- United States

- /

- Household Products

- /

- NasdaqCM:OBCI

Shareholders of Ocean Bio-Chem (NASDAQ:OBCI) Must Be Delighted With Their 610% Total Return

Long term investing can be life changing when you buy and hold the truly great businesses. And highest quality companies can see their share prices grow by huge amounts. To wit, the Ocean Bio-Chem, Inc. (NASDAQ:OBCI) share price has soared 556% over five years. If that doesn't get you thinking about long term investing, we don't know what will. In more good news, the share price has risen 2.9% in thirty days.

We love happy stories like this one. The company should be really proud of that performance!

See our latest analysis for Ocean Bio-Chem

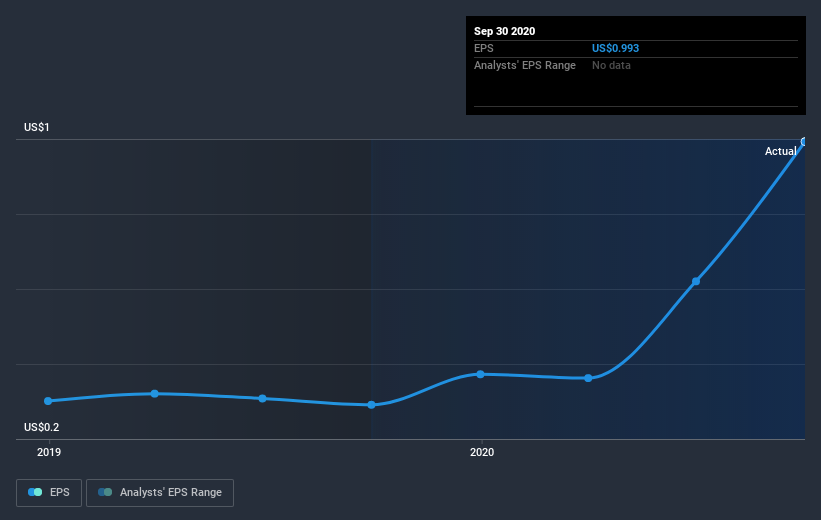

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Ocean Bio-Chem achieved compound earnings per share (EPS) growth of 58% per year. This EPS growth is higher than the 46% average annual increase in the share price. So one could conclude that the broader market has become more cautious towards the stock.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Ocean Bio-Chem's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Ocean Bio-Chem the TSR over the last 5 years was 610%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's good to see that Ocean Bio-Chem has rewarded shareholders with a total shareholder return of 321% in the last twelve months. That's including the dividend. That gain is better than the annual TSR over five years, which is 48%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. If you would like to research Ocean Bio-Chem in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

But note: Ocean Bio-Chem may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Ocean Bio-Chem or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:OBCI

Ocean Bio-Chem

Ocean Bio-Chem, Inc. manufactures, markets, and distributes appearance, performance, and maintenance products for the marine, automotive, power sports, recreational vehicle, home care, and outdoor power equipment markets in the United States and Canada.

Adequate balance sheet and overvalued.

Market Insights

Community Narratives