- United States

- /

- Insurance

- /

- NasdaqGS:EHTH

Market Cool On eHealth, Inc.'s (NASDAQ:EHTH) Revenues Pushing Shares 27% Lower

Unfortunately for some shareholders, the eHealth, Inc. (NASDAQ:EHTH) share price has dived 27% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 51% share price decline.

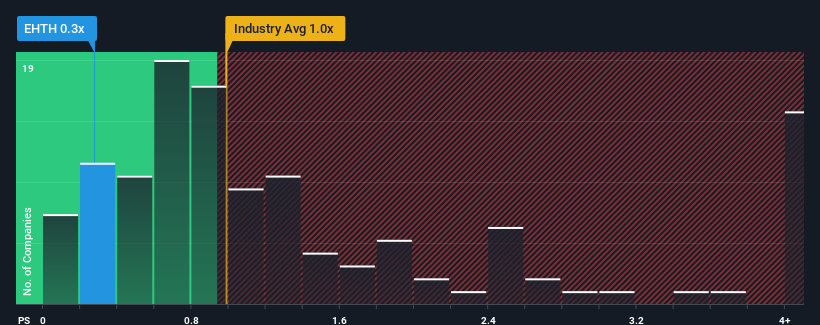

Since its price has dipped substantially, it would be understandable if you think eHealth is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.3x, considering almost half the companies in the United States' Insurance industry have P/S ratios above 1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for eHealth

What Does eHealth's P/S Mean For Shareholders?

eHealth could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on eHealth.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like eHealth's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 22% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 6.1% each year over the next three years. With the industry predicted to deliver 6.1% growth per year, the company is positioned for a comparable revenue result.

With this information, we find it odd that eHealth is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On eHealth's P/S

eHealth's P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of eHealth's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for eHealth that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:EHTH

eHealth

Operates a health insurance marketplace that provides consumer engagement, education, and health insurance enrollment solutions in the United States.

Excellent balance sheet and good value.