- United States

- /

- Personal Products

- /

- NYSE:ELF

A Look at e.l.f. Beauty’s Valuation Following Analyst Upgrades on Rhode Skincare Growth Potential

Reviewed by Kshitija Bhandaru

e.l.f. Beauty (NYSE:ELF) has captured investor attention following a wave of positive analyst reports, fueled by strong consumer interest in its Rhode skincare line and encouraging early results from its Sephora launch.

See our latest analysis for e.l.f. Beauty.

Even with a sharp one-day share price drop of 10.5% amid fresh tariff headlines, e.l.f. Beauty has shown remarkable overall momentum. Its 90-day share price return is a robust 22.3%, and the one-year total shareholder return stands at 18.2%. Long-term investors are still sitting on a stellar 229% gain over three years, highlighting both the market’s optimism around recent growth stories like Rhode and the business’s resilience in volatile conditions.

If you're watching e.l.f. Beauty's volatility and strong growth play out, this could be a smart moment to discover fast growing stocks with high insider ownership.

Yet with shares up sharply and analysts raising targets, the big question is whether e.l.f. Beauty remains undervalued, or if the market is already reflecting all that future growth in today’s stock price.

Most Popular Narrative: 9.2% Undervalued

Based on the most widely followed narrative, e.l.f. Beauty’s fair value sits at $142.79 per share. This reflects a modest premium over the last close of $129.69. The difference suggests that forward-looking assumptions about sales momentum and margin recovery keep optimism alive despite a recent price pullback.

The expansion into new international markets and rapid growth in existing ones (for example, 30% international net sales growth, top rankings in new geographies, global Sephora rollout) provide significant runway for future revenue growth and increased diversification, which is likely under-appreciated by the market.

Want to know what’s powering this target? The math hinges on surging international sales and a bold assumption about profit margins moving much higher in the years ahead. Which financial leap sets the stage for the current valuation? Tap in to find out what’s really driving the model’s price.

Result: Fair Value of $142.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on Chinese manufacturing and tariff risks could pressure margins and threaten earnings if cost volatility is not effectively managed.

Find out about the key risks to this e.l.f. Beauty narrative.

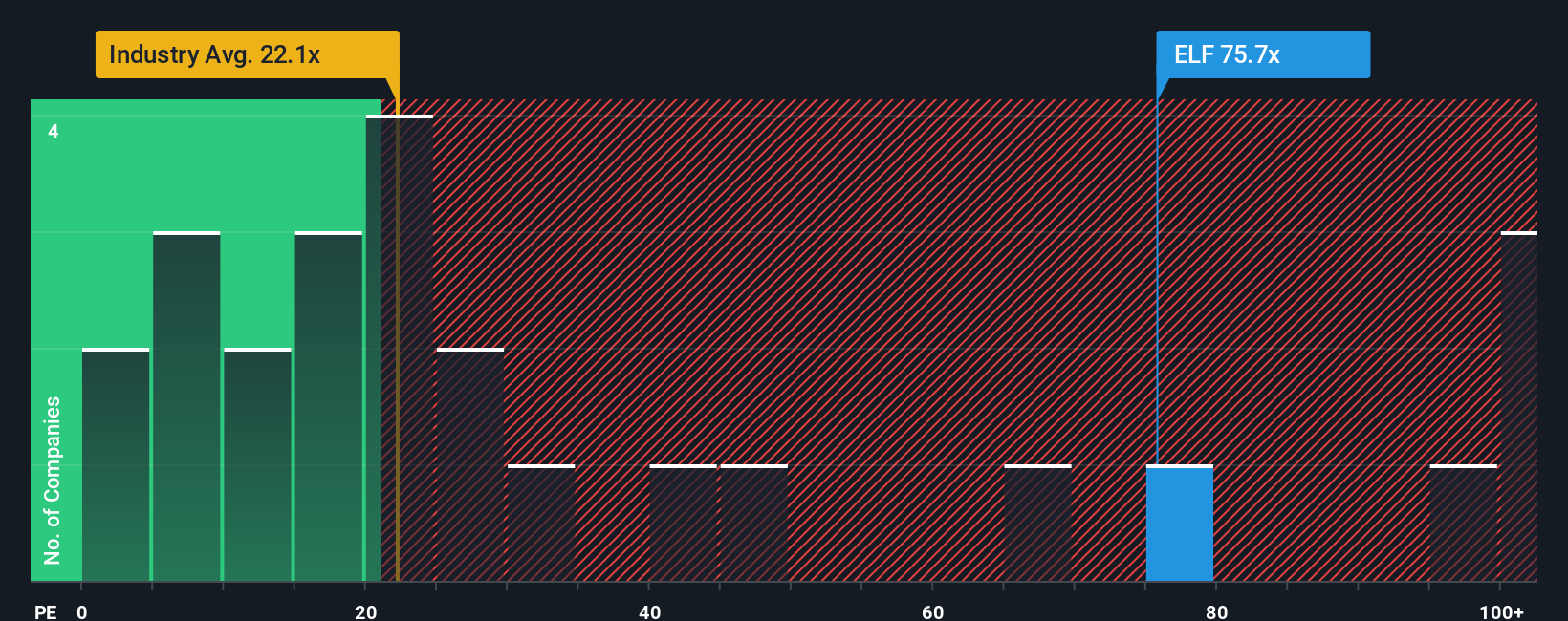

Another View: Multiples Tell a Cautionary Tale

While the fair value narrative paints e.l.f. Beauty as undervalued, its current price-to-earnings ratio stands out. At 78.6x, this is far higher than the industry average of 18.4x, peer average of 21.5x, and even the market-derived fair ratio of 31x. This signals a meaningful valuation gap. Does the current market price leave any room for error?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own e.l.f. Beauty Narrative

If you have a different perspective or want to dive deeper on your own, you can craft a personalized narrative in just a few minutes. Do it your way.

A great starting point for your e.l.f. Beauty research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Seeking More Investment Opportunities?

Turn today’s insight into real action by scanning other high-potential ideas. You could spot tomorrow’s breakthrough before most investors. Don’t miss your chance to get ahead.

- Tap into growing income with reliable yield by checking out these 19 dividend stocks with yields > 3%, offering attractive payouts above 3% from robust companies.

- Uncover forward-thinking leaders in medical innovation by exploring these 33 healthcare AI stocks, where AI is transforming the healthcare landscape.

- Capitalize on disruptive market trends by tracking these 24 AI penny stocks, which are set to reshape industries through artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELF

e.l.f. Beauty

A beauty company, provides cosmetics and skin care products worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives