- United States

- /

- Household Products

- /

- NYSE:CHD

A Fresh Look at Church & Dwight (CHD) Valuation Following OxiClean and White Castle Collaboration

Reviewed by Kshitija Bhandaru

Church & Dwight (CHD) Gets Playful With OxiClean and White Castle Collaboration

If you have Church & Dwight (CHD) on your radar, this week’s brand partnership with White Castle might catch your attention. OxiClean, one of Church & Dwight’s flagship names, is teaming up with the fast-food favorite just in time for National Adulting Day. The launch of “Craver’s Cleanup Kits” has a lighthearted tone, but there’s a serious strategy behind the effort. It is a creative push to put OxiClean front and center for a wider audience, blending pop culture buzz with everyday practicality. For investors, these kinds of campaigns can be meaningful, as they may give legacy consumer staples companies a shot in the arm when it comes to connecting with younger shoppers and revitalizing sales momentum.

The buzz around this event comes at an interesting moment for Church & Dwight. While the company has consistently delivered annual revenue growth and a major jump in net income this year, the stock itself has lost momentum, trading down 16% since January and about 16% over the past twelve months. Even with strong three-year returns, recent stock price trends suggest that sentiment has cooled despite ongoing innovation and brand extensions like this. It is a reminder that clever marketing alone is not always enough to sustain investor enthusiasm, especially if the market is adjusting its expectations for future growth.

After a year of lackluster returns, does this latest initiative from Church & Dwight hint at untapped value, or is the market already factoring in its next chapter of growth?

Most Popular Narrative: 13.3% Undervalued

Analysts see upside in Church & Dwight, pegging it well below fair value by just over 13%. They base their view on a blend of expected growth across revenue, profits, and margins.

The strong trajectory of e-commerce and online sales, with Church & Dwight's online channel now accounting for 23% of global sales and driving category growth (notably with Touchland's success on Amazon and other platforms), positions the company to benefit from higher-margin, direct-to-consumer sales and increased market reach. This is likely to support revenue growth and margin expansion in future years.

Want to know why analysts are so bullish on Church & Dwight? Their valuation hinges on a bold shift toward digital sales and ambitious profit targets. Curious what numbers are baked into this fair value calculation? The answers could surprise you. Find out what future milestones are driving this optimistic target.

Result: Fair Value of $100.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing weakness in the vitamin segment and rising input costs could challenge margins and disrupt the company’s longer term growth story.

Find out about the key risks to this Church & Dwight narrative.Another View

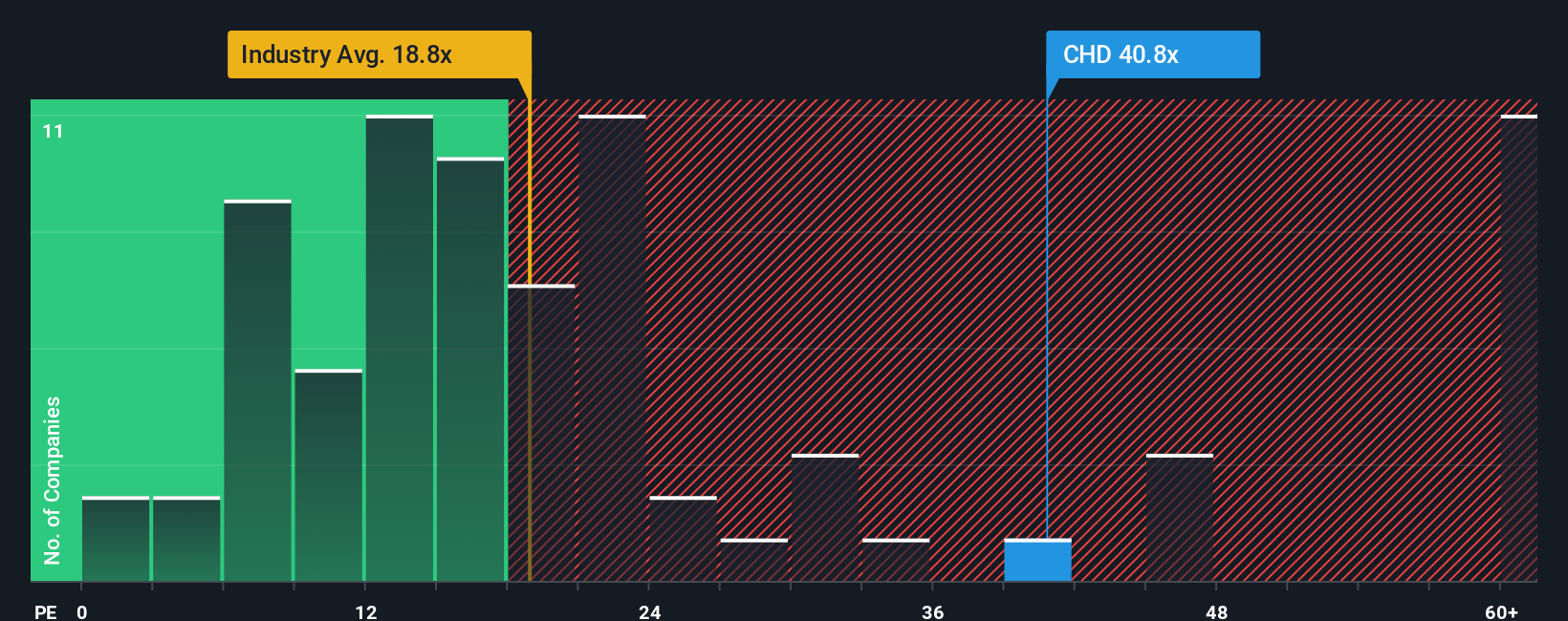

Taking a step back from growth expectations, looking at how the company is valued compared to its industry tells a different story. By this method, Church & Dwight appears more expensive than the average competitor. Does this signal caution, or is there something the market is missing?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Church & Dwight to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Church & Dwight Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own perspective on Church & Dwight’s outlook in just a few minutes. Do it your way.

A great starting point for your Church & Dwight research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investing Ideas?

Don’t let your research end here. The best opportunities often go unnoticed. Get ahead of the crowd by targeting stocks with strategies tailored to what matters most to you.

- Capture market mispricings and uncover value gems by starting with undervalued stocks based on cash flows.

- Supercharge your portfolio with the next wave of technology and breakthroughs through AI penny stocks.

- Secure steady income and add reliable payout potential to your holdings via dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHD

Church & Dwight

Develops, manufactures, and markets household, personal care, and specialty products.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives