- United States

- /

- Insurance

- /

- NasdaqGS:EHTH

Positive Sentiment Still Eludes eHealth, Inc. (NASDAQ:EHTH) Following 25% Share Price Slump

To the annoyance of some shareholders, eHealth, Inc. (NASDAQ:EHTH) shares are down a considerable 25% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 48% share price drop.

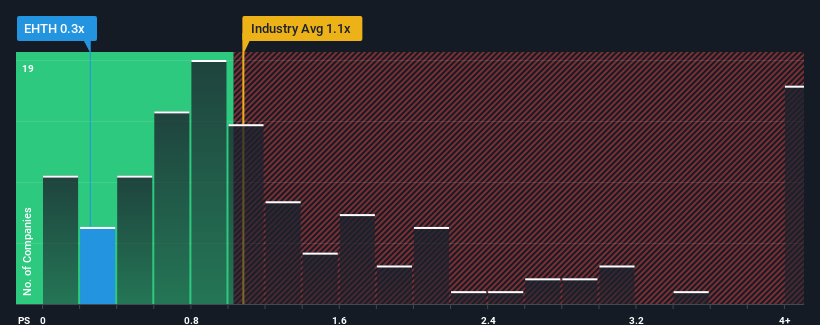

Since its price has dipped substantially, considering around half the companies operating in the United States' Insurance industry have price-to-sales ratios (or "P/S") above 1.1x, you may consider eHealth as an solid investment opportunity with its 0.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for eHealth

What Does eHealth's P/S Mean For Shareholders?

eHealth certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on eHealth.Is There Any Revenue Growth Forecasted For eHealth?

In order to justify its P/S ratio, eHealth would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 21% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 24% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 5.1% during the coming year according to the four analysts following the company. With the industry predicted to deliver 4.9% growth , the company is positioned for a comparable revenue result.

With this information, we find it odd that eHealth is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On eHealth's P/S

The southerly movements of eHealth's shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It looks to us like the P/S figures for eHealth remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you settle on your opinion, we've discovered 2 warning signs for eHealth that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:EHTH

eHealth

Operates a health insurance marketplace that provides consumer engagement, education, and health insurance enrollment solutions in the United States.

Excellent balance sheet and good value.