- United States

- /

- Healthcare Services

- /

- NYSE:UNH

Is UnitedHealth Group’s Slide an Opportunity After CEO and Chairman Role Debate?

Reviewed by Bailey Pemberton

If you've been wondering whether to hang onto UnitedHealth Group stock or look for greener pastures, you're not alone. Over the last year, the healthcare giant's shares have taken a wild ride, dropping nearly 40% in the last twelve months and almost 29% year-to-date. That kind of drop grabs everyone's attention, especially when the five-year total return still sits in positive territory at roughly 20%. It has been a turbulent stretch, with headlines swirling about government investigations, changes in executive leadership structure, and intense political debates over health insurance subsidies. All of these factors have added layers of risk perception and fueled recent price swings, even though the seven-day change hovered right at zero and the last month saw a modest 1.7% bump.

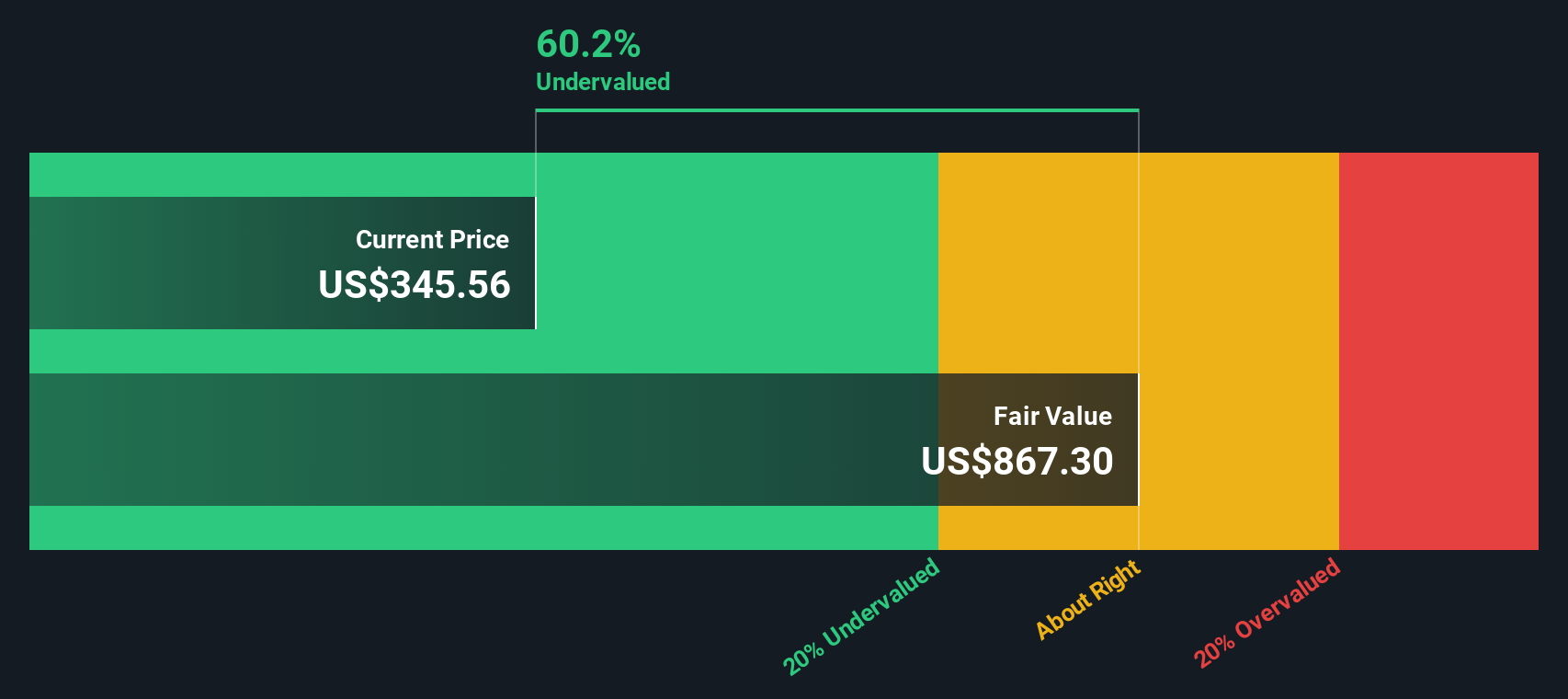

So, where does that leave potential investors? The big question is whether the recent underperformance means UnitedHealth is undervalued, or if there is more pain ahead. Interestingly, by running the stock through six key valuation checks, UnitedHealth Group racks up a value score of 4. That means it appears undervalued on four out of six major metrics, which is a solid signal but not the full story. Before making a move, let’s dig into what those valuation measures actually tell us about the stock, and then wrap up with an even more insightful approach to finding fair value.

Why UnitedHealth Group is lagging behind its peers

Approach 1: UnitedHealth Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a classic approach to valuation that estimates what a company is truly worth by forecasting its future cash flows and then discounting those figures back to today's dollars. Essentially, it aims to calculate how much value the company is likely to generate for shareholders over time, considering the time value of money.

For UnitedHealth Group, the current free cash flow (FCF) stands at approximately $25.2 Billion. Analysts provide solid visibility into cash generation for the next five years, after which Simply Wall St extrapolates further annual estimates. These projections suggest that by 2029, UnitedHealth's annual FCF could reach around $27.1 Billion, before stretching to about $39.4 Billion by 2035 based on expected growth rates tapering over time.

Taking these future cash flows and discounting them using a standard methodology, the DCF model arrives at an intrinsic value of $853.86 per share. This valuation implies that the stock is currently trading at a 58.0% discount to its fair value. Such a gap suggests there may be significant potential upside.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests UnitedHealth Group is undervalued by 58.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: UnitedHealth Group Price vs Earnings

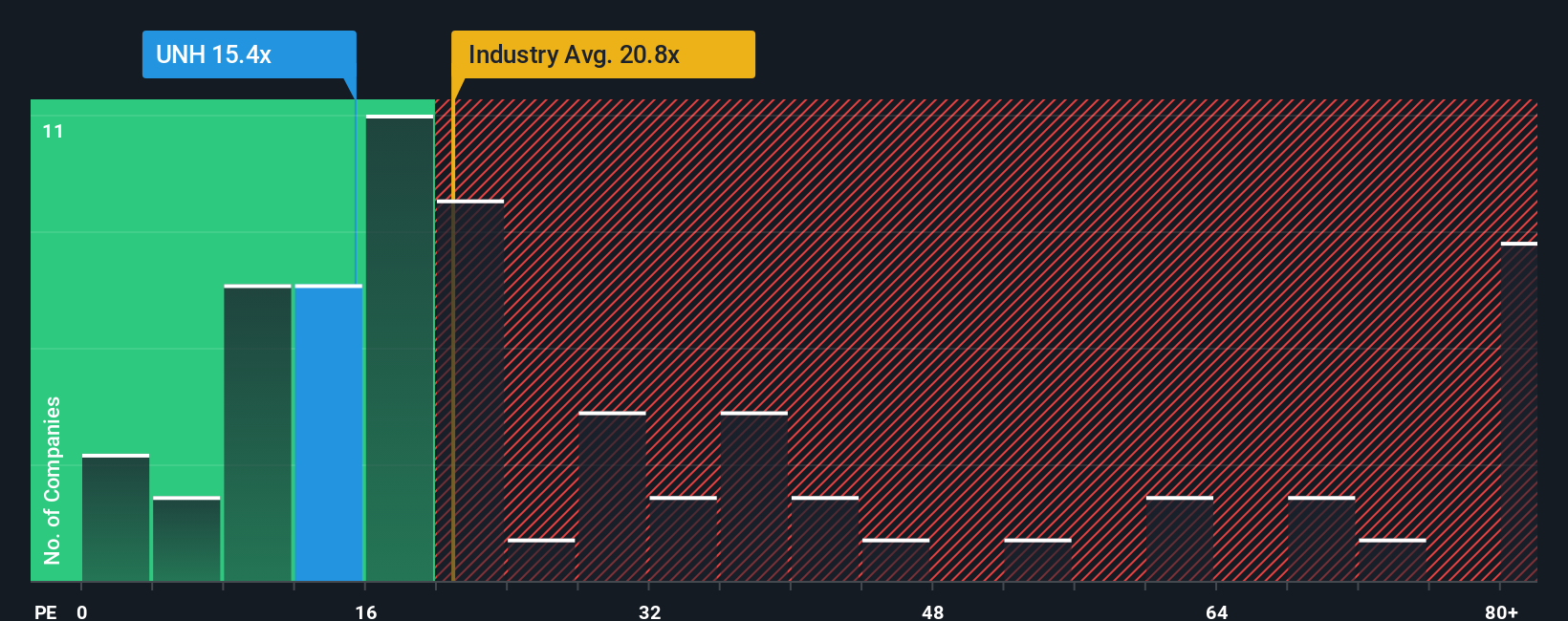

The Price-to-Earnings (PE) ratio is a widely used valuation multiple for profitable companies like UnitedHealth Group because it places the current share price in the context of earnings power. For investors, the PE ratio can help highlight whether a stock is relatively cheap or expensive compared to how much profit the company is actually generating. Growth expectations and risk are important in this context. Higher projected earnings growth or lower risk typically justify a higher PE ratio, while slower growth or added uncertainties could justify a lower one.

Currently, UnitedHealth Group has a PE ratio of 15.25x. For perspective, this is lower than both the average for the Healthcare industry at 20.68x and the peer group average of 13.36x. This suggests some conservatism built into UnitedHealth’s valuation, at least in surface-level comparisons.

Simply Wall St’s proprietary “Fair Ratio” helps investors look deeper. The Fair Ratio, calculated at 39.06x for UnitedHealth, reflects a custom benchmark that incorporates expected earnings growth, profit margins, industry dynamics, and the company’s market cap and risk profile. Unlike a simple industry average or peer comparison, this method adapts to UnitedHealth’s unique fundamentals and outlook, offering a more comprehensive picture of intrinsic value.

With UnitedHealth’s actual PE of 15.25x sitting well below the Fair Ratio of 39.06x, the numbers suggest that the stock may be undervalued on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your UnitedHealth Group Narrative

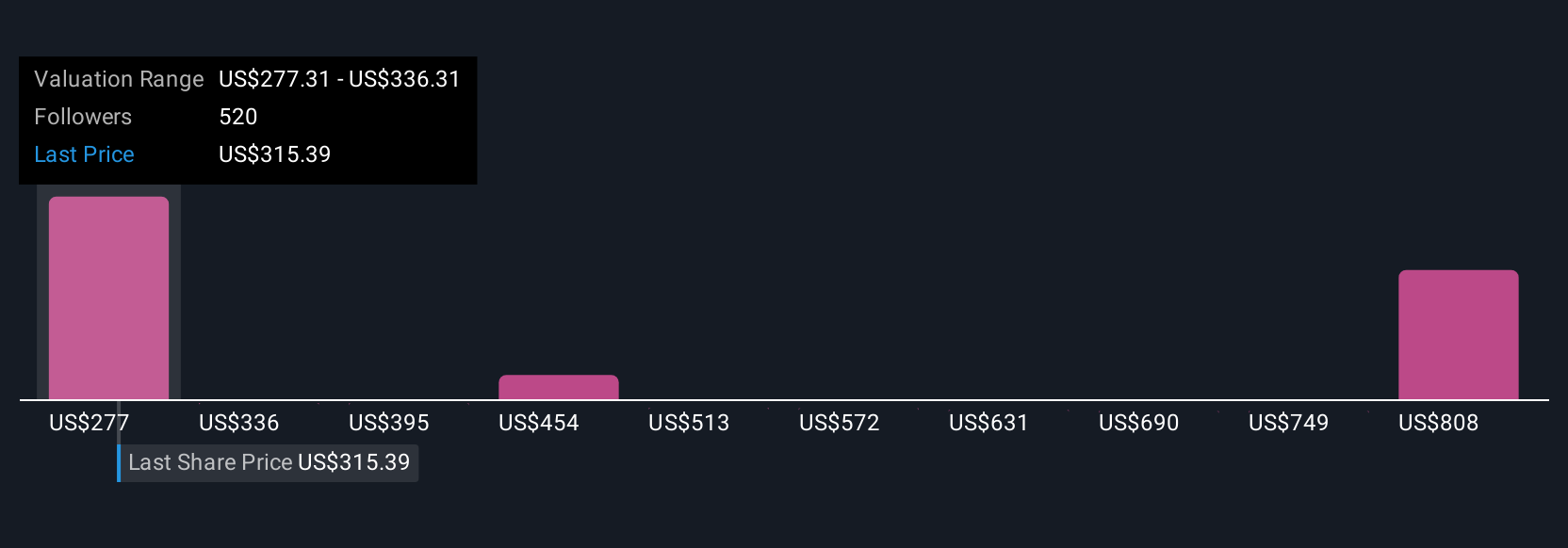

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is a simple, interactive framework where you describe your perspective on a company by connecting its story to the numbers, such as your expectations for UnitedHealth Group’s future revenue, earnings, and profit margins. This process ultimately produces your personalized Fair Value estimate.

This approach empowers you to see how your outlook translates directly into what you believe the stock is worth. It creates a clear link between business developments, financial forecasts, and investment decisions. Narratives are accessible to everyone on Simply Wall St’s Community page, used by millions of investors who want more than just standard ratios and analyst targets.

By comparing your Fair Value to the live share price, Narratives help you gauge whether it is time to buy, sell, or wait. Best of all, your Narrative and its Fair Value update automatically as new news, earnings data, or key metrics are released. This way, your view stays current without extra work.

For example, some UnitedHealth Group investors build bullish Narratives based on strategies for technology and value-based care, supporting fair values as high as $626 per share. More cautious investors consider Medicare and policy risks and arrive at valuations near $198. Each reflects a unique story, and you can easily create or adjust yours to match your outlook.

Do you think there's more to the story for UnitedHealth Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNH

UnitedHealth Group

Operates as a health care company in the United States and internationally.

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives