- United States

- /

- Healthcare Services

- /

- NYSE:UNH

UnitedHealth Group (NYSE:UNH) Faces 11% Dip After DOJ Medicare Investigation News

Reviewed by Simply Wall St

UnitedHealth Group (NYSE:UNH) experienced a 11% decline in its share price over the past week, amid heightened market volatility. A key factor driving this plunge was news of a Department of Justice investigation into the company's Medicare billing practices, which cast doubt on its regulatory compliance and financial stability. This headline significantly weighed on UnitedHealth's stock, as investors grew wary of potential legal repercussions. The company’s slump was part of a broader sell-off affecting the Dow Jones Industrial Average, which recorded its steepest weekly drop since October, primarily driven by disappointing economic data. In a challenging week for healthcare and tech stocks, UnitedHealth saw declines alongside other insurers like CVS Health and Humana, while major tech firms also posted losses. The market's drop for the period reflects these broader challenges, amplifying the scrutiny and pressure on UnitedHealth’s value.

Click to explore a detailed breakdown of our findings on UnitedHealth Group.

Over the past five years, UnitedHealth Group (NYSE:UNH) delivered a total shareholder return of 96.89%. Despite recent challenges, including a turbulent market reaction to a Justice Department investigation, this longer-term return highlights the company's ability to create value over time. Executive changes, like the promotion of Tim Noel to CEO of UnitedHealthcare following the past CEO's sudden passing, marked significant shifts within the company.

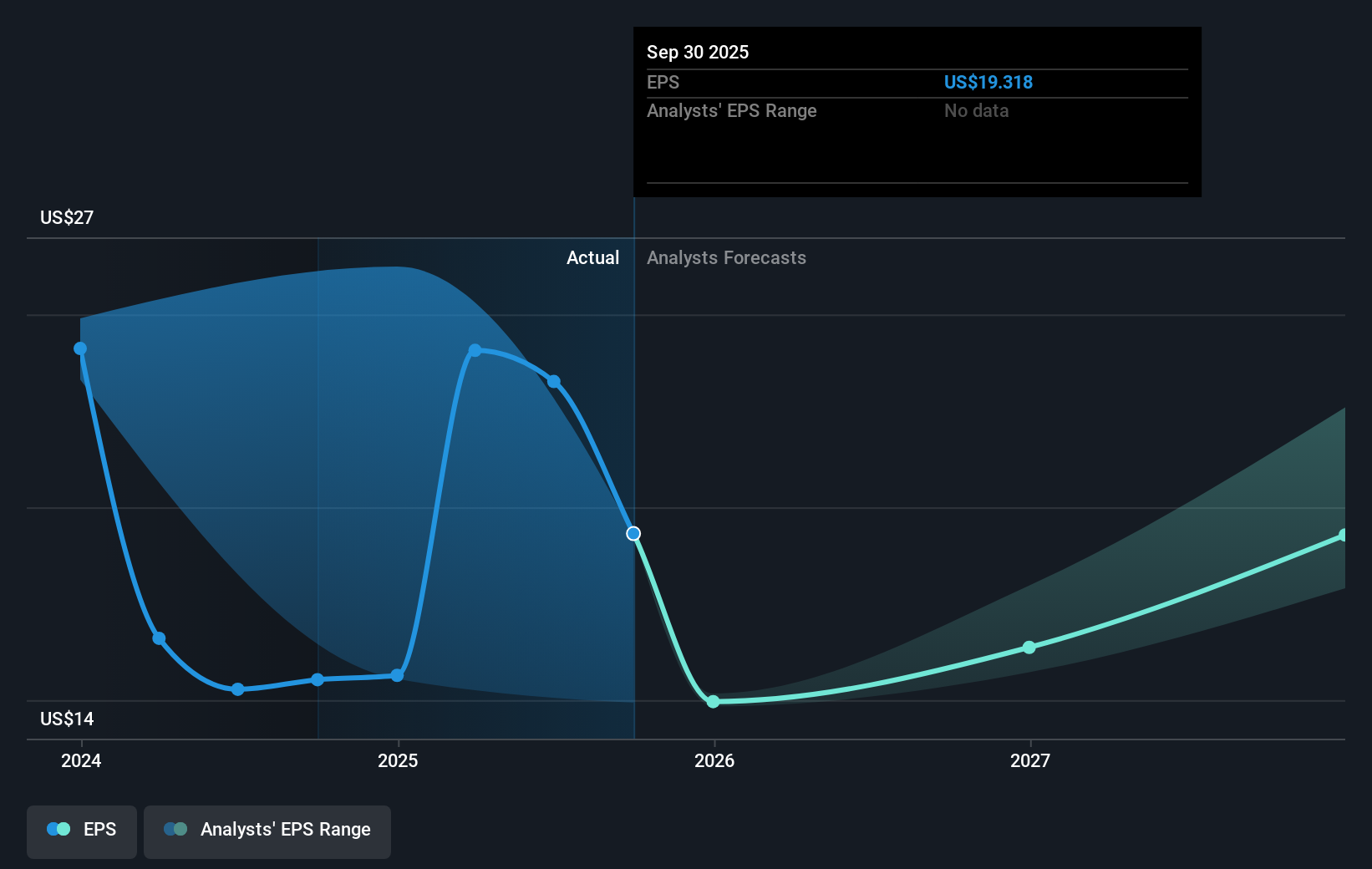

Throughout this period, UnitedHealth reported consistent revenue increases, exemplified by Q4 2024 results showing a revenue of US$100.81 billion. However, the company faced notable setbacks, such as a net loss of US$1.41 billion in Q1 2024. In addition to navigating these internal changes, UnitedHealth remained committed to shareholders through a reliable dividend policy and share repurchase programs. Additionally, the firm has pursued significant partnerships to improve healthcare access, while legal challenges pertaining to securities laws and employee benefits management have placed additional pressure on the company.

- See whether UnitedHealth Group's current market price aligns with its intrinsic value in our detailed report

- Assess the potential risks impacting UnitedHealth Group's growth trajectory—explore our risk evaluation report.

- Is UnitedHealth Group part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNH

UnitedHealth Group

Operates as a diversified health care company in the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives