- United States

- /

- Insurance

- /

- NasdaqCM:ACIC

American Coastal Insurance Corporation (NASDAQ:ACIC) Stock Rockets 29% As Investors Are Less Pessimistic Than Expected

Despite an already strong run, American Coastal Insurance Corporation (NASDAQ:ACIC) shares have been powering on, with a gain of 29% in the last thirty days. This latest share price bounce rounds out a remarkable 658% gain over the last twelve months.

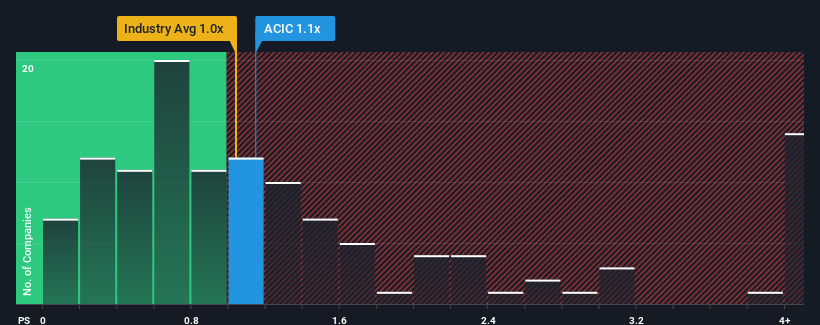

Even after such a large jump in price, there still wouldn't be many who think American Coastal Insurance's price-to-sales (or "P/S") ratio of 1.1x is worth a mention when the median P/S in the United States' Insurance industry is similar at about 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for American Coastal Insurance

How American Coastal Insurance Has Been Performing

Recent times have been advantageous for American Coastal Insurance as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on American Coastal Insurance will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like American Coastal Insurance's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 40%. Still, revenue has fallen 40% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 36% as estimated by the one analyst watching the company. That's not great when the rest of the industry is expected to grow by 7.0%.

In light of this, it's somewhat alarming that American Coastal Insurance's P/S sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What We Can Learn From American Coastal Insurance's P/S?

American Coastal Insurance appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

While American Coastal Insurance's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

Having said that, be aware American Coastal Insurance is showing 1 warning sign in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade American Coastal Insurance, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ACIC

American Coastal Insurance

Through its subsidiaries, primarily engages in the commercial and personal property and casualty insurance business in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives