- United States

- /

- Healthtech

- /

- NYSE:VEEV

Veeva Systems (VEEV): Evaluating Valuation After Strong Q2 Earnings and Upbeat Guidance

Reviewed by Simply Wall St

Veeva Systems (VEEV) just reported its second quarter earnings, and the numbers might make investors do a double-take. The company posted year-over-year gains in both revenue and net income, suggesting its core business continues to find momentum in a competitive market. Alongside those results, Veeva’s management issued fresh guidance for both the next quarter and the full fiscal year, signaling continued confidence for what’s ahead.

With these earnings out, Veeva’s share price has shown modest movement over the past month, but it has been a strong performer so far this year overall, up over 34% since January. While recent weeks brought less movement, the company’s longer-term track record points to significant cumulative returns over the past few years, though five-year numbers reflect a more muted climb. Past earnings seasons and strategic presentations, like the upcoming Citi conference, have also shaped sentiment.

All of this begs a bigger question: is the market underestimating what Veeva can deliver, or are future results already baked into the current price?

Most Popular Narrative: 10.3% Undervalued

According to the most widely followed narrative, Veeva Systems is trading below its estimated fair value, suggesting upside potential from current price levels.

The resolution of the long-standing dispute with IQVIA removes critical data interoperability barriers, enabling Veeva to fully integrate industry-leading datasets into its Commercial Cloud. This development is expected to materially expand its addressable market, improve product adoption across multiple commercial applications, and accelerate top-line revenue growth over the next several years.

Ever wondered what really moves Veeva’s story beyond the headlines? A bold earnings roadmap and a pricing multiple borrowed from tech high-flyers are at the heart of this valuation. Want to know the quantitative pillars that make analysts confident in that above-market fair value? The full narrative lays out the ambitious assumptions driving this bullish price target, and the numbers may surprise you.

Result: Fair Value of $315.34 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent customer resistance to new AI features and intensifying competition from tech giants could slow Veeva’s expected growth trajectory.

Find out about the key risks to this Veeva Systems narrative.Another View: What Do Market Ratios Say?

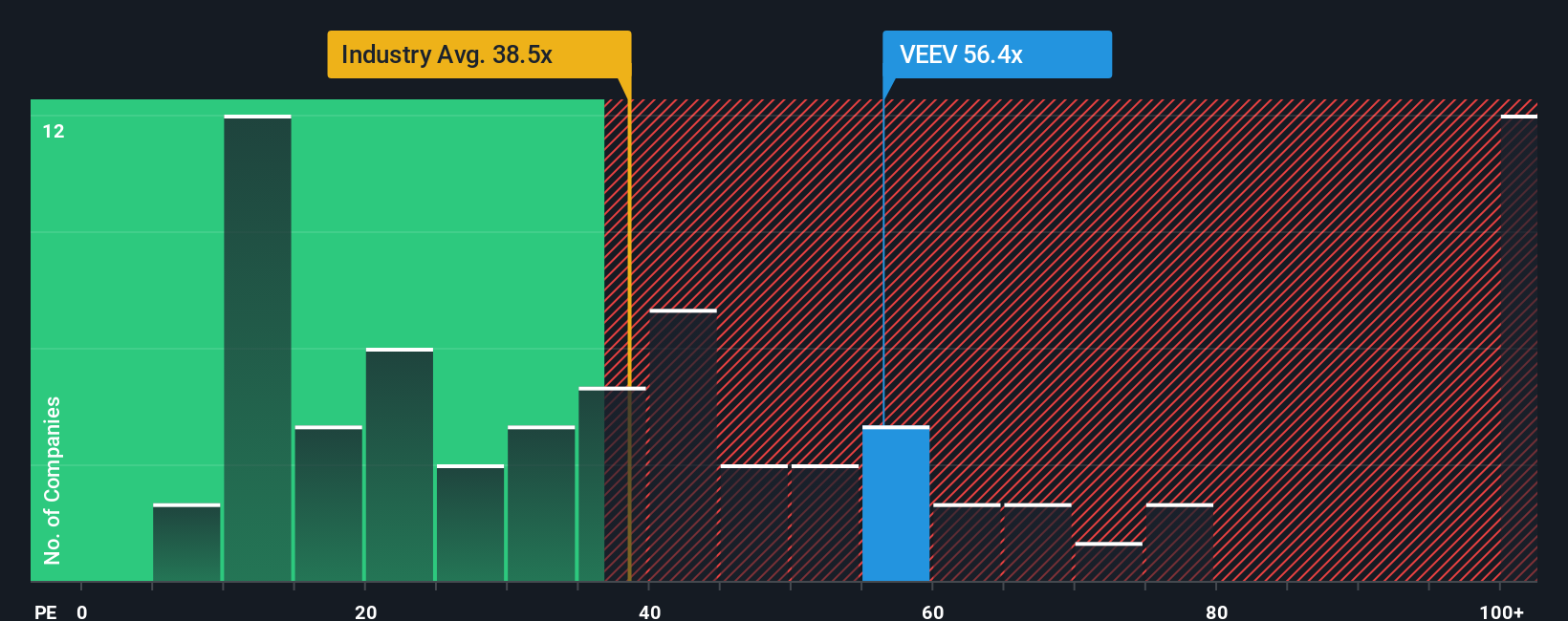

While the main narrative sees Veeva undervalued, another perspective points to its current market ratio, which is higher than the wider healthcare sector. Might the price already reflect some significant expectations? Are investors paying a premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Veeva Systems Narrative

Still think there’s more to uncover, or want to test your own take on Veeva? You can put your own perspective together in just minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Veeva Systems.

Looking for More Compelling Investment Ideas?

Smart investors look beyond just one stock. Don’t let unique opportunities pass you by. Use our research-driven tools to unlock untapped market potential before the crowd catches on.

- Tap into Wall Street’s hidden gems by spotting up-and-coming, financially solid companies through our penny stocks with strong financials resource.

- Access the wave of innovation fueling tomorrow’s medicine with our gateway to healthcare AI stocks that are transforming healthcare through artificial intelligence.

- Uncover high-potential bargains ready to be revalued by the market by leveraging insights from our undervalued stocks based on cash flows tool.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:VEEV

Veeva Systems

Provides cloud-based software for the life sciences industry in North America, Europe, the Asia Pacific, the Middle East, Africa, and Latin America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)