- United States

- /

- Personal Products

- /

- NasdaqGM:UG

Earnings Not Telling The Story For United-Guardian, Inc. (NASDAQ:UG) After Shares Rise 26%

United-Guardian, Inc. (NASDAQ:UG) shares have continued their recent momentum with a 26% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 78% in the last year.

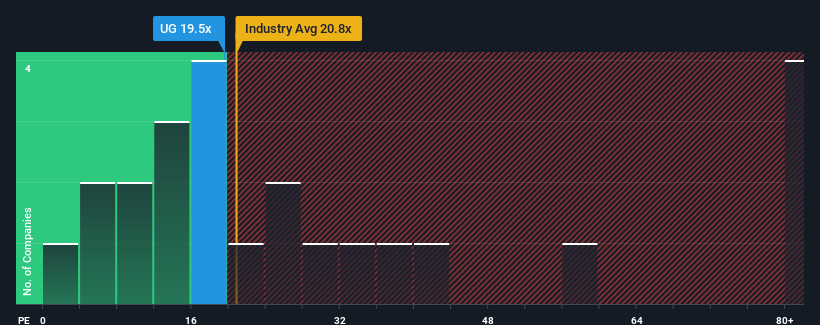

After such a large jump in price, given around half the companies in the United States have price-to-earnings ratios (or "P/E's") below 17x, you may consider United-Guardian as a stock to potentially avoid with its 19.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

United-Guardian certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for United-Guardian

Is There Enough Growth For United-Guardian?

The only time you'd be truly comfortable seeing a P/E as high as United-Guardian's is when the company's growth is on track to outshine the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 45% last year. Still, incredibly EPS has fallen 16% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Comparing that to the market, which is predicted to deliver 15% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's alarming that United-Guardian's P/E sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

What We Can Learn From United-Guardian's P/E?

The large bounce in United-Guardian's shares has lifted the company's P/E to a fairly high level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of United-Guardian revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware United-Guardian is showing 3 warning signs in our investment analysis, and 1 of those can't be ignored.

You might be able to find a better investment than United-Guardian. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:UG

United-Guardian

Manufactures and markets cosmetic ingredients, pharmaceuticals, medical lubricants, and proprietary specialty industrial products in the United States and internationally The company offers cosmetic ingredients, including LUBRAJEL, a line of water-based gel formulation for sensory enhancement, lubrication, and texture to personal care products; LUBRAJEL NATURAL for skin moisturizing; LUBRAJEL MARINE that develops natural products using naturally derived polymers; LUBRAJEL OlL NATURAL, which makes luxuriant textures without adding viscosity; LUBRAJEL TERRA, a multifunctional, moisturizing hydrogel products; LUBRASIL II SB, a formulation of LUBRAJEL; LUBRAJEL II XD; B-122, a powdered lubricant used in the manufacture of pressed powders, eyeliners, rouges, and industrial products; and ORCHID COMPLEX, an oil-soluble base for extract of fresh orchids used in fragrance products, such as perfumes and toiletries.

Flawless balance sheet with solid track record and pays a dividend.