- United States

- /

- Personal Products

- /

- NasdaqGS:HNST

After Leaping 26% The Honest Company, Inc. (NASDAQ:HNST) Shares Are Not Flying Under The Radar

Despite an already strong run, The Honest Company, Inc. (NASDAQ:HNST) shares have been powering on, with a gain of 26% in the last thirty days. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 2.4% in the last twelve months.

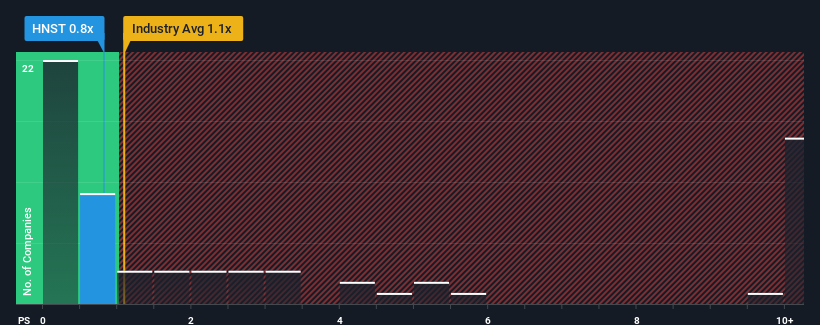

Although its price has surged higher, you could still be forgiven for feeling indifferent about Honest Company's P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Personal Products industry in the United States is also close to 1.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Honest Company

How Has Honest Company Performed Recently?

Honest Company could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Honest Company.Do Revenue Forecasts Match The P/S Ratio?

Honest Company's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.6%. Revenue has also lifted 12% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 4.5% per annum during the coming three years according to the four analysts following the company. That's shaping up to be similar to the 5.6% each year growth forecast for the broader industry.

In light of this, it's understandable that Honest Company's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Honest Company appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A Honest Company's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Personal Products industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

You always need to take note of risks, for example - Honest Company has 3 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on Honest Company, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Honest Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HNST

Honest Company

Manufactures and sells diapers and wipes, skin and personal care, and household and wellness products.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives