- United States

- /

- Personal Products

- /

- NYSE:BRBR

Should You Reconsider BellRing After Its 55% Slide and Packaged Foods Sector Shakeup?

Reviewed by Bailey Pemberton

Trying to decipher what to do with BellRing Brands stock? You are not alone. Investors find themselves at a crossroads after a dramatic stretch of volatility. BellRing’s share price recently closed at $33.73, which may catch your eye given the steep declines over the short and medium term. In the last week, shares are down 8.2%, and the past month has been even rougher with a drop of 14.5%. Most striking is the year-to-date slide, down 54.8%, and the 1-year return sits at a disappointing minus 45.6%.

While these numbers might trigger concern, it is worth noting the company’s longer-term trajectory remains positive, boasting 62% returns over three years and 51.2% over five years. Some recent market developments have shifted perceptions of risk across the packaged foods sector, possibly accounting for some of BellRing’s recent pain in the market. But if you are focused on fundamentals rather than headlines, the real question becomes: does the current price reflect an opportunity or a warning sign?

That is where valuation comes in. Based on our analysis, BellRing scores a strong 5 out of 6 on our undervaluation checks, a signal that the market may be underestimating its potential. Next, we will break down exactly how those numbers stack up across the most popular valuation methods, before exploring a smarter way to judge the stock’s worth that many investors miss entirely.

Why BellRing Brands is lagging behind its peers

Approach 1: BellRing Brands Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company's future cash flows and then discounts them back to today’s value. This provides an estimate of what the business is truly worth. This approach cuts through market noise by focusing on long term fundamentals.

For BellRing Brands, the most recent financials show a current Free Cash Flow of $128.5 Million. Analyst estimates suggest this will rise steadily, with projected FCF reaching $493 Million by 2030. For the next several years, analysts anticipate significant annual increases, with cash flow expected to nearly quadruple over the decade. Beyond the first five years, these numbers are extrapolated to provide a consistent long-term outlook.

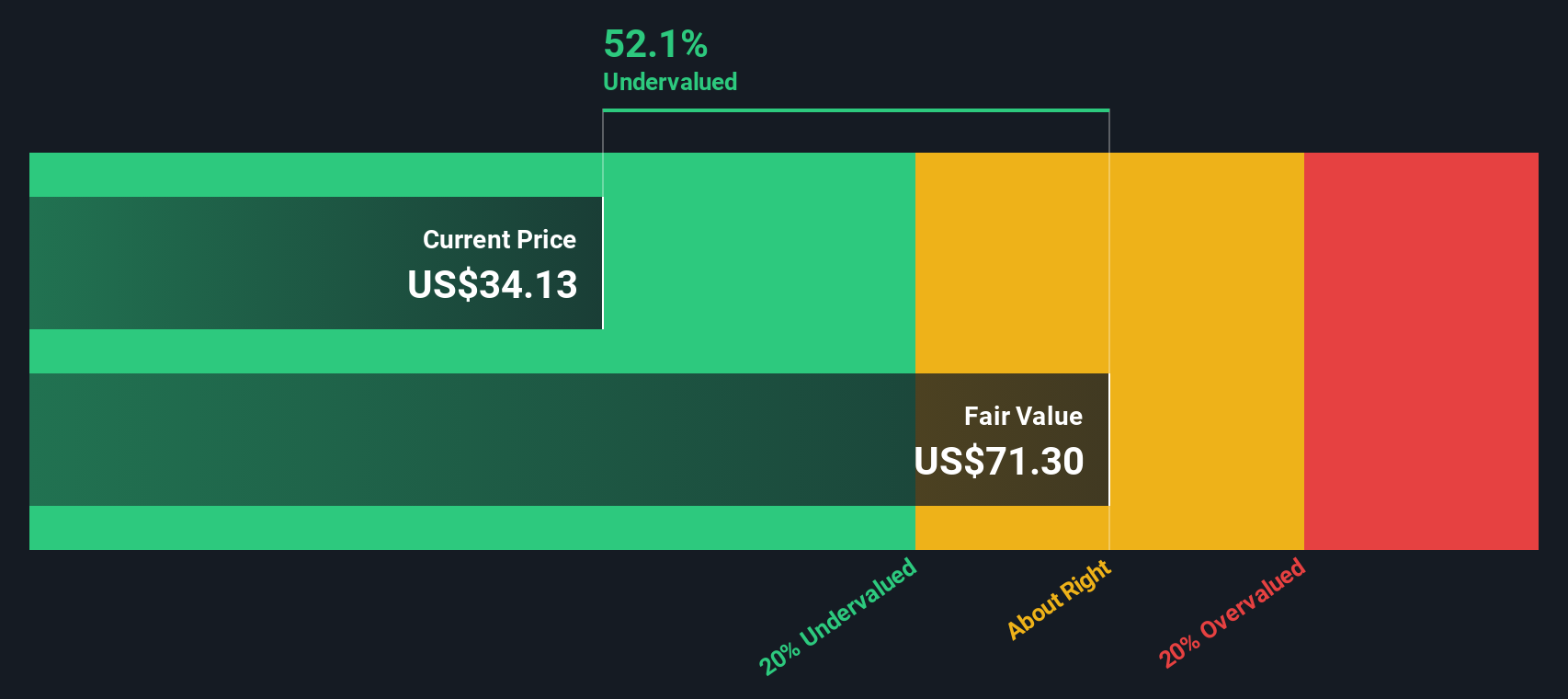

Using the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value for BellRing Brands is $70.39 per share. This is in contrast to the current share price of $33.73, indicating the stock is trading at a 52.1% discount relative to its fair value based on cash flow fundamentals.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BellRing Brands is undervalued by 52.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: BellRing Brands Price vs Earnings

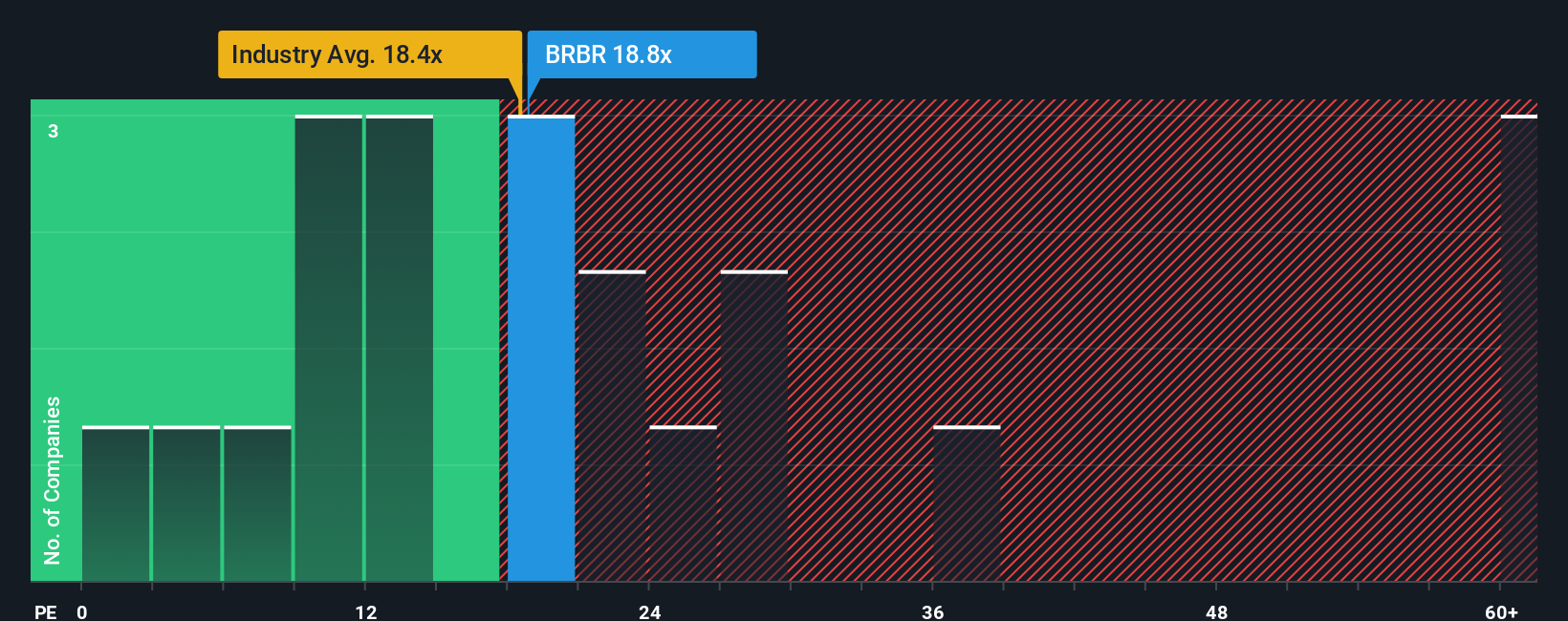

The Price-to-Earnings (PE) ratio is a favored valuation metric for profitable companies like BellRing Brands, as it directly relates a company’s stock price to its earnings. This provides investors with a quick sense of how much they are paying for each dollar of earnings generated by the business.

What constitutes a “normal” or “fair” PE ratio depends on factors such as future growth expectations, stability of earnings, and risk. Companies with higher expected earnings growth or lower risk profiles tend to command higher PE ratios. In contrast, slower-growing or riskier businesses typically trade at lower multiples.

BellRing Brands currently trades at a PE ratio of 18.6x. For context, the industry average is 22.4x and peers are priced around 37x. This means BellRing’s shares appear cheaper than both its direct competitors and the broader sector benchmark. However, these basic comparisons do not account for company-specific factors.

Simply Wall St’s “Fair Ratio” provides a more nuanced benchmark, adjusting for BellRing’s earnings growth prospects, risks, profit margins, market cap, and industry dynamics. By looking beyond simple averages, the Fair Ratio helps investors arrive at a valuation that reflects the company’s particular strengths and challenges rather than relying on broad one-size-fits-all measures.

BellRing’s Fair Ratio is 22.7x, while its actual PE is 18.6x. Since the actual PE is materially lower than the Fair Ratio, this signals that BellRing Brands is undervalued relative to what would be fair given its circumstances.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BellRing Brands Narrative

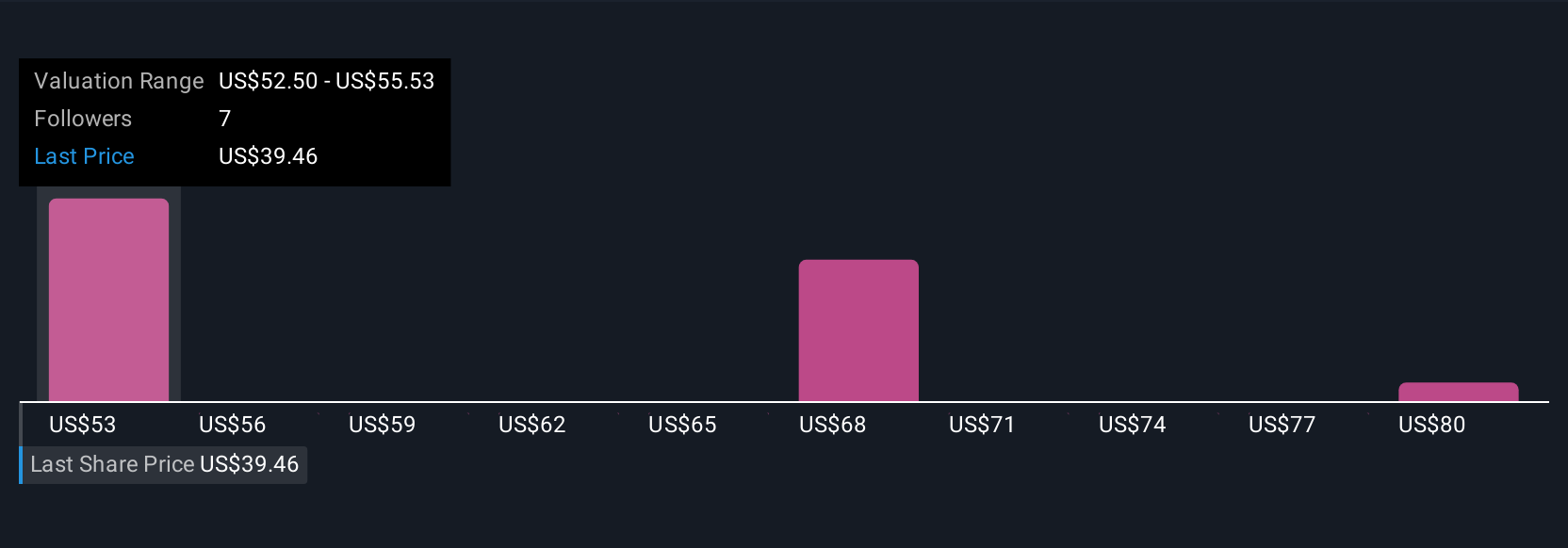

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives, a simple, yet powerful method for evaluating stocks available on Simply Wall St’s Community page.

A Narrative is your story about a company, where you bring together your own assumptions for BellRing’s future revenue, profit margins, and fair value, combining both the numbers and the business context.

Instead of just looking at ratios, Narratives allow every investor to connect the dots between BellRing’s business story (think new product launches or market risks), the likely financial results, and what a fair price should be today.

This isn’t just theory. A Narrative, once created, automatically updates as new news or earnings emerge, making sure your investment thesis stays current with real information.

For example, on Simply Wall St, one Narrative might project a fair value for BellRing Brands as high as $72.00 if innovation and retail expansion outperform; another takes a more cautious view with a fair value of $40.00 due to concerns about competition or regulation.

By comparing each Narrative’s fair value with today’s share price, you get a clear, personalized signal for when to consider buying or selling. You can easily see and learn from how thousands of others in the community are thinking, too.

Do you think there's more to the story for BellRing Brands? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BellRing Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRBR

BellRing Brands

Provides various nutrition products in the United States.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives