- United States

- /

- Personal Products

- /

- OTCPK:GHSI

Guardion Health Sciences, Inc. (NASDAQ:GHSI) Soars 46% But It's A Story Of Risk Vs Reward

Guardion Health Sciences, Inc. (NASDAQ:GHSI) shareholders would be excited to see that the share price has had a great month, posting a 46% gain and recovering from prior weakness. Unfortunately, despite the strong performance over the last month, the full year gain of 6.0% isn't as attractive.

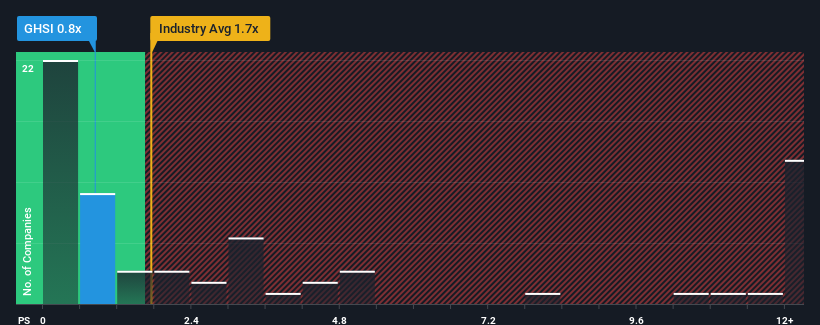

In spite of the firm bounce in price, Guardion Health Sciences may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.8x, considering almost half of all companies in the Personal Products industry in the United States have P/S ratios greater than 1.7x and even P/S higher than 5x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Guardion Health Sciences

What Does Guardion Health Sciences' Recent Performance Look Like?

Recent times haven't been great for Guardion Health Sciences as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Guardion Health Sciences.How Is Guardion Health Sciences' Revenue Growth Trending?

In order to justify its P/S ratio, Guardion Health Sciences would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 9.9%. The latest three year period has seen an incredible overall rise in revenue, even though the last 12 month performance was only fair. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 9.3% during the coming year according to the only analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 8.2%, which is not materially different.

With this information, we find it odd that Guardion Health Sciences is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does Guardion Health Sciences' P/S Mean For Investors?

The latest share price surge wasn't enough to lift Guardion Health Sciences' P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that Guardion Health Sciences currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

You should always think about risks. Case in point, we've spotted 4 warning signs for Guardion Health Sciences you should be aware of, and 1 of them is a bit unpleasant.

If these risks are making you reconsider your opinion on Guardion Health Sciences, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:GHSI

Guardion Health Sciences

A clinical nutrition company, develops and distributes clinically supported dietary supplements and medical foods in North America, Europe, and internationally.

Flawless balance sheet slight.

Market Insights

Community Narratives