- United States

- /

- Marine and Shipping

- /

- NasdaqCM:TORO

3 US Penny Stocks With Market Caps Under $200M To Consider

Reviewed by Simply Wall St

The U.S. stock market has shown resilience, with the Dow Jones Industrial Average rising on a softer-than-expected Producer Price Index report and a dip in oil prices. For those interested in exploring smaller or newer companies, penny stocks—despite their somewhat outdated name—remain an intriguing investment area. These stocks can offer a mix of affordability and growth potential, especially when backed by strong financials, making them appealing to investors seeking under-the-radar opportunities.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.33 | $1.87B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $100.69M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.87 | $6.14M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.41 | $10.57M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.3175 | $12.14M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.37 | $44.07M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.23 | $24.12M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9234 | $86.33M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.55 | $377.99M | ★★★★☆☆ |

Click here to see the full list of 720 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Toro (NasdaqCM:TORO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Toro Corp. is a shipping company that acquires, owns, charters, and operates oceangoing tanker vessels to provide seaborne transportation services for crude oil, LPG, and refined petroleum products globally, with a market cap of $53.33 million.

Operations: The company's revenue is derived from its LPG Carrier Segment, which generates $15.25 million, and its Handysize Tanker Segment, contributing $9.21 million.

Market Cap: $53.33M

Toro Corp., a shipping company with a market cap of US$53.33 million, has shown significant growth in earnings, rising by 451.7% over the past year, surpassing industry averages. Despite this growth, recent earnings reports indicate a decline in net income to US$24.23 million from US$112.41 million the previous year, and sales fell to US$5.46 million from US$11.86 million. Toro boasts an outstanding return on equity at 44.8% and maintains financial stability with no debt and short-term assets of $195.2M exceeding liabilities of $5.3M, although its management team is relatively inexperienced.

- Dive into the specifics of Toro here with our thorough balance sheet health report.

- Understand Toro's track record by examining our performance history report.

Veru (NasdaqCM:VERU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Veru Inc. is a late clinical stage biopharmaceutical company that develops medicines for metabolic diseases, oncology, and viral-induced acute respiratory distress syndrome (ARDS), with a market cap of $114.44 million.

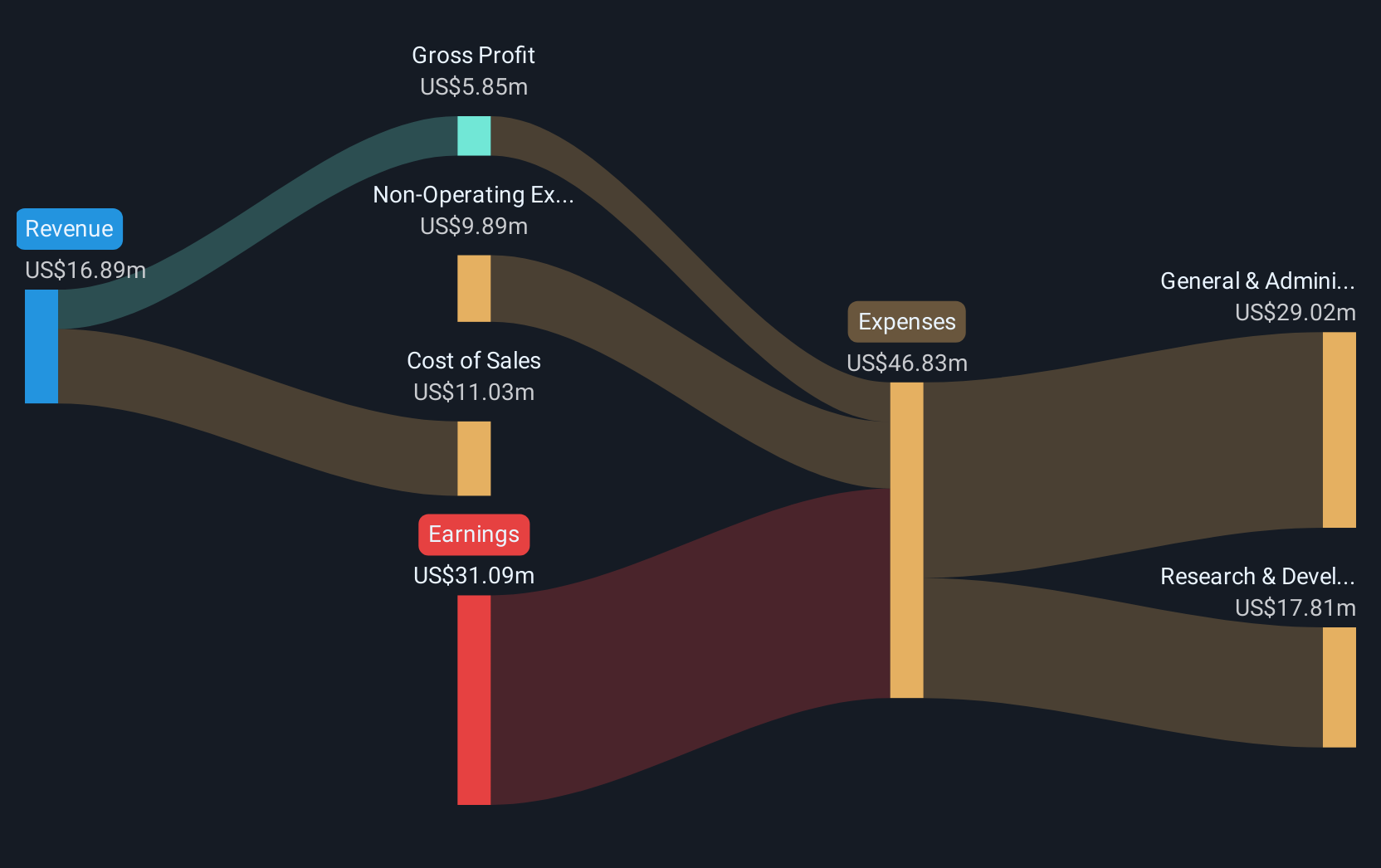

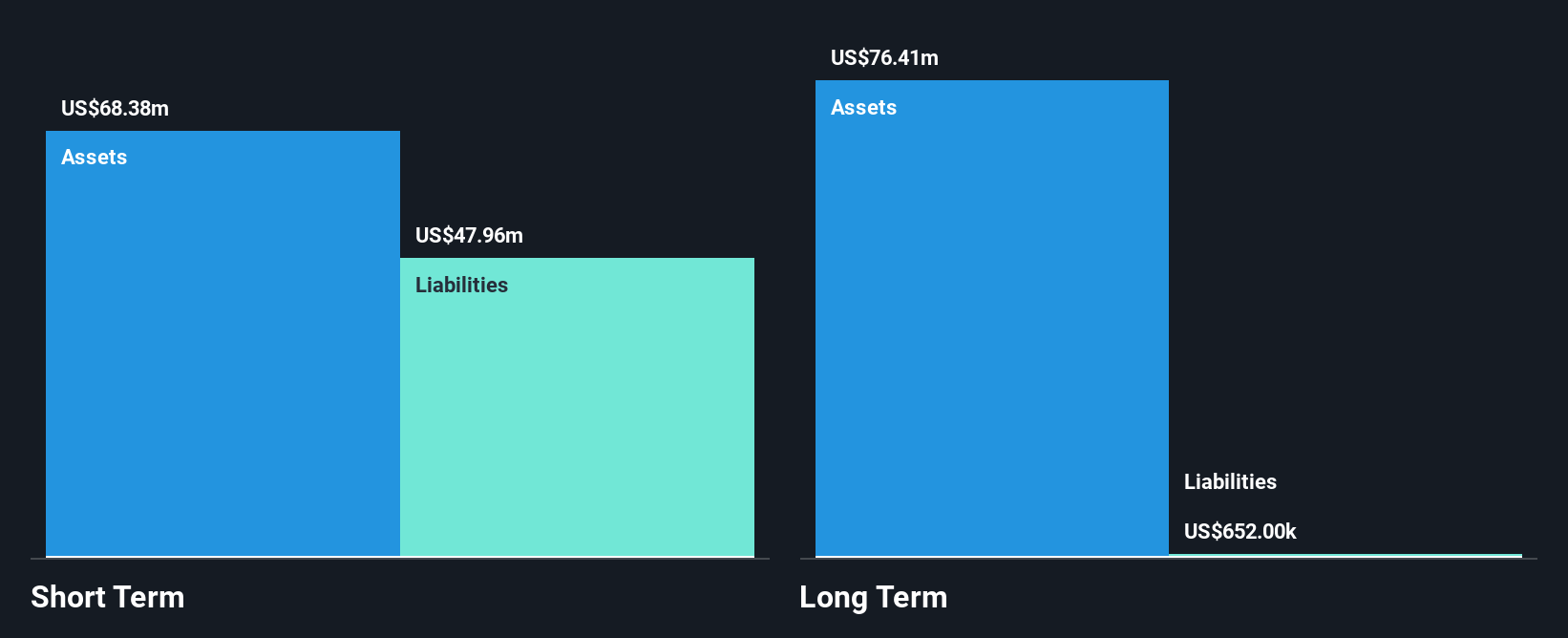

Operations: The company's revenue is primarily generated from its FC2 segment, amounting to $16.89 million.

Market Cap: $114.44M

Veru Inc., with a market cap of US$114.44 million, has faced challenges typical of penny stocks, including ongoing unprofitability and shareholder dilution. The company's recent annual revenue was US$16.89 million, showing slight growth from the previous year, but it reported a net loss of US$37.8 million. Despite having more cash than debt and short-term assets exceeding liabilities, Veru's cash runway is limited to less than a year if current trends continue. Recent auditor concerns about its ability to continue as a going concern underscore financial instability despite potential in its clinical developments like enobosarm for obesity treatment.

- Click to explore a detailed breakdown of our findings in Veru's financial health report.

- Assess Veru's future earnings estimates with our detailed growth reports.

PetMed Express (NasdaqGS:PETS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PetMed Express, Inc., along with its subsidiaries, operates as a pet pharmacy in the United States and has a market capitalization of approximately $98.42 million.

Operations: The company generates revenue primarily through its online retail segment, which accounted for $259.34 million.

Market Cap: $98.42M

PetMed Express, Inc., with a market cap of US$98.42 million, exemplifies the volatility and challenges associated with penny stocks. The company is currently unprofitable, with earnings expected to decline by an average of 22.8% annually over the next three years. Despite this, it maintains a debt-free balance sheet and has not diluted shareholders recently. Recent earnings showed improvement in net income to US$6.08 million for the six months ended September 2024, compared to a loss previously, indicating some operational resilience amidst sales declines from US$149.24 million to US$127.52 million year-over-year for the same period.

- Click here to discover the nuances of PetMed Express with our detailed analytical financial health report.

- Understand PetMed Express' earnings outlook by examining our growth report.

Where To Now?

- Gain an insight into the universe of 720 US Penny Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TORO

Toro

A shipping company, acquires, owns, charters, and operates oceangoing tanker vessels and provides seaborne transportation services for crude oil LPG, and refined petroleum products worldwide.

Flawless balance sheet with acceptable track record.