- United States

- /

- Personal Products

- /

- NYSE:ELF

What Does e.l.f. Beauty’s 500% Surge Mean After Walmart Expansion in 2025?

Reviewed by Bailey Pemberton

If you have been keeping an eye on e.l.f. Beauty lately, you are probably wondering whether now is the right moment to buy, hold, or walk away. Maybe you have heard the buzz about its meteoric rise over the last few years, or maybe its brand just keeps popping up in your local store. Either way, it is hard to ignore just how far this stock has come: up a whopping 517.0% over five years and an extraordinary 229.3% in the past three. Even with the latest dip of -3.7% in the last week and -3.5% over the past month, e.l.f. Beauty still boasts an impressive 5.4% year-to-date gain and an 18.2% rise over the last twelve months. That is not just luck; there is real momentum here, but also a level of volatility that may have you second-guessing the risk involved.

So, is e.l.f. Beauty's share price justified, or has the market gotten ahead of itself? The current valuation score for the company stands at 2 out of 6, meaning it appears undervalued in just 2 of the traditional 6 valuation checks. This is where the real analysis begins. Let us dig into the numbers, compare the different approaches investors use to determine value, and see if they provide the full picture, or if there is a smarter way to size up e.l.f. Beauty’s true worth that most miss.

e.l.f. Beauty scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: e.l.f. Beauty Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a favored approach among analysts because it estimates a company's intrinsic value by projecting its future cash flows and discounting them to today's dollars. By forecasting how much cash e.l.f. Beauty is expected to generate over the coming years and then adjusting for risk and time, the DCF reduces everything to what those future dollars are worth right now.

Currently, e.l.f. Beauty generates Free Cash Flow of $144.5 Million. Analysts anticipate continued growth, with projections reaching $401 Million by fiscal 2028. After the initial five-year analyst estimates, longer-term forecasts are extrapolated. Simply Wall St estimates that Free Cash Flow could climb past $900 Million by 2035. All cash flows are calculated in US dollars, in line with reporting practices.

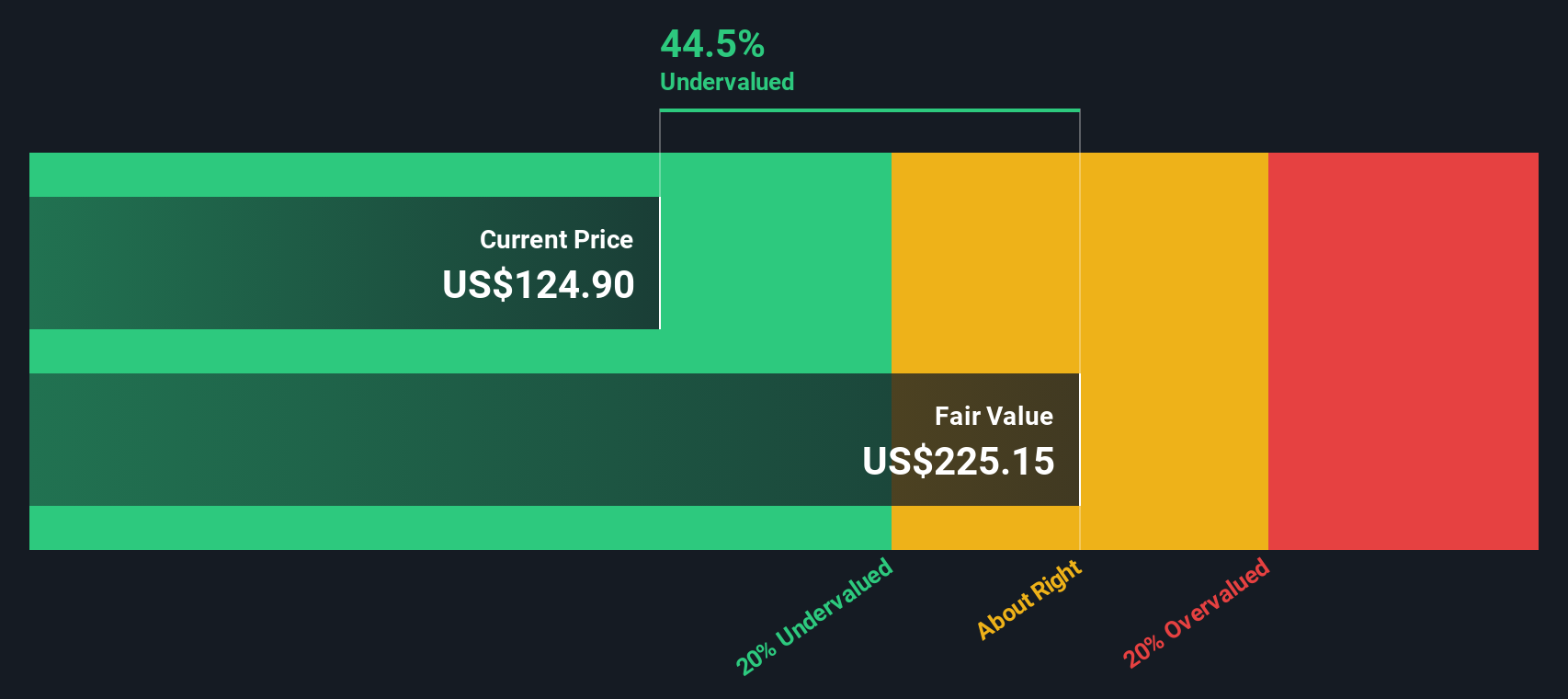

Based on these projections and using a 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value per share stands at $229.71. This figure suggests e.l.f. Beauty shares are trading at about a 43.5% discount compared to their current market price. According to the DCF, the market may be undervaluing the company's future earnings power.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests e.l.f. Beauty is undervalued by 43.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: e.l.f. Beauty Price vs Earnings (P/E Ratio)

The Price-to-Earnings (P/E) ratio is often considered the go-to metric for valuing profitable companies like e.l.f. Beauty. It tells investors how much they are paying for each dollar of the company’s earnings, making it particularly useful when a company is consistently generating profits. While a high P/E can reflect optimism about future growth, a low P/E may point to skepticism or underlying risks.

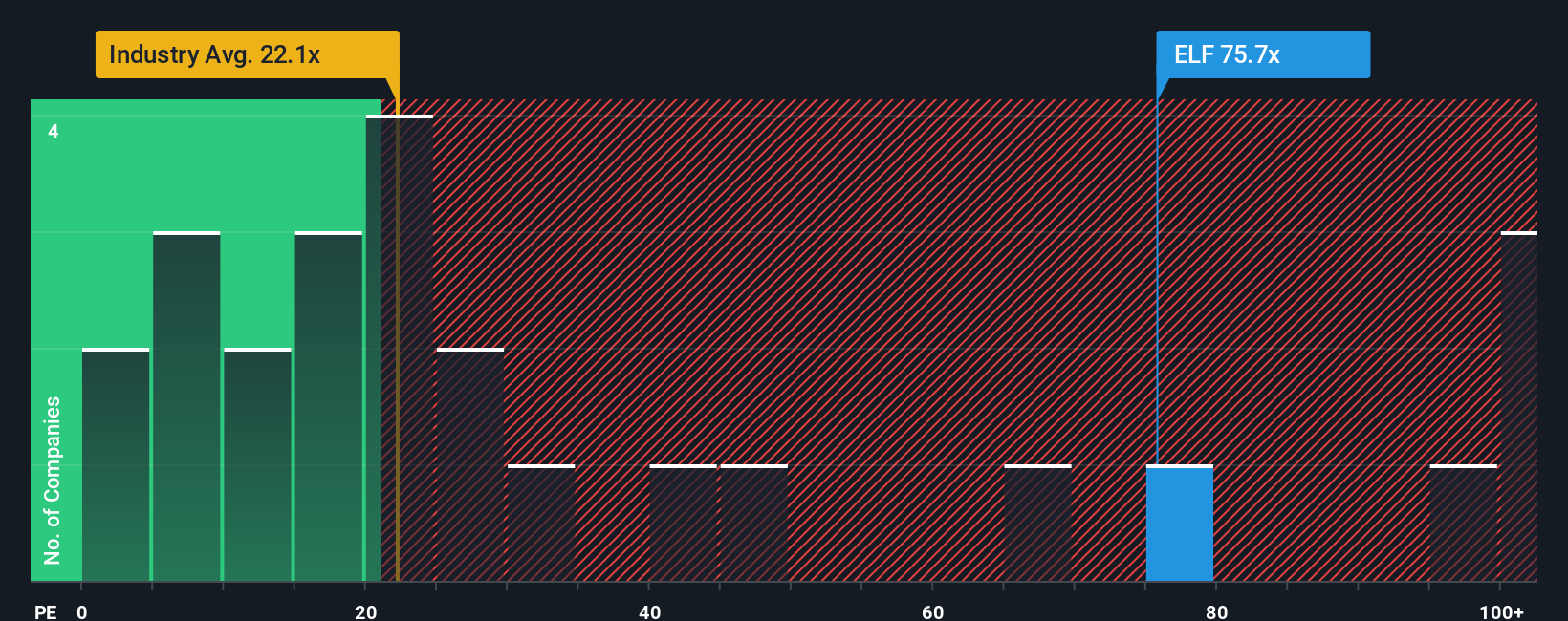

The “right” P/E ratio for any company depends on several factors. Fast-growing companies and those with lower risks often justify higher P/Es, while firms facing headwinds or industry disruption may command lower multiples. Currently, e.l.f. Beauty trades at a lofty 78.6x. This is well above the Personal Products industry average of 22.7x and the peer average of 21.5x. At face value, this looks expensive, but context matters.

Simply Wall St’s Fair Ratio goes further than simple benchmarks by tailoring the expected P/E to e.l.f. Beauty’s unique combination of earnings growth, profit margin, market cap, and risk profile. Their proprietary calculation suggests a fair P/E of 31.4x for the company. Because this metric blends in more specific company and industry dynamics, it aims to offer a more nuanced target than broad peer or sector averages.

Compared with its P/E of 78.6x, e.l.f. Beauty appears significantly overvalued relative to its Fair Ratio. This suggests that, at the moment, investors may be paying above and beyond what the fundamentals support for this level of expected growth.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your e.l.f. Beauty Narrative

Earlier, we alluded to an even better way to understand valuation. Now, let's introduce you to Narratives. Narratives are a simple yet powerful approach: instead of just looking at numbers, they let you build your own story about a company by connecting the facts, your expectations for future revenue or margins, and what you think its shares are really worth.

On Simply Wall St's Community page, millions of investors use Narratives to link a company's journey, financial outlook, and fair value, making investment decisions far more transparent and dynamic. Narratives help you decide when to buy or sell by directly comparing your Fair Value (the price you think makes sense given the story and forecast) to the current market Price, which can be automatically updated as important news, earnings, or trends break.

For example, with e.l.f. Beauty, some investors are convinced that global expansion and top-tier digital innovation will keep revenue surging and assign a Fair Value as high as $165. Others worry about competition and supply chain risks, resulting in a Fair Value as low as $112. With Narratives, you choose the story and the numbers you believe in, so the platform does the math for you and updates the analysis as things change.

Do you think there's more to the story for e.l.f. Beauty? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELF

e.l.f. Beauty

A beauty company, provides cosmetics and skin care products worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives