- United States

- /

- Personal Products

- /

- NasdaqGS:HNST

After Leaping 25% The Honest Company, Inc. (NASDAQ:HNST) Shares Are Not Flying Under The Radar

Despite an already strong run, The Honest Company, Inc. (NASDAQ:HNST) shares have been powering on, with a gain of 25% in the last thirty days. The annual gain comes to 213% following the latest surge, making investors sit up and take notice.

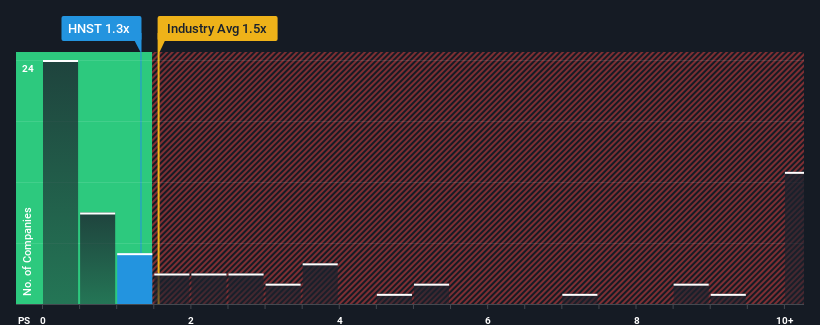

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Honest Company's P/S ratio of 1.3x, since the median price-to-sales (or "P/S") ratio for the Personal Products industry in the United States is also close to 1.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Honest Company

What Does Honest Company's P/S Mean For Shareholders?

Honest Company's revenue growth of late has been pretty similar to most other companies. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. Those who are bullish on Honest Company will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Keen to find out how analysts think Honest Company's future stacks up against the industry? In that case, our free report is a great place to start.How Is Honest Company's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Honest Company's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 6.4%. The latest three year period has also seen a 14% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 5.7% each year as estimated by the seven analysts watching the company. That's shaping up to be similar to the 4.6% per annum growth forecast for the broader industry.

With this information, we can see why Honest Company is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Honest Company's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at Honest Company's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Honest Company that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Honest Company, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Honest Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HNST

Honest Company

Manufactures and sells diapers and wipes, skin and personal care, and household and wellness products.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives