- United States

- /

- Household Products

- /

- NYSE:CLX

Clorox (CLX): Exploring Valuation After Screen+ Sanitizing Wipes Debut in the Tech Hygiene Market

Reviewed by Simply Wall St

Most Popular Narrative: 6.5% Undervalued

According to the most widely followed narrative, Clorox stock is considered undervalued by just over 6% compared to analyst consensus fair value. This reflects cautious optimism given recent business challenges and future growth assumptions.

The full-scale implementation of a modern ERP system is expected to drive long-term operational efficiencies. This should improve supply chain visibility, speed innovation cycles, and reduce structural costs. These improvements are expected to support margin expansion and sustained earnings growth once short-term transition noise normalizes.

Want to uncover the numbers behind this undervalued call? This narrative is built on ambitious, long-term profit improvements and the kind of margin outlook that could change the company’s story. Do these projections really hold water, or is there a hidden linchpin driving the price target? The truth is in the evidence powering these bullish expectations.

Result: Fair Value of $133.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent consumer uncertainty and intensifying price competition could quickly undermine the optimistic case for sustained margin and earnings growth.

Find out about the key risks to this Clorox narrative.Another View: DCF Model Offers a Different Perspective

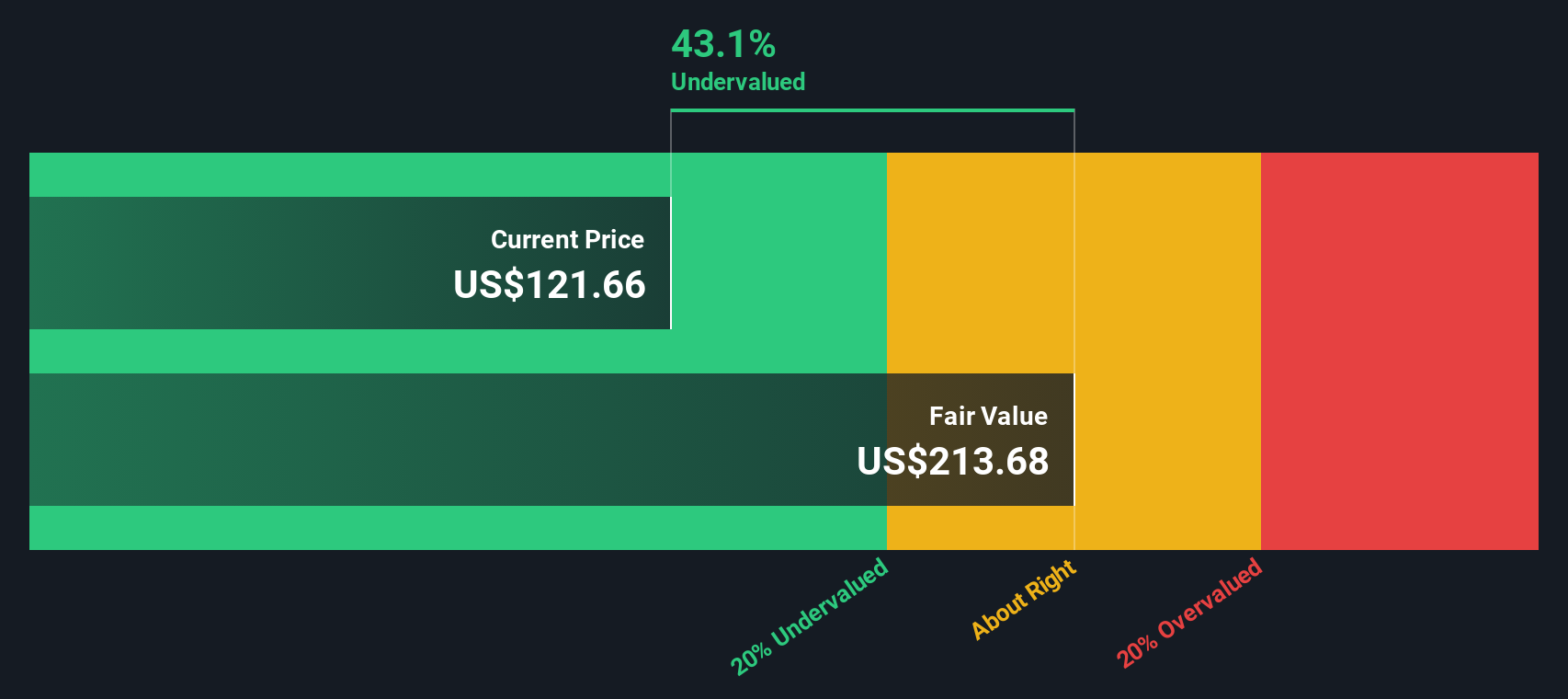

Looking at Clorox from another angle, our DCF model points to a very different valuation. This challenges the earlier narrative based on consensus price targets and raises the question of whether the market is missing something deeper.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Clorox Narrative

If the story so far does not line up with your own take or you want a hands-on look at the numbers, you can dig in and assemble a custom outlook in just a few minutes. Do it your way

A great starting point for your Clorox research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more smart investment ideas?

Every successful investor knows that a fresh perspective sparks opportunity. Don’t settle for the same stocks everyone else is watching. Expand your search and unlock your next breakthrough using Simply Wall Street’s unique screeners below.

- Target reliable income and boost your portfolio's yield by searching for dividend stocks with yields > 3% that stand out with consistent payouts.

- Be ahead of the curve as technology transforms healthcare. Uncover healthcare AI stocks driving revolutionary change in diagnostics, patient care, and medical innovation.

- Capture hidden gems trading at compelling prices by hunting for undervalued stocks based on cash flows with strong cash flow potential and attractive valuation metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLX

Clorox

Manufactures and markets consumer and professional products worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives