Key Takeaways

- On average, our population is getting older. While the population is expected to grow, average age in most parts of the world is on an upwards trajectory.

- Lower birth-rates and higher life expectancies will mean many countries will experience a natural decline in population by 2100, for the first time in modern history.

- Industries that cater to an aging population should expect to boom in the coming years.

The world’s population has been growing rapidly for decades and we’re predicted to surpass 8 Billion people by the end of 2023, but this figure fails to paint the full picture of what our population will look like.

Birth rates across much of the world are falling and the consequences of that are pretty alarming. Japan, Italy, Spain, Portugal, Thailand and South Korea are some of the 23 countries that are expected to have their populations halved by 2100. A falling birth rate compounded by the effects of modern medicine keeping people healthier for longer has meant that the world is in a unique position. Our population is getting older.

According to the United Nations , 2018 was the first time in human history that people 65 and older outnumbered children younger than 5. The idea that we’re approaching a ‘peak youth’ is an interesting one - and in all honesty, a scary one.

The ways in which we will adapt are yet to be seen, but an aging population does not spell disaster. In fact, there are some industries that are set to benefit from us getting older. Here are some of our suggestions to answer the question in the mind of investors: what are the best stocks to invest in for an aging population?

Best Aged Care Facilities & Healthcare Stocks

Thesis: Studies show that healthcare spending increases with age. Patients aged 60 and older account for the most healthcare expenditure. Healthcare providers will see greater earnings potential as the population ages.

Caring for a loved one or yourself becomes increasingly difficult in the twilight years of your life. Aged care and senior housing offers people the freedom to live as independently as they desire, but with the sense of community and care that older people need. Companies offering these living opportunities should see a rise in occupancy rates as the elderly proportion of the population grows.

UnitedHealth Group Incorporated

What Does UnitedHealth Group Do?

UnitedHealth Group (NYSE:UNH) is a diversified health care company in the United States operating through four main segments: UnitedHealthcare, Optum Health, Optum Insight, and Optum Rx. The largest segment, UnitedHealthCare, which brings in 78.1% of the revenues for the enterprise, offers health benefit plans and services for employees and individuals. A core focus of these health care plans and well-being services is to provide individuals aged 50 and older with the means to address their needs for preventive and acute health care services, as well as services dealing with chronic disease and other specialized issues for older individuals.

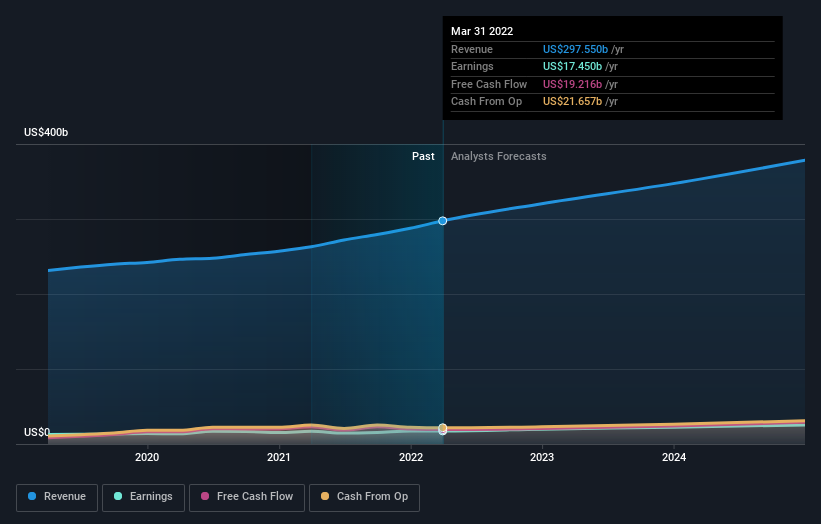

UnitedHealth Group Financial Performance

Enterprise-wide results for UnitedHealth Group have been impressive. The company recorded first quarter revenues of US$80.1B, representative of a 14% growth year-over-year, compared to the same period 12 months ago. UnitedHealthcare attributes this improved financial performance to an increasing customer-base serving nearly 1.5 million more people, which was led by growth in its community and senior programs. Consistent medical cost ratio - which is the ratio of costs of medical services provided to the premiums collected - has allowed the top line growth the company experienced to translate into earnings growth. The company recently reported that earnings for the quarter increased from US$6.7B 12 months ago to US$7.0B in the most recently completed quarter.

Why UnitedHealth Group Benefits From an Aging Population

A recent survey by UnitedHealth Group has show that nearly 70% of Americans ages 62 and older said physical health is most important to them as they age. While most are feeling good and being proactive to maintain or improve their health, nearly all are worried about ending up sick or hospitalized. Given UnitedHealth Group provides care plans and services specifically for preventative care and specialized services for older individuals, the company should experience continued top-line growth owing to the expected increase in healthcare services required to support an aging population. An aging population may impact medical cost ratio, but bottom-line growth should be ensured if the company monitors cost drivers closely and maintains an appropriate premium pricing model.

Analysts are anticipating continued strength for the company as the recent consensus figures from the analysts covering UnitedHealth Group forecast earnings to grow at 11.9% annually. If future earnings and return on equity figures for UnitedHealth Group interest you, feel free to check out our Future Growth analysis on Simply Wall St.

Ventas

What Does Ventas Do?

Ventas (NYSE:VTR) is a real estate investment trust that operates at the intersection of two powerful and dynamic industries – healthcare and real estate. Ventas has commercial holdings with interests leading care providers, developers, research and medical institutions all of whom will see business boom from an aging population. Ventas’ largest property interest is in senior housing communities, of which it owns over 800 throughout the United States, Canada and the United Kingdom, providing living arrangements to over 75,000 seniors.

Ventas Financial Performance

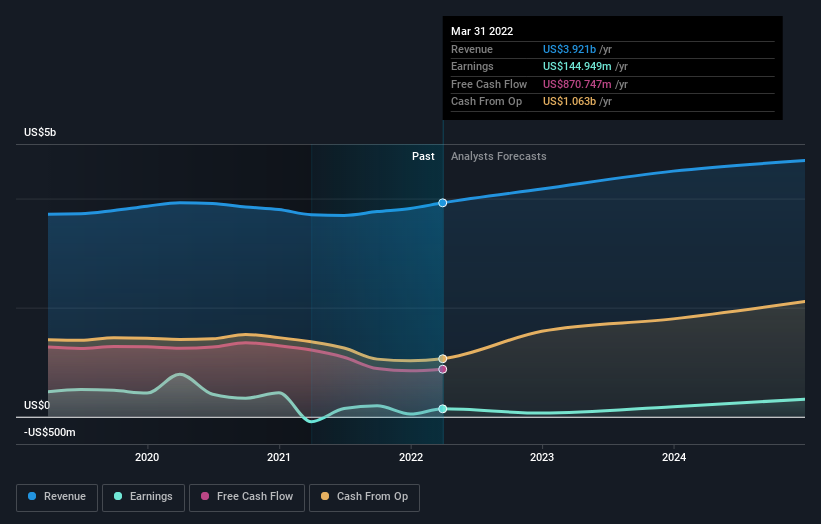

Representing approximately half of the Company’s net operating income (NOI), the company’s senior housing portfolio is well-positioned to capture the powerful senior housing upside presented by population trends. Within its senior housing operating portfolio (SHOP) alone, the company has been able to deliver year-on-year revenue growth of 10%, supported by growth in occupancy levels and the rental rates. Guidance given by the company expects similar growth for the next quarter as these trends are set to continue for the rest of 2022.

Occupancy rates in Ventas’ senior housing operating portfolio (SHOP) increased 1.1% to 83.3% in the fourth quarter of 2021 compared with the previous quarter, driven in part by an increase in leads as demand accelerates post-COVID.

Ventas has continued to show its faith in the senior housing market when, in February 2022, it completed the acquisition of Mangrove Bay senior housing community located in Jupiter, Florida for US$107M. The property located in a highly sought after market and the in-place cash yield of 5.6% provides a great rationale for investment. This recent acquisition tops off an impressive 2021 which saw nearly US$2.6B of investment in independent living communities that have already exhibited low labor requirements and high occupancy rates.

Why Ventas Benefits From an Aging Population

Ventas’ senior housing portfolio is so integral to their business, and with the senior demographic set to expand, there'll be a rise in demand for Senior Housing. Simply put, if there are more seniors in a given population, then more senior communities are required to support them. Given that Ventas predicts a 22.7% growth in the U.S. population over the age of 80 over the next 5 years, Ventas' senior housing portfolio should expect to see high demand driving solid yield, which will flow through to shareholders in the form of consistent dividends. In the next few years, analysts expect that the increasing addressable in the senior sector market will bolster top line growth, the effects of which will be seen by the market on its income statement.

Given Ventas’ commitment to growing its senior housing portfolio in preparation for an aging population, it’s no surprise that analysts are forecasting 27% annual earnings growth for the company. If you want to find out more about the company’s future, check out our analysis on Ventas’ Future Earnings and Revenue Growth forecasts for free on our website.

Best Leisure in Retirement Stocks

Thesis: Older people - specifically those in retirement - generally have more wealth and more time than any other demographic. Given that holidaying is a popular leisure activity among retirees and older travelers spend more on travel than any other age group , it’s expected that the travel segment will see vast inflows of cash as the population trends towards getting older. Cruises and RV/Campervan traveling are among some of the most popular ways to holiday for older travelers. Cruise companies and RV manufacturers should expect to see demand grow as our population ages.

Carnival Corporation & plc

What Does Carnival Do?

Carnival (NYSE:CCL) is a leisure travel company that offers travelers the opportunity to to set sail to around 700 ports globally under the Carnival Cruise Line, Princess Cruises, Holland America Line, P&O Cruises (Australia), Seabourn, Costa Cruises, AIDA Cruises, P&O Cruises (UK), and Cunard brand names.

The cruise industry was heavily impacted by the COVID-19 pandemic, with their business effectively grinding to a halt. To the rejoice of cruise businesses, the path to recovery has begun and by March 22, 2022, Carnival’s operations were back to 75% capacity. It’s a far cry from the pre-COVID peak but it’s meaningful progress towards getting back to ‘business as usual’.

Carnival Financial Performance

It’s not surprising that Carnival posted a net loss of US$1.9B for the quarter given the reduced capacity, but it stands as a notable improvement over the previous quarter’s loss of US$2.6B.

For the cruise segment, revenue per passenger cruise day (PCD) is an important measure of the average revenue each passenger is expected to generate for the company per day. For the first quarter of 2022 Carnival’s revenue per PCD increased approximately 7.5% compared to a strong 2019. This increase was driven by exceptionally strong onboard revenue. If the company is able to keep these high revenue per PCD consistent, they should expect a strong 2023 financial year if they’re able to maintain 100% capacity.

The company expects to have each brand's full fleet back in guest cruise operations for its respective summer season where it historically generates the largest share of its operating income. Monthly adjusted EBITDA expected to turn positive at the beginning of this period which should be a welcome change for shareholders.

Why Carnival Benfits From an Aging Population

The last two years have been disappointing for the cruise industry as they’ve faced some extreme difficulties during the pandemic. The horizon seems much brighter for them on the other hand and an aging population will only help further.

As the population aged over 50 grows, so too does the largest demographic of cruise ship passengers. Market data from Cruise Lines Association International shows that passengers over the age of 50 account for 50% of all cruise passengers. Demand for cruises rise, passengers with greater disposable income should lead to growth in revenue PCD growth as they have the means to spend more on onboard services.

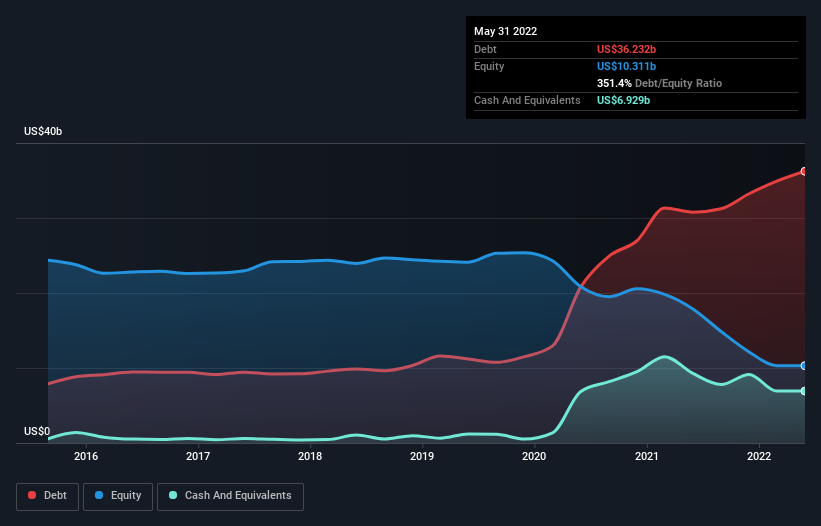

Carnival should expect to see solid recovery as they head back to 100% capacity over the coming months given the tough economic conditions, it won’t necessarily be smooth sailing. Our look at Carnival’s liabilities has highlighted that the company’s net debt to equity ratio of 284.2% is considered high. To find out more about Carnival’s balance sheet, head over to our Financial Health Analysis on Carnival’s company report .

Thor Industries Inc.

What Does Thor Industries Do?

Thor Industries (NYSE:THO) designs, manufactures, and sells recreational vehicles (RVs), and caravans across the United States, Canada and Europe. The company offers travel trailers; gasoline and diesel Class A, Class B, and Class C motorhomes; conventional travel trailers and fifth wheels; luxury fifth wheels; and motorcaravans, caravans, campervans, and urban vehicles. It also provides aluminum extrusion and specialized component products to RV and other manufacturers; and digital products and services for RVs.

Retailing under its numerous major brands like Airstream, Heartland RV, Jayco, Starcraft RV and Thor Motor Coach, the company offers customers with a home for the road where people can explore to their heart’s content without foregoing the luxury

Thor Industries Financial Performance

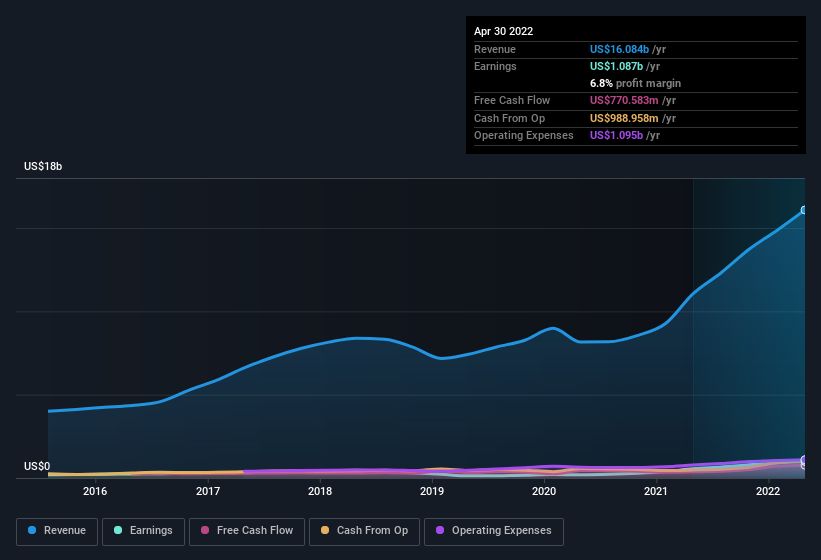

Thor Industries has delivered solid quarterly earnings results underpinned by strong RV demand and operational improvements. Net sales increased 34.6% from 12 months ago to US$4.66B due to an increase in unit shipments and alterations to product pricing strategies.

The company’s gross profit margin increased 270 basis points to 17.3% driven by optimizations in labor, overhead, and freighting costs. This was offset to some extent by the increase in raw material costs, however, these impacts are widespread and will impact Thor Industries’ competitors also.

Improvements in net sales and profit margin lead to an appreciable 92.1% increase in diluted earnings per share for the quarter. Shareholders will be pleased to know that quarterly earnings per share hit $6.32, up from $3.29 in the same period a year ago.

Why Thor Industries Benefits From an Aging Population

It’s clear that the COVID-19 downturn that impacted many businesses hasn’t had a lasting impact on Thor Industries. If anything, a rise in units delivered and product backlogs is an indication that demand for RVs and caravans is growing; perhaps a direct result of international travel being off-limits for an extended period. As the population ages, Thor Industries should continue to see solid demand for their products.

Caravan and RV travel remains a firm favorite of baby boomers looking to use their time in retirement to explore. If the most popular demographic for RV/Camper van usage grows, so too should Thor’s revenue opportunities. If the supply issues impacting the company’s raw material costs resolve themselves, gross profit margin should grow and support strong earnings results as demand should continue to be high.

While past performance isn't indicative of future performance, it's hard to deny that its a marker for potential. Thor industries' recent earnings has been incredibly strong, with a 21.5% annualised earnings growth over the last few years. But what does the future hold for Thor Industries? Analysts are forecasting tougher times ahead in the near future, but our analysis of Thor's insider transactions shows that insiders have only been buying. To find out more about who's been buying Thor Industries stock, head to our Ownership Breakdown which can be viewed for free on our website .

How Relevant is an Aging Population to the Stock Market Right Now?

Referring back to the article from the United Nations, or even the research conducted by Ventas, we can see this theme of an Aging Population is extremely relevant to the economy right now. Rapid change in the age demographics is an ongoing factor and the effects of which will be apparent on a 5 year timescale, not just a 30+ year one. Companies like the above have enjoyed some nice growth, which they should expect to see continue so long as the average age of the population trends in the same direction.

The impacts of an aging population should compound into the future as birth-rates across many European and Asian countries continues to decline. In decades to come, the question on people's mind may be about how we can deal with a declining workforce or support a large proportion of the population who require care.

However, an aging population isn't the only factor impacting the world economy. Supply chain shortages, high interest rates and record inflation are all contributing to what many people see is a looming recession. If you're someone who sees a recession on the horizon and you want to understand how capital markets may fair in this time, you might want to check out our collection of the best stocks to invest in during a recession.

We are looking for feedback on this article. Click HERE to complete a short survey to let us know how we did.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Bailey and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Bailey Pemberton

Bailey is an Equity Analyst at Simply Wall St with 4 years of experience as an Associate Adviser at Baywealth Financial Group, where he helped with client portfolio management, investment strategy and research. He completed a Bachelor of Commerce majoring in Finance from the University of Western Australia. As an equity analyst, Bailey provides the team with valuable insights, helping guide the creation of article content and new features like Narratives.

About NYSE:UNH

UnitedHealth Group

Operates as a health care company in the United States and internationally.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives