- United States

- /

- Insurance

- /

- NasdaqGS:CINF

Cincinnati Financial (CINF): Examining Current Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

Cincinnati Financial (CINF) has shown some steady price movement in recent weeks, gaining roughly 5% over the past month. Let's take a closer look at what could be behind these shifts and what investors might watch next.

See our latest analysis for Cincinnati Financial.

The recent climb in Cincinnati Financial's share price, now at $163.9, continues a solid run, with a 15% share price gain year-to-date and a three-year total shareholder return near 66%. That steady momentum suggests investors are gradually warming to the company’s growth prospects, even as market sentiment around insurers can shift quickly.

If you’re interested in other companies that are trending higher with impressive insider confidence and strong growth, now’s a great time to discover fast growing stocks with high insider ownership

But with the stock trading just shy of analyst price targets and after such strong gains, the real question is whether Cincinnati Financial is still undervalued or if the market has already priced in its future growth.

Most Popular Narrative: 4% Undervalued

Compared to its latest close of $163.90, the most widely followed narrative sets Cincinnati Financial's fair value at $171 per share, suggesting some upside still remains. This sets the stage for a closer look at what’s driving those numbers.

Consistent underwriting discipline, profitable premium growth, diversified expansion, strong investment results, and technology-driven efficiencies are supporting Cincinnati Financial's long-term earnings stability and competitive positioning.

Want to know the core financial levers behind this valuation? The narrative leans heavily on surprising forecasts for future profit margins and premium growth. Which assumptions drive that ambitious price target? Get the details that underpin this calculation and discover the figures behind the headline.

Result: Fair Value of $171 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected severe weather or new macroeconomic shocks could quickly reverse Cincinnati Financial’s current earnings strength. This could prompt analysts to reassess their valuation outlook.

Find out about the key risks to this Cincinnati Financial narrative.

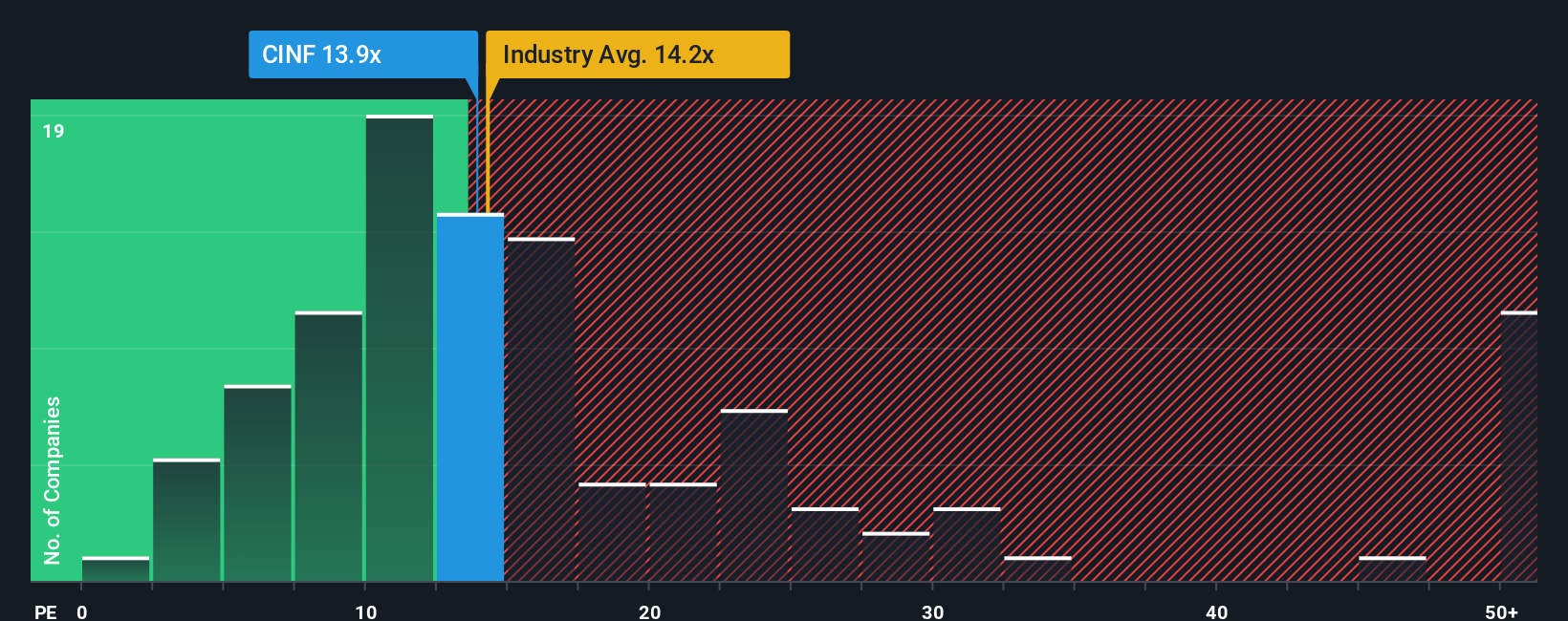

Another View: Market Multiples Perspective

Looking at Cincinnati Financial through the lens of its price-to-earnings ratio, the picture is a little different. The company trades at 12.1x earnings, which is lower than both the US Insurance industry average of 13.2x and its peer group. However, the fair ratio, based on market trends, sits at just 6.5x. This gap suggests that, while Cincinnati Financial appears attractively priced versus the industry, there may still be valuation risk ahead if the market shifts toward that fair ratio benchmark. Could the stock be more vulnerable than it looks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cincinnati Financial Narrative

If the current view doesn’t match your own, or you want to dig deeper, you can quickly build your personal take using the same financial data. Craft your perspective in under three minutes. Do it your way

A great starting point for your Cincinnati Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors don't limit themselves to one opportunity. Stay ahead of the curve by tapping into powerful, tailored stock ideas that match your goals and interests.

- Explore the potential of tomorrow’s AI breakthroughs by reviewing these 25 AI penny stocks that could shape the next wave of innovation.

- Find compelling yield opportunities and see which reliable payers are meeting the mark with these 16 dividend stocks with yields > 3%.

- Discover rare value plays that may offer strong returns by checking out these 879 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CINF

Cincinnati Financial

Provides property casualty insurance products in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives