- United States

- /

- Personal Products

- /

- NYSE:COTY

Why Coty (COTY) Is Down 6.4% After Berenberg Downgrade on Slower Sales Recovery and Missed Earnings

Reviewed by Simply Wall St

- Earlier this week, Coty's shares declined after Berenberg downgraded the company due to concerns around delayed sales growth recovery and ongoing sector headwinds, following quarterly results that missed earnings expectations and a 9% year-over-year decline in like-for-like sales.

- Despite the challenges cited by analysts, insider purchasing activity such as the recent share acquisition by Coty's Chief Legal Officer has signaled management confidence in the company’s prospects.

- We'll examine how Berenberg's downgrade over weak sales momentum may alter the outlook for Coty's anticipated growth recovery.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Coty Investment Narrative Recap

To own Coty shares, you need to believe in a rebound for global beauty demand, particularly as inventory destocking winds down and new product launches stimulate growth. The recent Berenberg downgrade and weak Q4 results have cast doubt on the speed of recovery, which may challenge the anticipated second-half sales turnaround; persistent inventory headwinds remain the key short-term risk, while an easing of these pressures is still central to Coty’s growth catalyst. However, the magnitude of the news has made the near-term risks more prominent without fundamentally changing the long-term recovery thesis.

One recent development closely tied to these risks is Coty's Q4 2025 results, with like-for-like sales falling 9% year-over-year and management reaffirming that inventory destocking will weigh on results through the first half of fiscal 2026. The guidance that revenue growth may only return in the second half frames the delayed timeline for any turnaround, keeping a focus on when top-line growth will begin to materialize in earnest.

But, for those considering Coty, one issue investors need to watch out for is that if inventory destocking drags on longer than expected…

Read the full narrative on Coty (it's free!)

Coty's forecast calls for $6.1 billion in revenue and $302.1 million in earnings by 2028. This outlook assumes a 1.3% annual revenue growth rate and a $683.2 million increase in earnings from the current level of -$381.1 million.

Uncover how Coty's forecasts yield a $4.82 fair value, a 18% upside to its current price.

Exploring Other Perspectives

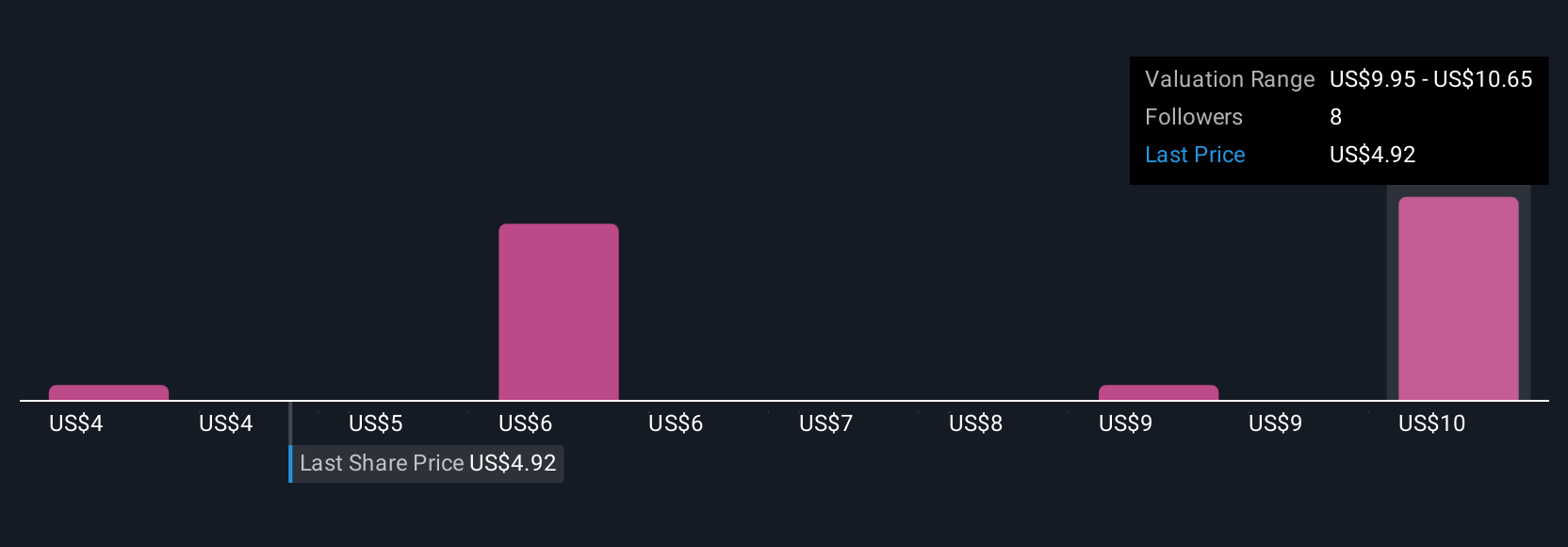

Simply Wall St Community members have published 5 diverse fair value targets for Coty, ranging from US$3.69 to as high as US$10.66 per share. With recent analyst concerns about prolonged inventory headwinds, it is clear that outlooks and risk assessments differ widely and deserve your attention.

Explore 5 other fair value estimates on Coty - why the stock might be worth 10% less than the current price!

Build Your Own Coty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coty research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Coty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coty's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COTY

Coty

Manufactures, markets, distributes, and sells branded beauty products worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives