- United States

- /

- Personal Products

- /

- NYSE:KVUE

Kenvue (NYSE:KVUE) Unveils Neutrogena Sunscreen Collaboration With John Cena And New Initiatives

Reviewed by Simply Wall St

Kenvue (NYSE:KVUE) recently launched the Neutrogena® Ultra Sheer® Face Liquid Mineral Sunscreen SPF 70, supported by a campaign featuring John Cena, emphasizing its commitment to sun safety and innovation. This effort likely played a role in Kenvue's 11% share price increase over the last quarter, despite a challenging macroeconomic landscape, where major indexes like the S&P 500 and Nasdaq saw significant declines due to tariff-related concerns and economic uncertainties. Additionally, investor activism, including TOMS Capital Management acquiring a stake and advocating changes, may have influenced Kenvue’s share performance during this period.

Over the past year, Kenvue achieved a total shareholder return of 16.04%, reflecting strong performance despite broader market and industry challenges. Kenvue outpaced the US Personal Products industry, which saw a return of -33% over the same period. This performance can be partly attributed to its strategic cost-cutting measures aimed at generating US$350 million in savings by 2026, enhancing its ability to invest in brand growth and innovations. Further bolstering investor confidence was Kenvue's increase in quarterly dividends announced in July 2024 and the subsequent declaration in January 2025, offering a consistent return to shareholders.

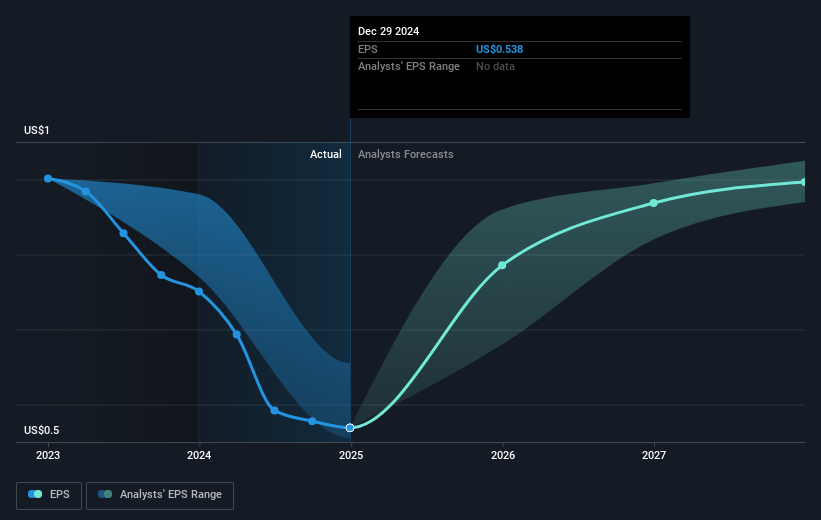

Additionally, financial activities such as a share repurchase program in February 2025 demonstrated Kenvue's commitment to enhancing shareholder value. However, challenges, such as a reported net income of US$1.03 billion for 2024, down from US$1.664 billion, along with operational impacts from its separation from Johnson & Johnson, highlighted the company's adaptive strategies in an evolving macroeconomic environment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Kenvue, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kenvue might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KVUE

Kenvue

Operates as a consumer health company in the United States, Europe, the Middle East, Africa, Asia-Pacific, and Latin America.

Slight with moderate growth potential.

Similar Companies

Market Insights

Community Narratives