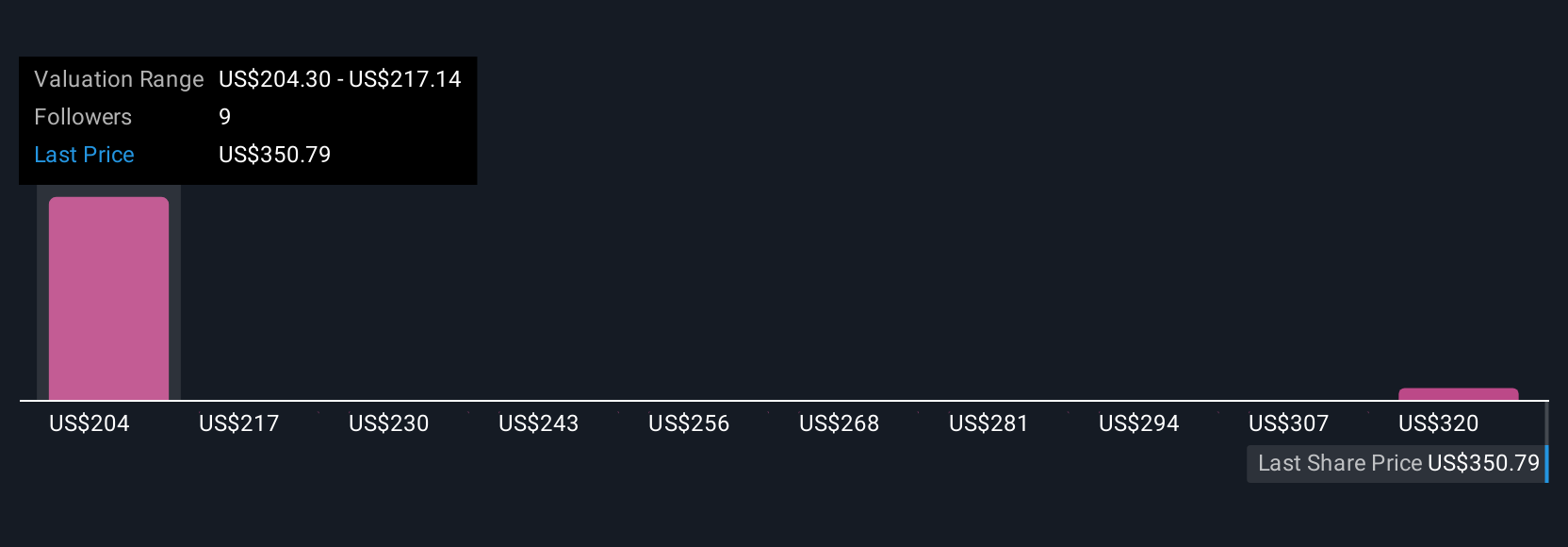

For those considering Erie Indemnity as an investment, the core belief rests on its consistency in growing both revenue and net income quarter after quarter, driven by a seasoned management team and a history of prudent capital allocation. The company’s latest results, with second-quarter revenues at US$1.06 billion and net income reaching US$174.69 million, reinforce this pattern of operational strength. While these numbers are encouraging and may offer continued momentum as a short-term catalyst, it’s important to note that the market had already priced in optimistic expectations. The modest recent price uptick suggests the results, though positive, were largely anticipated, so immediate shifts in the risk or catalyst profile appear limited. Investors should continue to watch valuation closely, as Erie trades at a premium relative to industry averages, and monitor for any changes in executive leadership or shifts in profitability.

However, valuation remains a key risk investors should be mindful of, given current pricing.

Exploring Other Perspectives

Explore 2 other fair value estimates on Erie Indemnity - why the stock might be worth as much as $332.66!

Build Your Own Erie Indemnity Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Erie Indemnity research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Erie Indemnity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Erie Indemnity's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Erie Indemnity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ERIE

Erie Indemnity

Operates as a managing attorney-in-fact for the subscribers at the Erie Insurance Exchange in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives