- United States

- /

- Household Products

- /

- NasdaqGS:REYN

Investor Optimism Abounds Reynolds Consumer Products Inc. (NASDAQ:REYN) But Growth Is Lacking

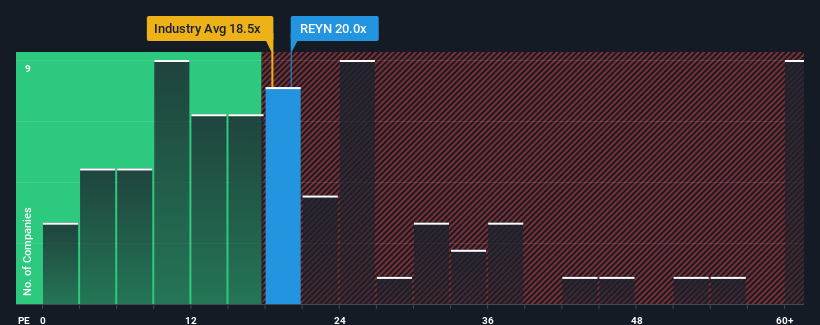

Reynolds Consumer Products Inc.'s (NASDAQ:REYN) price-to-earnings (or "P/E") ratio of 20x might make it look like a sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 17x and even P/E's below 9x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Reynolds Consumer Products has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Reynolds Consumer Products

How Is Reynolds Consumer Products' Growth Trending?

In order to justify its P/E ratio, Reynolds Consumer Products would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered an exceptional 15% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 20% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 10% each year over the next three years. Meanwhile, the rest of the market is forecast to expand by 10% per annum, which is not materially different.

With this information, we find it interesting that Reynolds Consumer Products is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Reynolds Consumer Products currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 2 warning signs for Reynolds Consumer Products that we have uncovered.

If these risks are making you reconsider your opinion on Reynolds Consumer Products, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:REYN

Reynolds Consumer Products

Produces and sells products in cooking, waste and storage, and tableware product categories in the United States and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives