- United States

- /

- Healthcare Services

- /

- NYSE:UNH

UnitedHealth Group (UNH) Affirms US$2.21 Cash Dividend

Reviewed by Simply Wall St

UnitedHealth Group (UNH) experienced an 11.7% increase in its stock price over the past week, influenced by several significant developments. The board's decision to affirm a cash dividend of $2.21 per share likely bolstered investor confidence, while the recent update on the buyback program indicates proactive capital management. In addition, the appointment of Wayne S. DeVeydt as CFO might have provided assurance about future strategic stability. These internal factors coincided with broader market activity, as Federal Reserve Chair Jerome Powell hinted at potential interest rate cuts, enhancing overall market sentiment and contributing to UNH's substantial weekly gain.

We've spotted 1 warning sign for UnitedHealth Group you should be aware of.

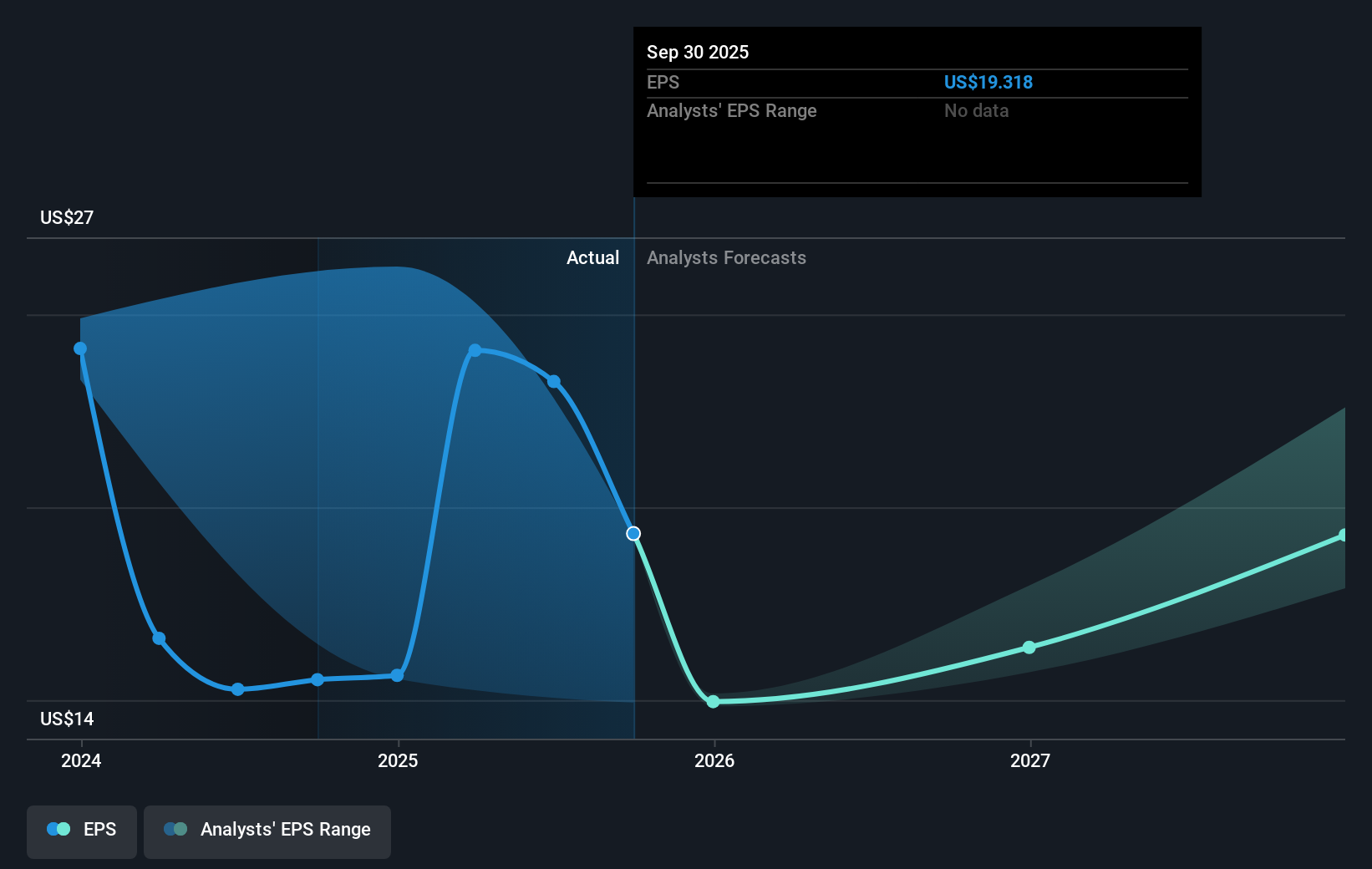

The recent developments involving UnitedHealth Group, including the reaffirmed cash dividend and the CFO appointment, could strengthen investor confidence and contribute to stability in strategic execution. These moves reflect proactive capital management and might positively affect the company's narrative concerning strategic investment in technology and Medicare adjustments. The share price increase aligns with general market optimism sparked by potential interest rate cuts, yet it remains essential to observe how these factors will influence revenue and earnings forecasts. Analysts are highly focused on revised Medicare strategies and digital tool investments aimed at stabilizing revenue and improving operational margins.

Over a longer-term period, UnitedHealth Group's total return, including share price and dividends, was 5.04% over five years. Historically, this reflects modest growth relative to its recent one-year performance, where it underperformed compared to the broader US Healthcare industry, which experienced a return of 27.5%. Understanding these dynamics can provide a broader context for assessing the company's financial health and market positioning.

The current stock price reflects an 8.40% discount from analysts' consensus price target of US$328.83, indicating potential upside if UnitedHealth achieves its projected revenue and earnings growth. These growth objectives and the potential for share buybacks could influence perceptions of the company's market valuation. Analysts' forecasts on revenue and earnings largely hinge on the successful execution of the company's Medicare and technology shifts, which are crucial for navigating potential external funding pressures and healthcare industry challenges. The company's use of advanced predictive care models and digital engagement tools also factor into these expectations, promising efficiency improvements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNH

UnitedHealth Group

Operates as a health care company in the United States and internationally.

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives