- United States

- /

- Insurance

- /

- NasdaqGS:CINF

Is Cincinnati Financial Set for More Gains After Five-Year 151% Rally?

Reviewed by Bailey Pemberton

If you’re weighing what to do with Cincinnati Financial’s stock right now, you’re not alone. This is one of those names where investors are trying to figure out if steady long-term growth means the stock is setting up for more gains, or if recent optimism has already priced in most of the good news. What makes it even more interesting is that Cincinnati Financial seems to shrug off market noise, with a powerhouse 151.2% return over five years and a solid 13.5% over the past year. It’s not just a short-term wonder.

Lately, shares have crept upward, rising 2.4% this past week and adding another 1.4% in the last month. Part of that momentum comes from the insurance giant’s conservative reputation and its resilience during volatile periods for financial stocks. Investors also seem to be reassessing perceived risks thanks to a string of positive headlines about insurance sector stability and Cincinnati Financial’s disciplined underwriting approach. Each of these factors nudges sentiment higher, helping explain why the stock has outperformed so consistently over multiple timeframes.

But when it comes to valuation, things get really interesting. On the most common measures such as price-to-earnings, price-to-book, and a few others, Cincinnati Financial earns a value score of 0 out of 6, meaning it doesn’t screen as undervalued on any of the standard six checks used by analysts. But is that the full story? Next, let’s dig into those valuation methods, and then consider whether there’s a more meaningful way to think about value for a company like this.

Cincinnati Financial scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Cincinnati Financial Excess Returns Analysis

The Excess Returns model calculates a company’s intrinsic value based on the profits it generates above its cost of equity. Rather than just looking at earnings, this approach measures how effectively Cincinnati Financial reinvests shareholder capital to create value beyond what investors could expect elsewhere at similar risk levels.

For Cincinnati Financial, the key inputs are:

- Book Value: $91.50 per share

- Stable EPS: $7.99 per share (Source: Weighted future Return on Equity estimates from 5 analysts.)

- Cost of Equity: $6.68 per share

- Excess Return: $1.31 per share

- Average Return on Equity: 8.11%

- Stable Book Value: $98.54 per share (Source: Weighted future Book Value estimates from 5 analysts.)

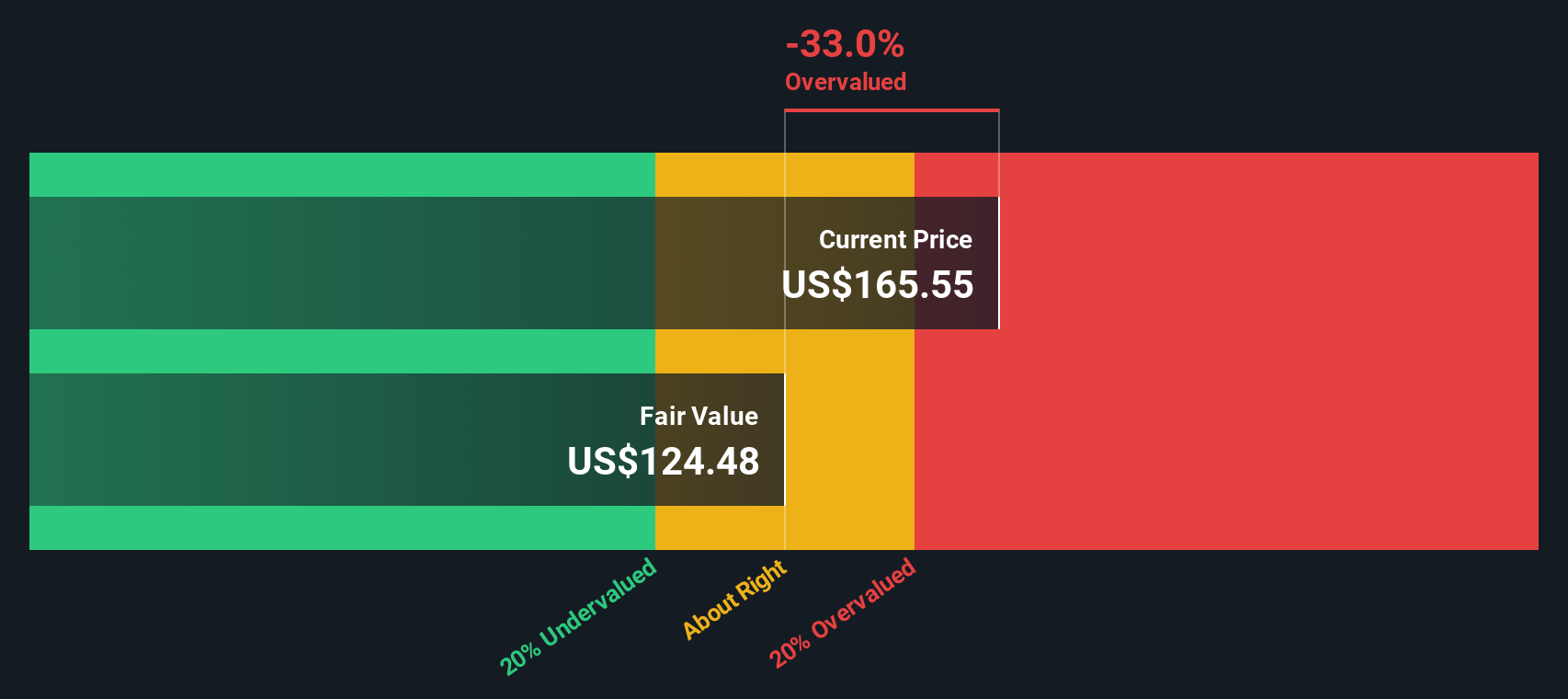

By projecting these returns forward and discounting them to today, the model estimates an intrinsic value for Cincinnati Financial of $134.02 per share. Compared to the current share price, this suggests the stock is trading at a 16.9% premium and is therefore overvalued according to this methodology.

Result: OVERVALUED

Our Excess Returns analysis suggests Cincinnati Financial may be overvalued by 16.9%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Cincinnati Financial Price vs Earnings

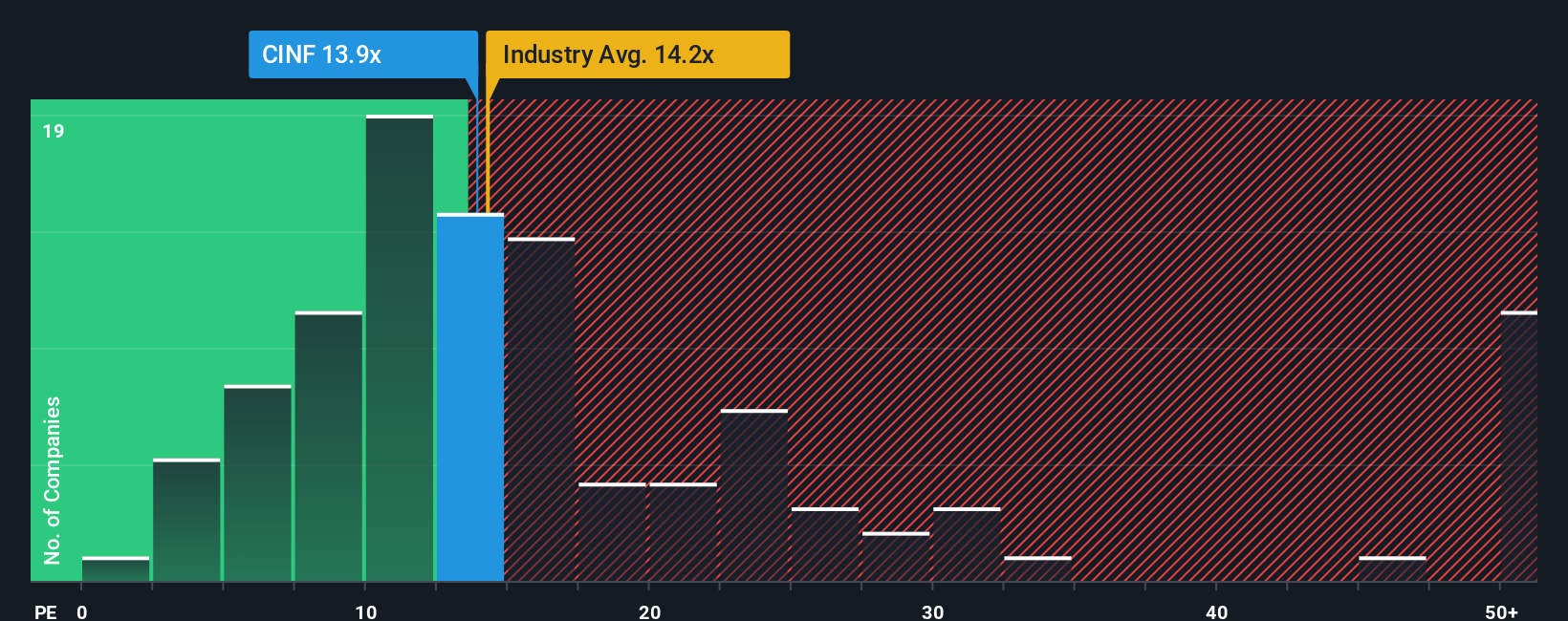

For profitable companies like Cincinnati Financial, the price-to-earnings (PE) ratio is a time-tested metric for gauging whether a stock is trading at a reasonable value relative to its earnings power. The PE ratio is attractive because it accounts for how much investors are willing to pay today for a dollar of future earnings. This makes it especially relevant for stable, consistently profitable businesses in the insurance sector.

Growth expectations and risk both play a major role in what makes a "normal" or "fair" PE ratio. Higher growth and lower risk typically justify higher PE multiples. Cincinnati Financial’s current PE ratio is 13.46x, closely aligned with the broader Insurance industry average of 13.47x and just above its peer group average of 12.54x. This suggests investors recognize the company’s modestly above-average potential and conservative risk profile.

Simply Wall St uses a "Fair Ratio" proprietary metric, which forecasts a stock’s ideal PE multiple by weighing company-specific factors such as earnings growth, profit margin, risk profile, industry, and market cap. For Cincinnati Financial, the Fair Ratio stands at 8.93x, notably below its current market PE. This approach improves on simple peer or industry comparisons by blending in crucial aspects like growth outlook and risk-adjusted returns, leading to a more tailored valuation benchmark.

Because Cincinnati Financial’s current PE is meaningfully above its Fair Ratio, the shares look overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cincinnati Financial Narrative

Earlier, we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives, an intuitive approach that helps investors connect a company’s story with a financial forecast and an estimated fair value, all in one place. Instead of relying solely on numbers or rigid formulas, Narratives empower you to define your perspective on Cincinnati Financial by blending your assumptions about its future revenue, earnings, and margins with your view of the business and its industry.

Narratives bridge the gap between what you believe about a company and the numbers behind it. They enable you to translate outlook and risks into a real-time estimate of fair value. On Simply Wall St's platform, millions of investors access Narratives through the Community page, where you can see a range of perspectives and update your own thesis as new information arises. This tool helps you decide how your Fair Value compares to the current market Price, and because Narratives update automatically with news or earnings, your story always stays relevant.

For example, the most optimistic Narrative might see $175.00 as fair value for Cincinnati Financial, focusing on resilient earnings and strong long-term growth. A more cautious Narrative might value it at $145.00, citing margin compression and rising catastrophe risks.

Do you think there's more to the story for Cincinnati Financial? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CINF

Cincinnati Financial

Provides property casualty insurance products in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion