- United States

- /

- Household Products

- /

- NYSE:CLX

Does Persistent Underperformance Change the Bull Case for Clorox (CLX)?

Reviewed by Sasha Jovanovic

- In recent news, Clorox has faced a prolonged period of underperformance, with both its share price and earnings per share declining over the past five years.

- This downturn, which has outpaced the decline in earnings, highlights how earlier market expectations were likely too optimistic about the company's outlook.

- We'll examine how this prolonged period of weak performance raises new questions for Clorox's path to regaining margin and revenue growth.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Clorox Investment Narrative Recap

To own Clorox stock today, you need to have confidence in the company’s ability to revitalize revenue and margins after years of lackluster growth and pricing pressures. While the latest news confirms that the share price has fallen faster than earnings, this event doesn’t dramatically change the central story, short-term momentum will likely hinge on how quickly Clorox can restore category growth, but the key risk remains unsteady consumer demand and the ongoing threat of intense price competition, particularly from private labels and discount rivals.

Among recent company developments, the announcement of a quarterly dividend increase to US$1.24 per share stands out amid recent share price losses. For those following the company’s narrative, this signal of continued capital returns is relevant, but with management warning of lower sales and earnings in the coming fiscal year, the company’s ability to balance payout stability with margin recovery becomes a focus for anyone tracking catalysts and risks.

Yet despite the resilient dividend, what matters even more for investors is the persistent uncertainty surrounding...

Read the full narrative on Clorox (it's free!)

Clorox's outlook anticipates $7.0 billion in revenue and $881.8 million in earnings by 2028. This implies a 0.4% annual revenue decline and a $71.8 million earnings increase from the current earnings of $810.0 million.

Uncover how Clorox's forecasts yield a $133.59 fair value, a 11% upside to its current price.

Exploring Other Perspectives

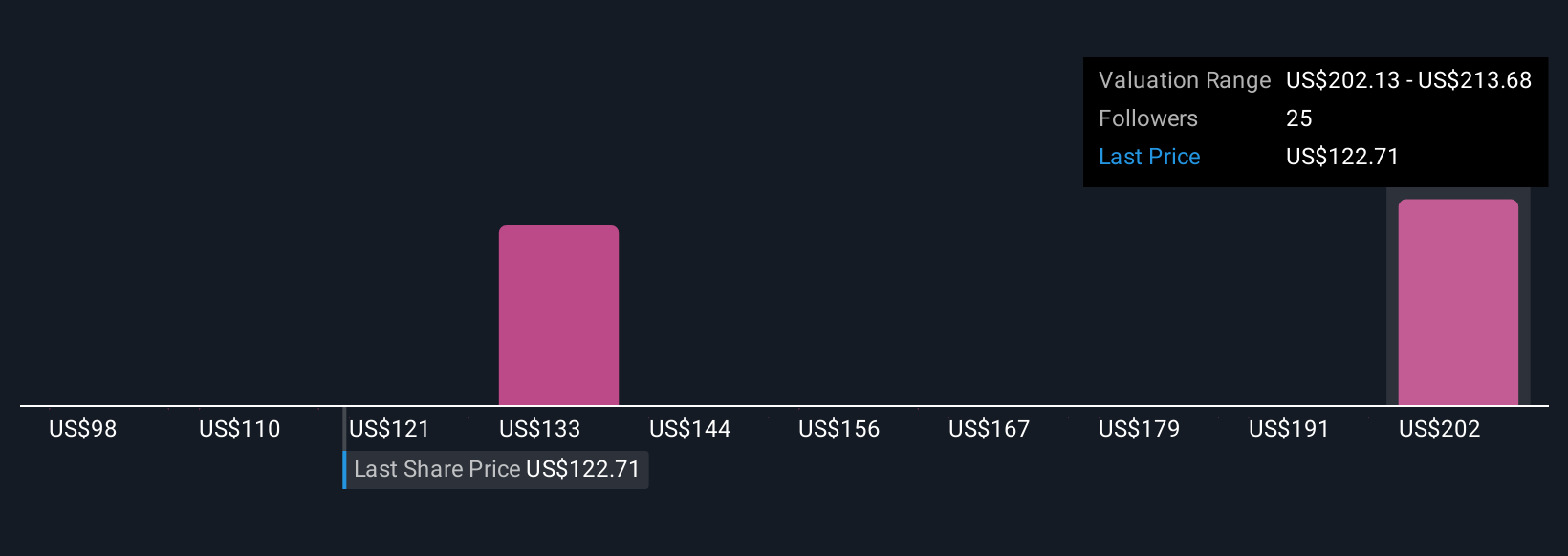

Simply Wall St Community members offer six fair value estimates for Clorox, ranging from US$98.22 to US$213.68 per share. With stubborn competition and slow demand growth at the forefront, these differing outlooks invite you to compare a spectrum of views on the company’s prospects.

Explore 6 other fair value estimates on Clorox - why the stock might be worth as much as 77% more than the current price!

Build Your Own Clorox Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clorox research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Clorox research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clorox's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLX

Clorox

Manufactures and markets consumer and professional products worldwide.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives