- United States

- /

- Household Products

- /

- NasdaqGS:WDFC

WD-40 (WDFC): Assessing Valuation After Recent Share Price Slide

Reviewed by Kshitija Bhandaru

See our latest analysis for WD-40.

WD-40’s share price has seen some downward momentum lately, but this comes after a longer stretch where its three-year total shareholder return remains positive at 14.25%. Despite recent losses, the company’s longer-term resilience is still in view. Investors are reassessing the balance of risk and growth potential.

If you’re looking to see what else stands out this season, now’s a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst price targets, but modest annual growth, the key question is whether WD-40 remains undervalued or if the market has already priced in its future prospects. Is this a genuine buying opportunity?

Most Popular Narrative: 31.1% Undervalued

WD-40’s most widely followed narrative sets its fair value at $277.50, giving it a hefty margin above the latest close. The focus is on global expansion, premiumization, and margin enhancement that support a higher price target, despite modest near-term growth expectations.

The company’s focus on premiumization of products, with targets for a compound annual growth rate for premium products exceeding 10%, is poised to improve net margins by shifting the product mix towards higher-margin offerings. WD-40’s strategy to divest its less profitable home care and cleaning brands is expected to position the company as a higher growth and higher gross margin enterprise, ultimately boosting operational margins and net margins once complete.

Want to know what aggressive profit mix shifts and market expansion plans make this fair value plausible? Behind this narrative, bold growth bets and margin upgrades combine to create a valuation playbook that most investors would not expect for a household staple. Uncover the assumptions and see what truly powers that lofty price tag.

Result: Fair Value of $277.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as uncertainty over WD-40’s divestiture timeline and foreign currency fluctuations could undermine margin growth and future revenue expectations.

Find out about the key risks to this WD-40 narrative.

Another View: Market Multiples Raise Questions

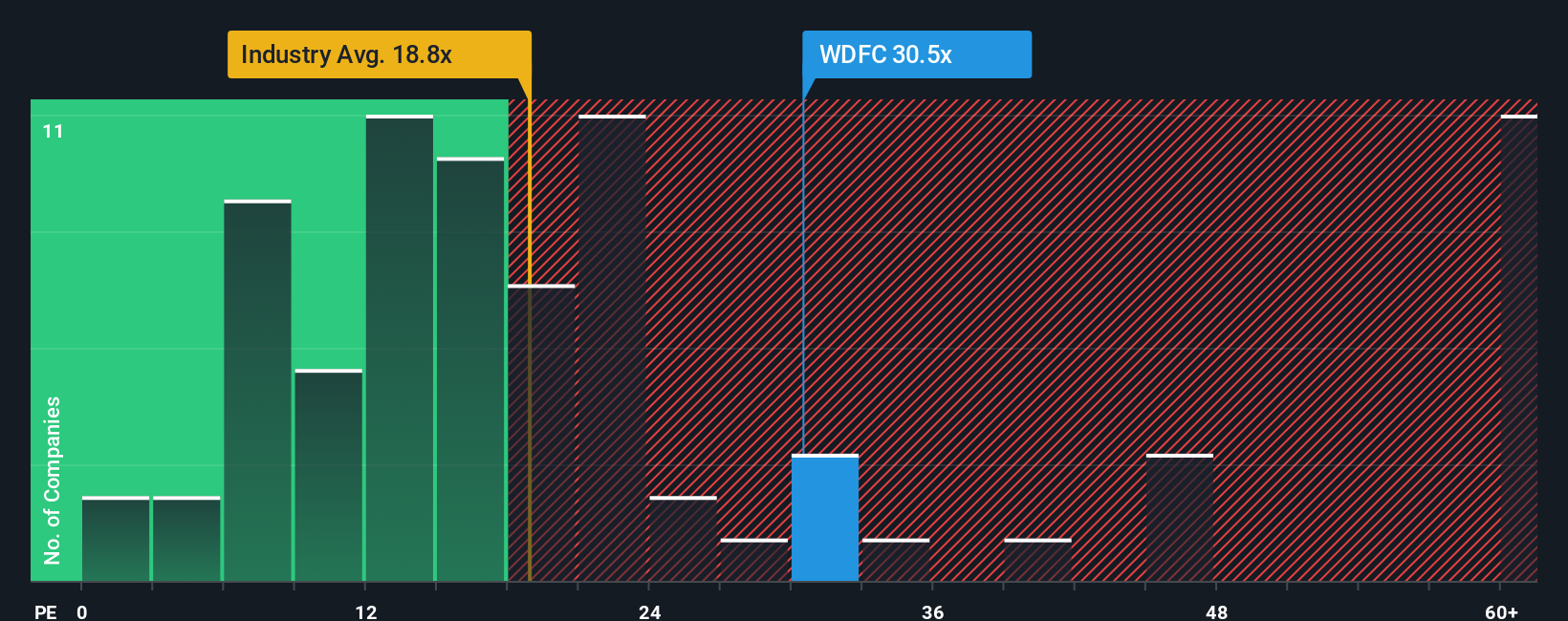

While analyst narratives present WD-40 as undervalued based on growth and margin ambitions, looking at its price-to-earnings ratio reveals a different picture. The company trades at 30x earnings, which is well above the industry average of 18.5x and its peer average of 14.2x. The fair ratio is just 16.3x, suggesting the market could push the valuation lower if future growth falls short.

Does this premium signal confidence or a potential overvaluation risk? For investors, the big question is whether current optimism is truly justified or if there is a correction ahead.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own WD-40 Narrative

If you have a different perspective or want to look deeper into the numbers, you can craft your own view in just a few minutes, Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding WD-40.

Looking for More Investment Ideas?

Smart investors never rely on a single stock story. Tap into the latest trends and uncover exceptional opportunities with targeted lists designed for forward-thinking portfolios.

- Secure steady income streams when you check out these 18 dividend stocks with yields > 3% with yields over 3% and a consistent payout record.

- Capitalize on rapid tech advancements by uncovering the potential in these 25 AI penny stocks that are transforming industries with artificial intelligence.

- Spot hidden value early by targeting these 881 undervalued stocks based on cash flows backed by robust cash flows before the mainstream catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WD-40 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDFC

WD-40

Develops and sells maintenance products, and homecare and cleaning products in North America, Central and South America, Asia, Australia, Europe, India, the Middle East, and Africa.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives