- United States

- /

- Personal Products

- /

- NYSE:KVUE

Kenvue (KVUE): Evaluating Valuation After Tylenol-Autism Headlines Shake Investor Confidence

Reviewed by Simply Wall St

If you are watching Kenvue (KVUE), you have probably noticed the headlines swirling around Tylenol and a potential link to autism after a forthcoming statement from the Health Secretary. News that the report could suggest a connection between prenatal Tylenol use and autism sent shares lower, raising the stakes for the company’s reputation and future sales. Kenvue, for its part, has firmly reiterated that major regulators and leading medical organizations stand by the drug’s safety. This is an important point, but one that has not settled investor nerves just yet.

Unsurprisingly, the stock has taken a hit. Shares dropped more than 13% after the news broke and have fallen 17% over the past year, as negative headlines and a climate of uncertainty cloud the outlook. Even before this latest drop, Kenvue was dealing with operational challenges and tariff headwinds. Momentum appears to be fading. However, management remains optimistic about regaining stability through new marketing and product launches.

After this year’s steep decline, is Kenvue trading at a meaningful discount, or is the market simply pricing in the risk of future fallout?

Most Popular Narrative: 25.8% Undervalued

According to the most widely followed narrative, Kenvue is trading well below its estimated fair value, offering upside for investors based on recent projections.

With autonomy from its former parent, Kenvue can allocate resources to best fit its needs and grow the business. Macro drivers such as an aging population and premiumization of health care will act as tailwinds for all of Kenvue’s brands.

Curious how Kenvue’s independence and focus on premium health trends might unlock shareholder value? There is one key growth factor in these bold projections that sets this valuation apart. Find out which crucial financial assumptions power this discounted fair value and why they could reshape the outlook.

Result: Fair Value of $25.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising input costs may pressure Kenvue to raise prices. This could push cost-sensitive consumers toward private-label competitors.

Find out about the key risks to this Kenvue narrative.Another Angle: How Does Kenvue's Price Stack Up?

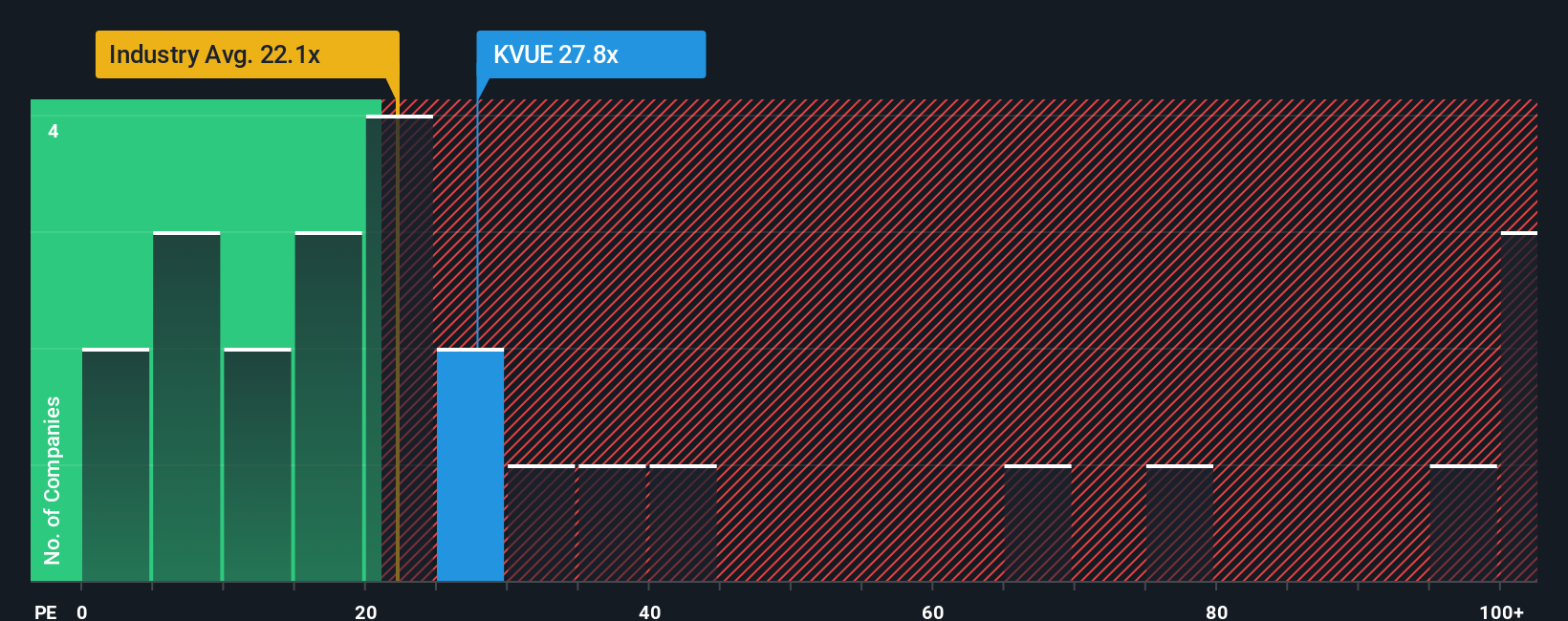

Looking from a different perspective, Kenvue’s valuation appears higher than average relative to others in its industry according to this approach. Does this contradict the earlier view, or is it simply a question of timing and market mood?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Kenvue to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Kenvue Narrative

If you want to challenge these interpretations or dive deeper on your own, you’re free to start exploring the numbers and assemble your own view. It only takes a few minutes to get started. Do it your way.

A great starting point for your Kenvue research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Unleash your portfolio’s potential by acting now. Some of the most exciting market opportunities are just a click away and are waiting for you to seize them.

- Tap into tomorrow’s technology leaders making waves in quantum computing by checking out quantum computing stocks.

- Generate steady income with companies offering reliable yields above 3 percent through dividend stocks with yields > 3%.

- Spot hidden value with stocks trading below what their cash flows suggest by visiting undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kenvue might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:KVUE

Kenvue

Operates as a consumer health company in the United States, Europe, the Middle East, Africa, Asia-Pacific, and Latin America.

Proven track record and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion