- United States

- /

- Personal Products

- /

- NasdaqGS:IPAR

Interparfums (IPAR) Valuation Check After Berenberg’s New Buy Rating and Asset-Light Growth Thesis

Reviewed by Simply Wall St

Berenberg’s fresh Buy rating on Interparfums (IPAR) has turned a few heads, not because everything is going smoothly, but because the bank sees opportunity in the middle of current headwinds.

See our latest analysis for Interparfums.

The new Buy call comes after a rough stretch, with the latest share price at $81.8 and a year to date share price return of minus 36.44 percent. However, the five year total shareholder return of 55.85 percent suggests the long term story is still intact, even if near term momentum has clearly faded.

If this kind of reset in expectations has you scanning the rest of the market, now is a good moment to explore fast growing stocks with high insider ownership.

With Berenberg’s $103 target implying meaningful upside from today’s price, the key debate now is simple: is Interparfums a beaten down quality compounder on sale, or is the market already discounting its next leg of growth?

Most Popular Narrative: 21% Undervalued

With Interparfums closing at $81.8 against a narrative fair value of $103.6, the valuation case leans on disciplined growth and margin resilience.

Strong category momentum for prestige fragrances, bolstered by continued consumer preference for branded, luxury personal products and supported by a disciplined innovation pipeline (upcoming launches for Montblanc, Jimmy Choo, Moncler, and new artisanal lines), is expected to maintain pricing power, boost net sales, and support higher net margins.

Curious how steady, single digit growth can still justify a richer future earnings multiple than the wider beauty sector? The narrative leans on operating leverage, a tighter margin profile, and a surprisingly ambitious profit base a few years out. Want to see exactly how those moving parts add up to this fair value call?

Result: Fair Value of $103.6 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on smooth execution. License concentration and shifting retailer inventories are both capable of quickly upsetting the margin and growth trajectory.

Find out about the key risks to this Interparfums narrative.

Another Angle on Value

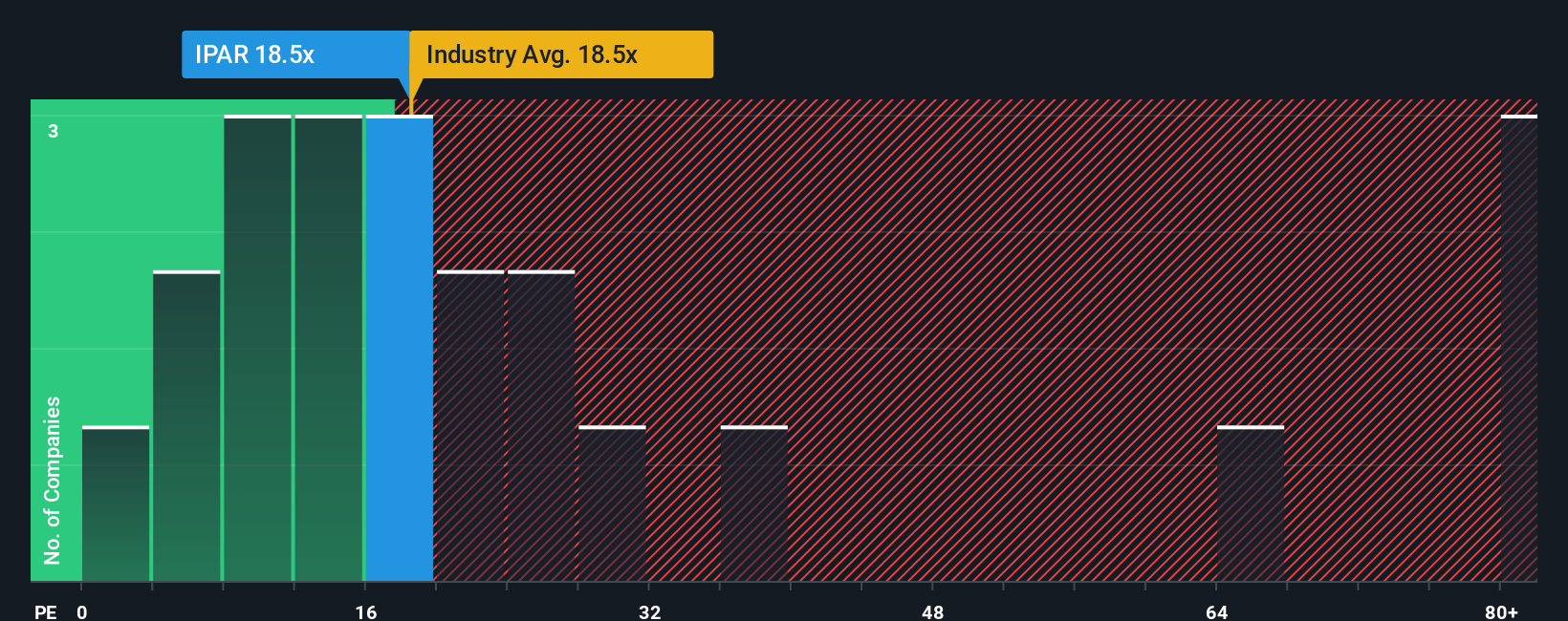

Step away from narrative fair value and the picture looks less generous. On earnings, Interparfums trades on 15.9x, cheaper than the North American personal products sector at 22.4x and peers at 24.9x, but slightly above its own 14.1x fair ratio, which hints at some valuation risk if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Interparfums Narrative

If this view does not line up with your own research approach, you can quickly build a customized thesis in under three minutes using Do it your way.

A great starting point for your Interparfums research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential opportunity by scanning focused stock lists that can quickly surface candidates most investors are still overlooking.

- Capture mispriced opportunities by reviewing these 903 undervalued stocks based on cash flows that may offer stronger upside based on future cash flows rather than short term market sentiment.

- Tap into powerful structural growth trends with these 30 healthcare AI stocks, where advanced analytics and medical innovation could reshape long term earnings potential.

- Supercharge your income strategy using these 15 dividend stocks with yields > 3% to find companies combining attractive yields with the balance sheet strength to support sustainable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IPAR

Interparfums

Manufactures, markets, and distributes a range of fragrances and fragrance related products in the United States and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026