- United States

- /

- Personal Products

- /

- NYSE:HLF

Investors Still Aren't Entirely Convinced By Herbalife Ltd.'s (NYSE:HLF) Earnings Despite 27% Price Jump

Herbalife Ltd. (NYSE:HLF) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 30% in the last twelve months.

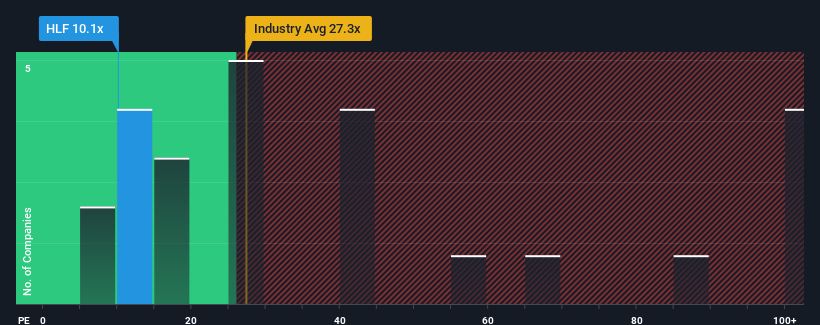

Even after such a large jump in price, Herbalife may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 10.1x, since almost half of all companies in the United States have P/E ratios greater than 20x and even P/E's higher than 36x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

While the market has experienced earnings growth lately, Herbalife's earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Herbalife

Is There Any Growth For Herbalife?

The only time you'd be truly comfortable seeing a P/E as low as Herbalife's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 54% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 80% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 92% as estimated by the five analysts watching the company. With the market only predicted to deliver 15%, the company is positioned for a stronger earnings result.

With this information, we find it odd that Herbalife is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Herbalife's P/E

Despite Herbalife's shares building up a head of steam, its P/E still lags most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Herbalife currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Herbalife (2 make us uncomfortable!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Herbalife might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HLF

Herbalife

Provides health and wellness products in North America, Mexico, South and Central America, Europe, the Middle East, Africa, China, and the Asia Pacific.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives