- United States

- /

- Medical Equipment

- /

- NYSEAM:XTNT

US Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As the U.S. stock market reaches new heights, with major indices like the S&P 500 and Nasdaq surging on the back of strong earnings and AI-driven optimism, investors are increasingly exploring diverse investment opportunities. Penny stocks, while often considered speculative, can still offer significant potential when backed by solid financials and growth prospects. These smaller or newer companies may present unique opportunities for value at lower price points, making them an intriguing option for those seeking to uncover hidden gems in today's dynamic market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $108.36M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.88224 | $6.46M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $4.00 | $11.73M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.75 | $2.08B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2998 | $10.12M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.49 | $52.14M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.41 | $61.94M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.25 | $20.04M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9174 | $80.38M | ★★★★★☆ |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

WM Technology (NasdaqGS:MAPS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: WM Technology, Inc. offers ecommerce and compliance software solutions for retailers and brands in the cannabis market both in the United States and internationally, with a market cap of approximately $216.13 million.

Operations: The company's revenue is primarily derived from its Software & Programming segment, totaling $183.31 million.

Market Cap: $216.13M

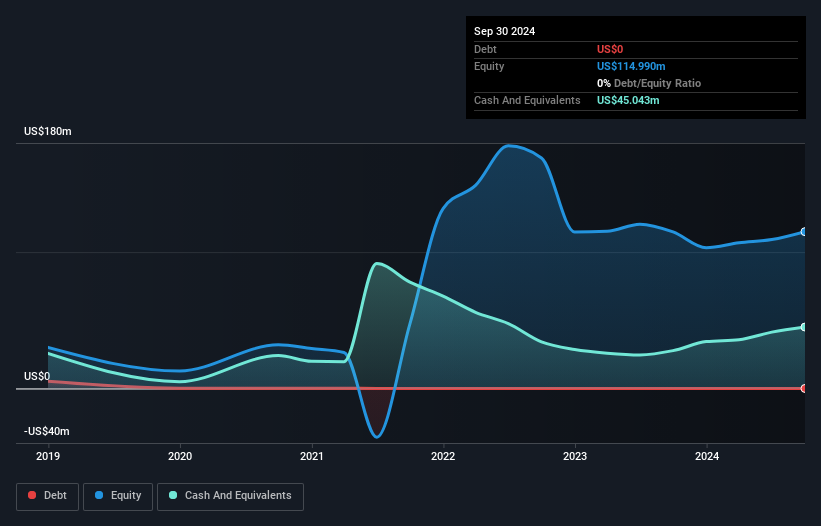

WM Technology, Inc. operates in the cannabis market with a market cap of US$216.13 million and generated US$183.31 million in revenue from its software segment. Despite being unprofitable, it has a strong cash position with no debt and sufficient runway for over three years. Recent developments include the appointment of Sarah Griffis as CTO and a proposed acquisition by existing shareholders for US$240 million, which is under review by an independent board committee. The company has faced legal challenges concerning securities reporting but remains valued below industry estimates, offering potential value to investors mindful of its volatility and ongoing profitability issues.

- Dive into the specifics of WM Technology here with our thorough balance sheet health report.

- Evaluate WM Technology's prospects by accessing our earnings growth report.

Prelude Therapeutics (NasdaqGS:PRLD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Prelude Therapeutics Incorporated is a clinical-stage biopharmaceutical company dedicated to discovering and developing novel precision cancer medicines for underserved patients, with a market cap of approximately $57.79 million.

Operations: Prelude Therapeutics Incorporated does not report any revenue segments.

Market Cap: $57.79M

Prelude Therapeutics, with a market cap of US$57.79 million, is pre-revenue and focuses on developing cancer medicines. It recently presented interim clinical data for its CDK9 inhibitor PRT2527, showing acceptable safety and preliminary activity in relapsed/refractory lymphoid malignancies. Despite reporting US$3 million in sales for the third quarter of 2024, the company remains unprofitable with a net loss of US$32.27 million. Prelude's cash runway exceeds one year without debt obligations, suggesting financial stability amidst high volatility and ongoing clinical trials that could impact future growth prospects significantly.

- Unlock comprehensive insights into our analysis of Prelude Therapeutics stock in this financial health report.

- Explore Prelude Therapeutics' analyst forecasts in our growth report.

Xtant Medical Holdings (NYSEAM:XTNT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Xtant Medical Holdings, Inc. develops and supplies regenerative medicine products and medical devices for orthopedic and neurological surgeons, with a market cap of $72.28 million.

Operations: The company generates $113.86 million in revenue from the development, manufacture, and marketing of orthopedic medical products and devices.

Market Cap: $72.28M

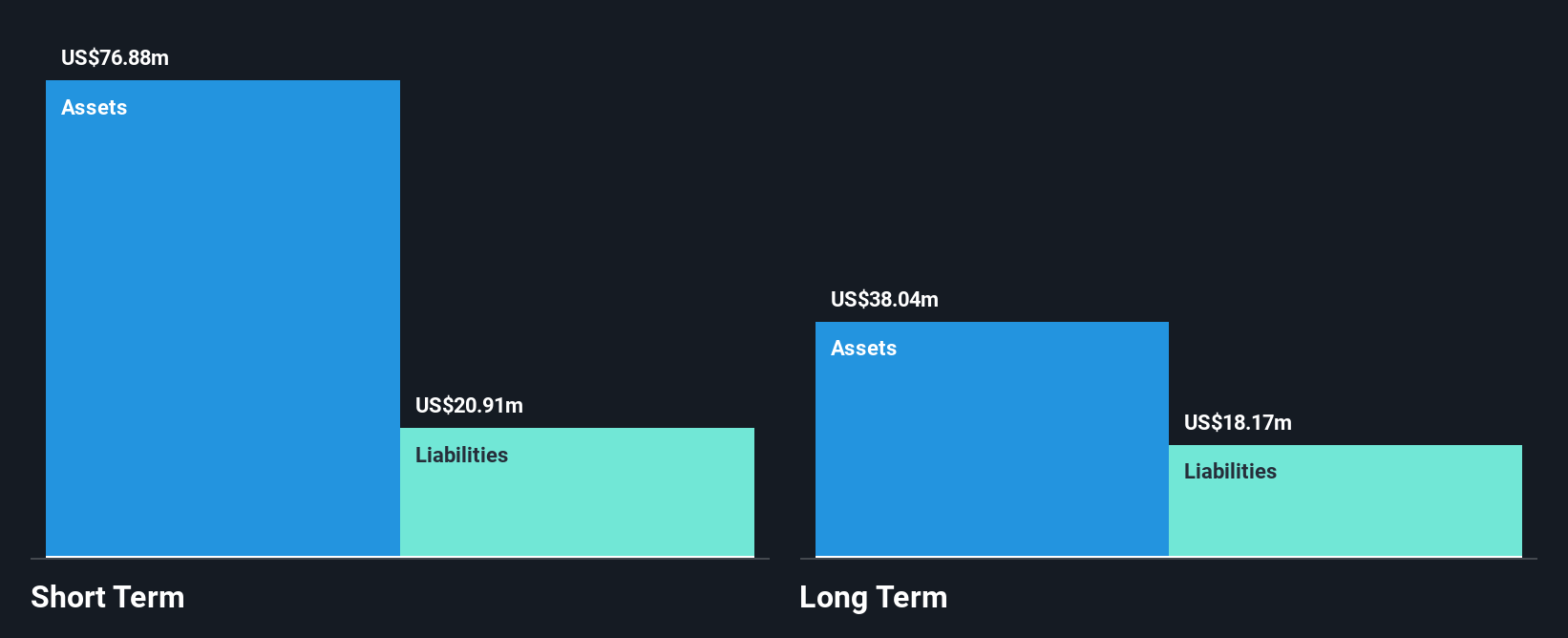

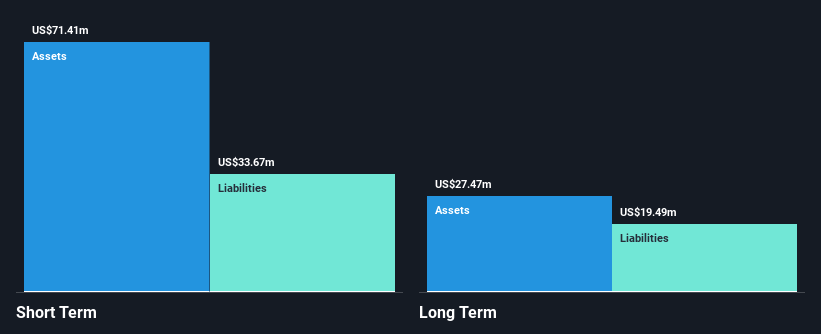

Xtant Medical Holdings, with a market cap of US$72.28 million, reported third-quarter 2024 sales of US$27.94 million, up from US$25.02 million the previous year, but faced a net loss of US$5.02 million compared to prior net income. Despite unprofitability and a high net debt to equity ratio of 61.6%, its short-term assets surpass both short- and long-term liabilities, indicating some financial stability. The company reaffirmed its revenue guidance for 2024 at US$116-120 million, reflecting anticipated growth between 27% and 31%. Xtant's experienced management team could support strategic initiatives moving forward.

- Click here and access our complete financial health analysis report to understand the dynamics of Xtant Medical Holdings.

- Review our growth performance report to gain insights into Xtant Medical Holdings' future.

Summing It All Up

- Investigate our full lineup of 709 US Penny Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:XTNT

Xtant Medical Holdings

Provides regenerative medicine products and medical devices for orthopedic and neurological surgeons in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives