- United States

- /

- Household Products

- /

- NYSE:ODC

Imagine Owning Oil-Dri of America (NYSE:ODC) And Wondering If The 18% Share Price Slide Is Justified

Oil-Dri Corporation of America (NYSE:ODC) shareholders should be happy to see the share price up 20% in the last quarter. But in truth the last year hasn't been good for the share price. After all, the share price is down 18% in the last year, significantly under-performing the market.

View our latest analysis for Oil-Dri of America

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate twelve months during which the Oil-Dri of America share price fell, it actually saw its earnings per share (EPS) improve by 45%. It's quite possible that growth expectations may have been unreasonable in the past. It's fair to say that the share price does not seem to be reflecting the EPS growth. So it's easy to justify a look at some other metrics.

Revenue was pretty flat on last year, which isn't too bad. But the share price might be lower because the market expected a meaningful improvement, and got none.

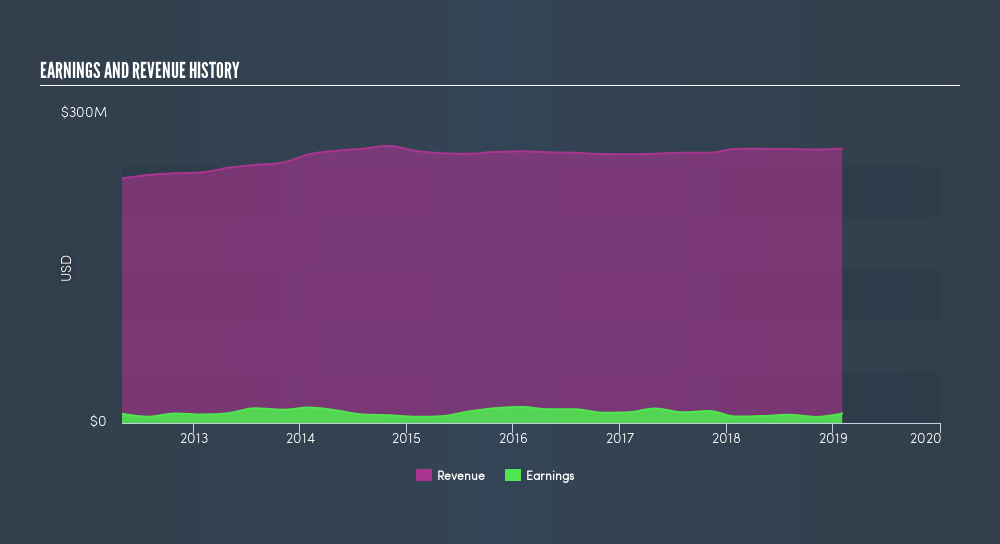

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Oil-Dri of America's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Oil-Dri of America the TSR over the last year was -16%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Oil-Dri of America shareholders are down 16% for the year (even including dividends), but the market itself is up 9.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 2.3% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:ODC

Oil-Dri Corporation of America

Develops, manufactures, and markets sorbent products in the United States and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives