- United States

- /

- Personal Products

- /

- NasdaqCM:FLGC

The Market Lifts Flora Growth Corp. (NASDAQ:FLGC) Shares 26% But It Can Do More

Flora Growth Corp. (NASDAQ:FLGC) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 21% in the last twelve months.

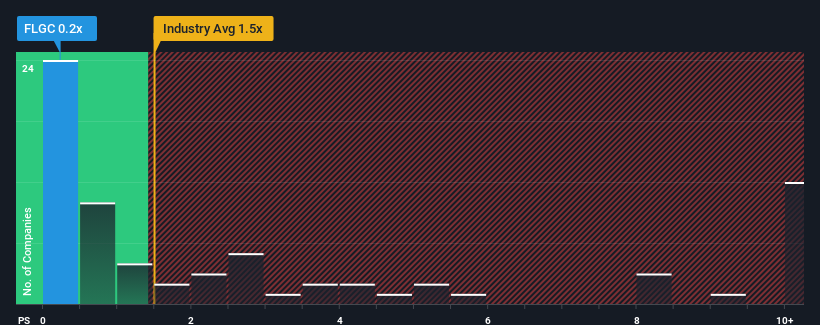

Even after such a large jump in price, Flora Growth's price-to-sales (or "P/S") ratio of 0.2x might still make it look like a buy right now compared to the Personal Products industry in the United States, where around half of the companies have P/S ratios above 1.5x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Flora Growth

How Has Flora Growth Performed Recently?

Flora Growth certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Flora Growth's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Flora Growth's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. While this performance is only fair, the company was still able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 5.6% over the next year. With the industry predicted to deliver 4.6% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Flora Growth's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

The latest share price surge wasn't enough to lift Flora Growth's P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've seen that Flora Growth currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Flora Growth (1 is concerning) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:FLGC

Flora Growth

Engages in the growth, cultivation, and development of medicinal cannabis and medicinal cannabis derivative products worldwide.

Excellent balance sheet slight.

Similar Companies

Market Insights

Community Narratives