- United States

- /

- Personal Products

- /

- NYSE:KVUE

Did Albert Invent’s AI Partnership Just Shift Kenvue’s (KVUE) Innovation and Investment Narrative?

Reviewed by Sasha Jovanovic

- On October 14, 2025, Albert Invent announced a multi-year partnership with Kenvue Inc. to accelerate R&D efforts across Kenvue’s global brand portfolio using advanced AI technologies aimed at streamlining and digitalizing the entire product lifecycle.

- This collaboration reflects a significant push toward integrating AI into scientific research processes, targeting greater operational efficiency and enhanced responsiveness to consumer needs across a wide range of health products.

- We’ll examine how the integration of Albert Invent’s AI platform could reshape Kenvue’s investment narrative by accelerating product innovation.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Kenvue Investment Narrative Recap

To be a Kenvue shareholder today, you have to believe in the turnaround potential from digital and operational streamlining, especially as the company looks to AI-driven innovation and efficiency. The recent partnership with Albert Invent highlights this modernization push but does not materially change the biggest short-term catalyst, executing on cost efficiency, and the leading risk of operational complexity or potential disruption from ongoing business restructuring.

One timely announcement that ties into this partnership is the appointment of Michael Wondrasch as Chief Technology & Data Officer in August 2025, reinforcing Kenvue’s commitment to digital transformation. Together with Albert Invent, this provides the technology foundation needed to streamline operations and could support efforts to address Kenvue’s complexity and margin pressures if executed well.

In contrast, investors should also consider the potential for near-term disruption as Kenvue restructures and reduces internal complexity...

Read the full narrative on Kenvue (it's free!)

Kenvue's narrative projects $16.3 billion revenue and $2.1 billion earnings by 2028. This requires 2.6% yearly revenue growth and a $0.7 billion earnings increase from $1.4 billion today.

Uncover how Kenvue's forecasts yield a $21.70 fair value, a 33% upside to its current price.

Exploring Other Perspectives

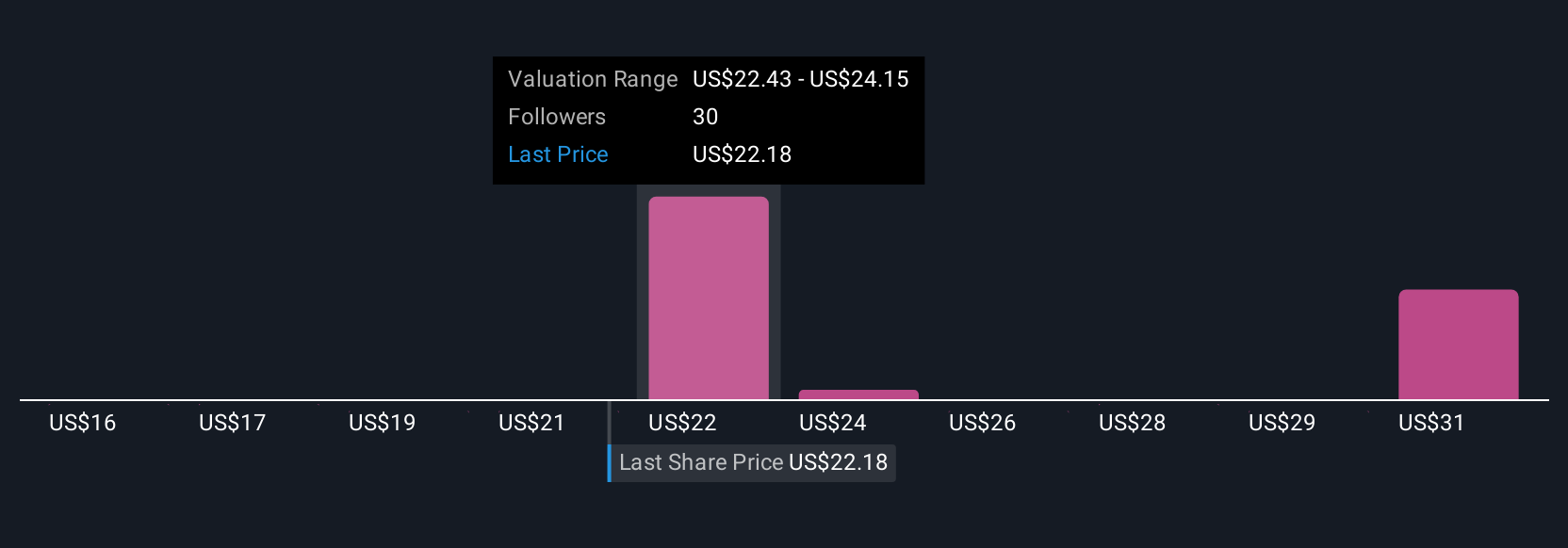

Six members of the Simply Wall St Community set their fair values for Kenvue stock between US$15.58 and US$27.14 per share. While opinions vary widely, many participants are watching how digital upgrades and AI initiatives will play into operational improvements and future earnings power, making now a good time to compare community forecasts for yourself.

Explore 6 other fair value estimates on Kenvue - why the stock might be worth just $15.58!

Build Your Own Kenvue Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kenvue research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kenvue research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kenvue's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kenvue might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KVUE

Kenvue

Operates as a consumer health company in the United States, Europe, the Middle East, Africa, Asia-Pacific, and Latin America.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives